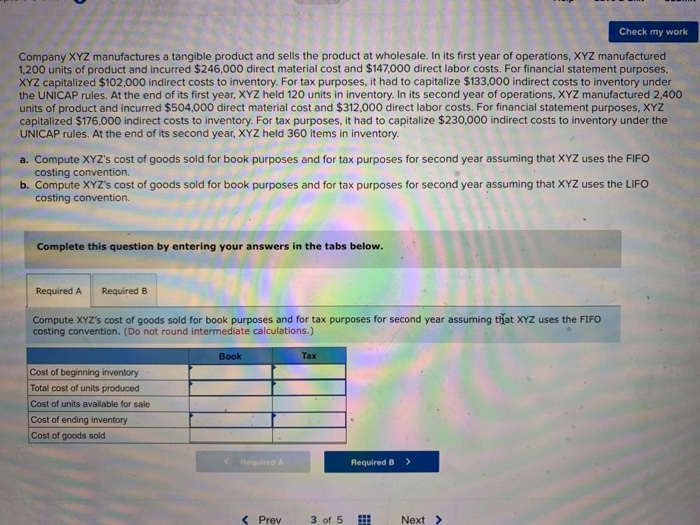

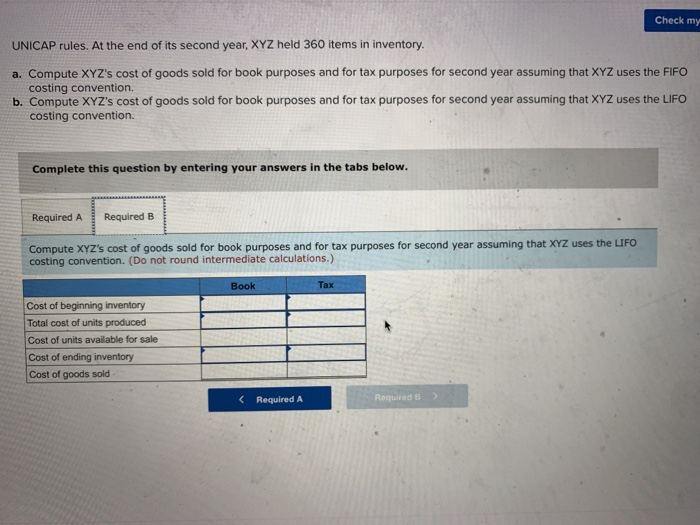

Check my work Company XYZ manufactures a tangible product and sells the product at wholesale. In its first year of operations, XYZ manufactured 1.200 units of product and incurred $246,000 direct material cost and $147,000 direct labor costs. For financial statement purposes XYZ capitalized $102,000 indirect costs to inventory. For tax purposes, it had to capitalize $133,000 indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ held 120 units in inventory. In its second year of operations, XYZ manufactured 2,400 units of product and incurred $504,000 direct material cost and $312,000 direct labor costs. For financial statement purposes, XYZ capitalized $176,000 indirect costs to inventory. For tax purposes, it had to capitalize $230,000 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 360 items in inventory. a. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO costing convention. b. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the LIFO costing convention. Complete this question by entering your answers in the tabs below Required A Required B Compute XYz's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO costing convention. (Do not round intermediate calculations.) Book Cost of beginning inventory Total cost of units produced Cost of units available for sale Cost of ending inventory Cost of goods sold Required A Required B> K Prev3 of 5Next> Check my UNICAP rules. At the end of its second year, XYZ held 360 items in inventory. a. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO costing convention. b. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the LIFO costing convention. Complete this question by entering your answers in the tabs below. Required A Required B Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the LIFO costing convention. (Do not round intermediate calculations.) Book Tax Cost of beginning inventory Total cost of units produced Cost of units available for sale Cost of ending inventory Cost of goods sold Required A Required B