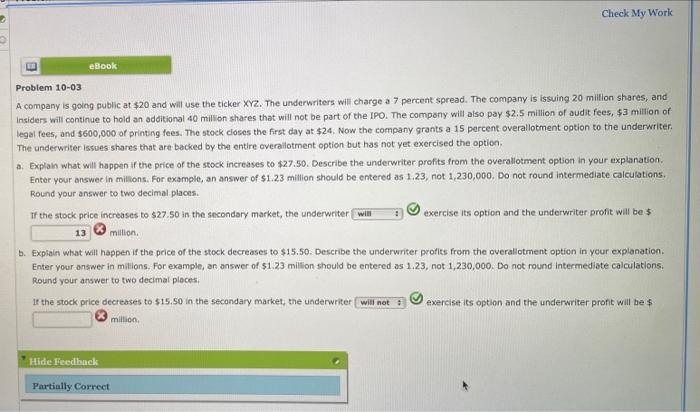

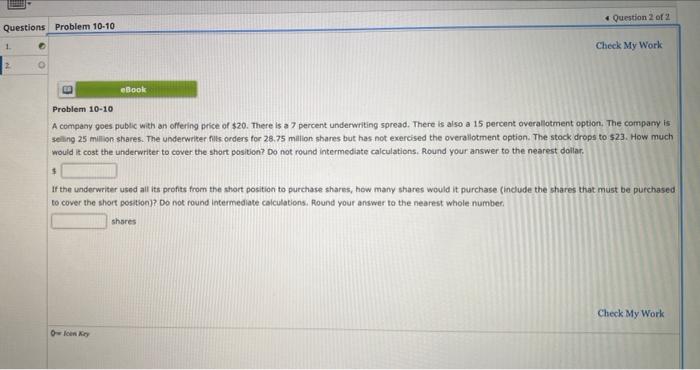

Check My Work eBook Problem 10-03 A company is going public at $20 and will use the ticker XYZ. The underwriters will charge a 7 percent spread. The company is issuing 20 million shares, and Insiders will continue to hold an additional 40 million shares that will not be part of the IPO. The company will also pay $2.5 million of audit fees, $3 million of legal fees, and $600,000 of printing fees. The stock closes the first day at $24. Now the company grants a 15 percent overallotment option to the underwriter. The underwriter issues shares that are backed by the entire overallotment option but has not yet exercised the option, a. Explain what will happen if the price of the stock increases to $27.50. Describe the underwriter profits from the overallotment option in your explanation. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Do not round intermediate calculations, Round your answer to two decimal places. If the stock price increases to $27.50 in the secondary market, the underwriter will 4 exercise its option and the underwriter profit will be $ 13 million. b. Explain what will happen if the price of the stock decreases to $15.50. Describe the underwriter profits from the overallotment option in your explanation. Enter your answer in milions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Do not round intermediate calculations. Round your answer to two decimal places. If the stock price decreases to $15.50 in the secondary market, the underwriter will not exercise its option and the underwriter profit will be $ million. Hide Feedback Partially Correct Question 2 of 2 Check My Work 3 eBook Problem 10-10 A company goes public with an offering price of $20. There is a 7 percent underwriting spread. There is also a 15 percent overallotment option. The company is selling 25 million shares. The underwriter fills orders for 28.75 million shares but has not exercised the overallotment option. The stock drops to $23. How much would it cost the underwriter to cover the short position? Do not round intermediate calculations. Round your answer to the nearest dollar. $ If the underwriter used all its profits from the short position to purchase shares, how many shares would it purchase (include the shares that must be purchased to cover the short position)? Do not round intermediate calculations. Round your answer to the nearest whole number. shares Check My Work Ow Icen Kry Questions Problem 10-10 1. C 0