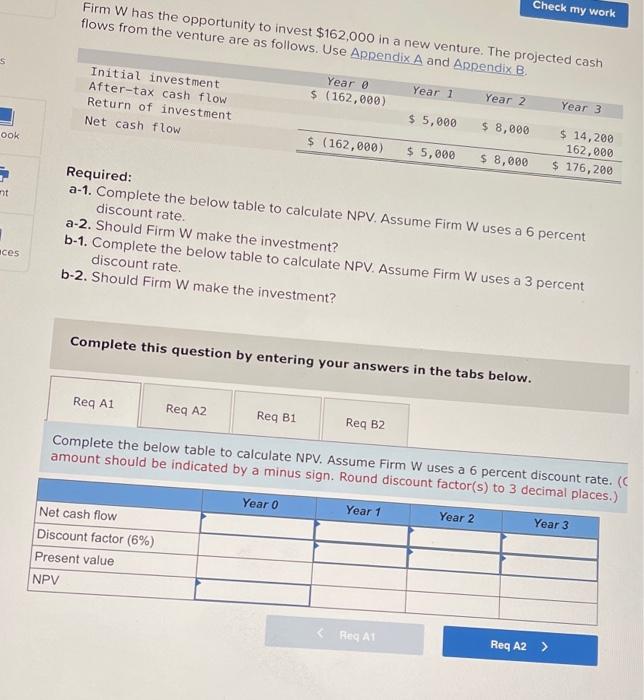

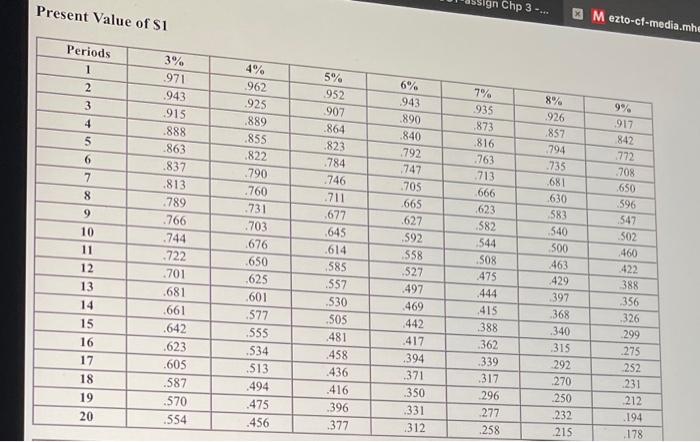

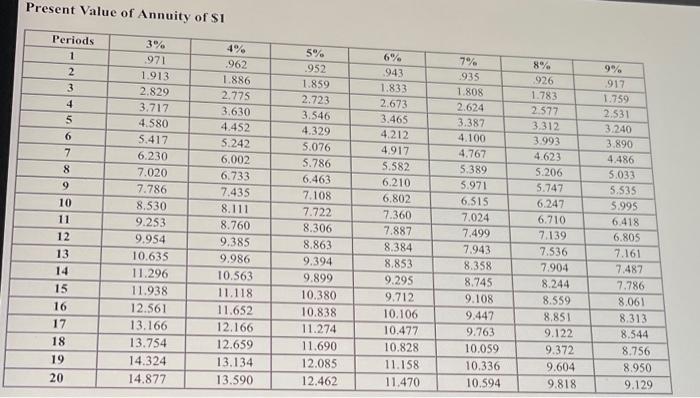

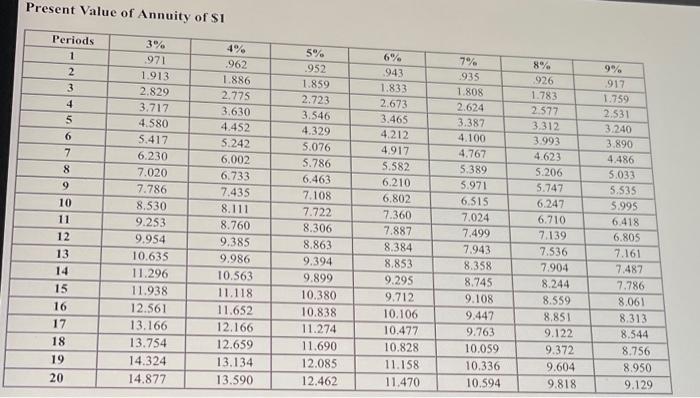

Check my work Firm W has the opportunity to invest $162,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. s Initial investment After-tax cash flow Return of investment Net cash flow Year $ (162,000) Year 1 Year 2 Year 3 $ 5,000 $ 8,000 ook $ (162,000) $ 5,000 $ 8,000 $ 14,200 162,000 $ 176,200 mt Required: a-1. Complete the below table to calculate NPV. Assume Firm W uses a 6 percent discount rate. a-2. Should Firm W make the investment? b-1. Complete the below table to calculate NPV. Assume Firm W uses a 3 percent discount rate b-2. Should Firm W make the investment? 1 aces Complete this question by entering your answers in the tabs below. Reg A1 Req AZ Reg B1 Req B2 Complete the below table to calculate NPV. Assume Firm W uses a 6 percent discount rate.( amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places.) Year 0 Year 1 Year 2 Year 3 Net cash flow Discount factor (6%) Present value NPV sign Chp 3 -.- Present Value of si 3 M ezto-ct-media.me Periods 1 3% 971 .943 2 3 6% 943 .890 .840 792 8% 926 857 4 5 6 7 8 9 7% 935 .873 816 .763 713 666 .623 .582 10 11 12 13 14 544 4% 962 925 .889 .855 .822 790 .760 .731 .703 1676 .650 .625 .601 577 .555 .534 .513 494 475 .456 .915 .888 -863 .837 .813 789 .766 .744 .722 .701 .681 .661 .642 .623 .605 .587 .570 .554 5% 952 907 .864 .823 784 746 .711 .677 645 .614 585 1557 .530 505 481 458 436 416 396 .377 747 705 665 .627 592 558 527 .497 469 .442 417 .394 371 .350 .331 1312 794 735 .681 630 583 540 500 463 429 397 368 .340 315 292 270 250 232 215 508 .475 444 415 388 362 339 .317 296 277 258 9% 917 842 772 708 650 596 547 502 460 422 388 356 326 299 .275 252 231 212 .194 178 15 16 17 18 19 20 Present Value of Annuity of $1 Periods 1 2 5% 6% 943 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 3% 971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 4% 962 1.886 2.775 3.630 4.452 5.242 6,002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 1952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 7% 1935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7,499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 8% 926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8,851 9.122 9.372 9.604 9.818 9% 917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 19 20