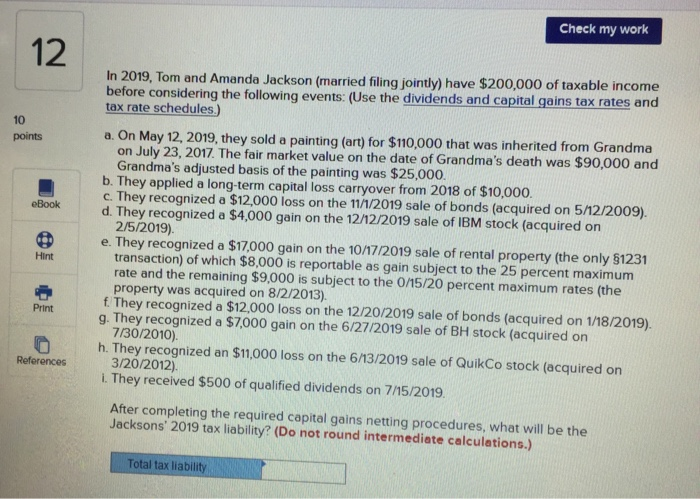

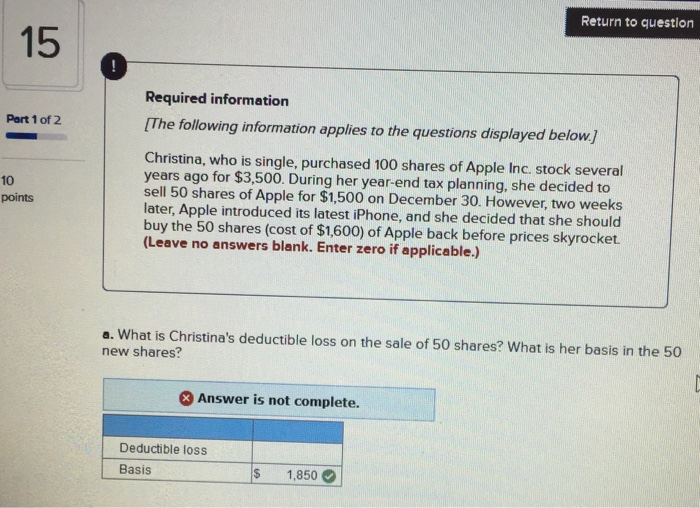

Check my work In 2019, Tom and Amanda Jackson (married filing jointly) have $200,000 of taxable income before considering the following events: (Use the dividends and capital gains tax rates and tax rate schedules.) 10 points eBook Hint a. On May 12, 2019, they sold a painting (art) for $110,000 that was inherited from Grandma on July 23, 2017. The fair market value on the date of Grandma's death was $90,000 and Grandma's adjusted basis of the painting was $25,000. b. They applied a long-term capital loss carryover from 2018 of $10,000. c. They recognized a $12,000 loss on the 11/1/2019 sale of bonds (acquired on 5/12/2009). d. They recognized a $4,000 gain on the 12/12/2019 sale of IBM stock (acquired on 2/5/2019). e. They recognized a $17,000 gain on the 10/17/2019 sale of rental property (the only $1231 transaction) of which $8,000 is reportable as gain subject to the 25 percent maximum rate and the remaining $9,000 is subject to the 0/15/20 percent maximum rates (the property was acquired on 8/2/2013). f. They recognized a $12,000 loss on the 12/20/2019 sale of bonds (acquired on 1/18/2019). g. They recognized a $7,000 gain on the 6/27/2019 sale of BH stock (acquired on 7/30/2010). h. They recognized an $11,000 loss on the 6/13/2019 sale of QuikCo stock (acquired on 3/20/2012) 1. They received $500 of qualified dividends on 7/15/2019. Print References After completing the required capital gains netting procedures, what will be the Jacksons' 2019 tax liability? (Do not round intermediate calculations.) Total tax liability Return to question 15 Required information [The following information applies to the questions displayed below. Part 1 of 2 points Christina, who is single, purchased 100 shares of Apple Inc. stock several years ago for $3,500. During her year-end tax planning, she decided to sell 50 shares of Apple for $1,500 on December 30. However, two weeks later, Apple introduced its latest iPhone, and she decided that she should buy the 50 shares (cost of $1,600) of Apple back before prices skyrocket. (Leave no answers blank. Enter zero if applicable.) a. What is Christina's deductible loss on the sale of 50 shares? What is her basis in the 50 new shares? * Answer is not complete. Deductible loss Basis $ 1,850