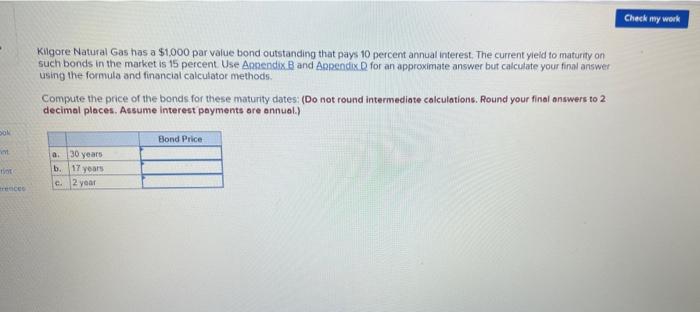

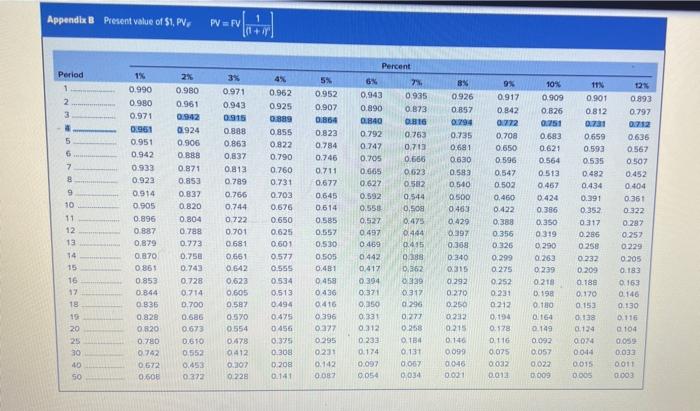

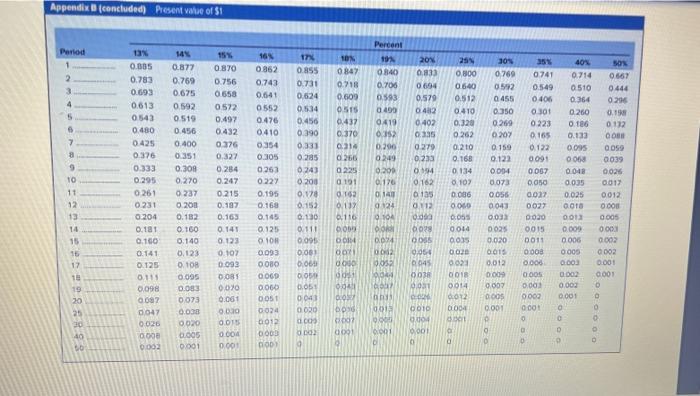

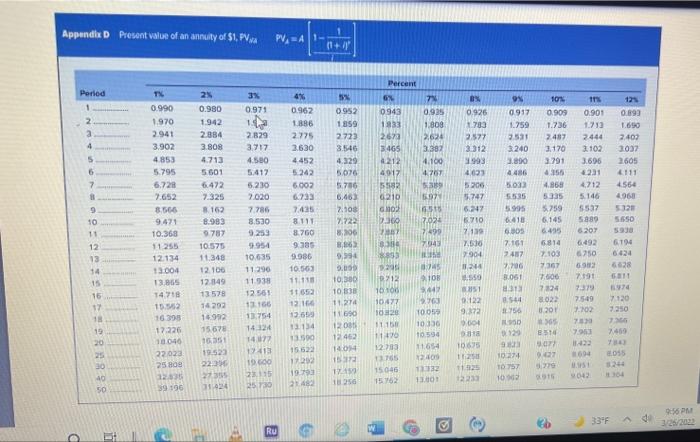

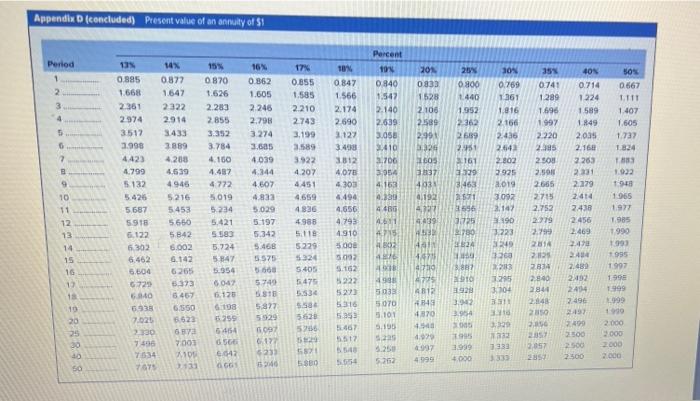

Check my work Kilgore Natural Gas has a $1,000 par value bond outstanding that pays 10 percent annual interest. The current yield to maturity on such bonds in the market is 15 percent Use Annendix Band Appendix. for an approximate answer but calculate your final answer using the formula and financial calculator methods. Compute the price of the bonds for these maturity dates (Do not round intermediate calculations. Round your final onswers to 2 decimal places. Assume interest payments are annual) Son Bond Price tot a. 30 years b. 17 years c. 2 year Appendix B Present value of S1, PV, PVFV 1 +2 Period 1 3% 101 0.909 2 3 5% 0.952 0.907 0.850 0.823 0.784 0.746 0.711 5 6 7 8 0.677 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.679 0.870 O 861 0.853 0844 0836 0.828 0.820 0.780 0.742 0.672 0.500 9 10 11 12 13 14 15 16 17 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0788 0.773 0.750 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0272 0.971 0.943 0.915 0.888 0.863 0,837 0.813 0.789 0.766 0.744 0722 0.701 0681 0.661 0.642 0.623 0.605 0.58 03570 0.554 0.478 0412 0.302 0.228 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.575 0.650 0.625 0601 0577 0.555 0.534 0.513 0/494 0.475 0456 0.375 0 308 02208 01:41 9% 0.917 0.842 0.272 0.708 0.650 0596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0275 Percent G 7% 0.943 0.935 0.890 0.873 0.840 10 0.792 0.763 0.747 0.713 0.705 0.656 0.865 0.623 0.622 0582 0.592 0544 0.558 0,508 0.527 0.475 0.497 0.444 0469 0.415 0442 0.388 0.417 0.362 0.394 0339 0371 0.31% 0.350 0.296 0.331 0.277 0.312 0.268 0.233 0.174 0.131 0.097 0.06% 0.054 0034 0,645 0.614 0585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0396 0377 0.295 0231 0.142 0.087 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0540 0.500 0403 0.429 0.397 0.368 0 340 0315 0.292 0.270 0.250 022 0.215 0:10 0090 0.046 0001 0.826 0.751 0.683 0.62 0.564 0.513 0.457 0.424 0.386 0.250 0319 0290 0.263 0239 0.218 0.19 0.180 0.164 0.149 0.092 0.057 0.022 0.009 11N 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.134 0.074 0044 0.015 DOGS 12, 0.893 0.797 0.712 0.636 0.567 0507 0.452 0.404 0.361 0.322 0.287 0.252 0229 0205 0.183 0.163 0.146 0.130 116 104 0.05 0.033 0011 0.003 0.252 18 19 20 0.231 0 212 0.194 0.178 0116 0.075 0022 0.013 25 30 40 50 Appendix concluded) Present value of $1 16 Period 1 2 3 4 5 6 TON 0847 0.18 0.000 0515 0.437 0.370 0314 0266 0225 25 0.800 0.640 0.512 0.410 0,320 0.262 9.210 0.168 7 1800 6500 15% 0.870 0.756 0.658 0572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 B 0.862 0.743 0.641 0552 0.476 0.410 0354 0.305 0263 0227 0.195 0.168 0.145 0.125 108 0.003 IT 0.855 0.731 0.624 0.534 0.456 0.390 0.331 0.285 0.243 0 200 0.17 0.152 0.130 0.111 0095 0001 30 0769 0522 0.455 0.350 0269 0207 0.159 0.122 0.054 0.073 0.056 0043 Percent 10 20% 0.840 0.833 0.700 0.694 0.593 0.579 0490 0.4.2 0419 0402 0352 0.335 0.700 0.279 0249 0.233 0.200 0594 01126 0.162 0 1 24 012 0.10 do OOR 0024 BOSS 012 0.064 0032 0.045 Od 00 0.005 0.783 0.693 0.613 0543 0.480 0.425 0.376 0.333 0.295 0261 0231 0.204 0.181 0.160 0.141 0.125 0.113 0.098 0087 0047 0.026 14% 0.877 0.769 0.675 0.592 0519 0.456 0.400 0351 0.300 0.270 0.237 0.200 0.182 0.160 0.140 6,123 0.10 0095 0.083 0.073 0.000 0020 6 2000 PEIO COLO IGLD CO10 GERO 0086 0.000 055 0014 TEOO 40% sos 0741 0.714 0.667 0.549 0510 0.444 0406 0.364 0.29 0301 0.260 0.18 0223 0.186 0112 0165 0.133 0.122 0.095 0091 0068 0039 0.048 0024 0.050 0.035 0.017 0.03 0.025 0.012 0027 GOTO 0.000 001 0005 0015 0.009 0.003 0011 0006 0003 000 0009 G002 0.000 0.000 0.002 0.00 0.000 000 o O 0 0 D OROD 10 11 12 13 14 15 16 12 18 19 20 21 30 40 8200 SCOO 0.020 0.13 0.116 DO DONDA QOX 0000 G 004 DO DO 0025 0.020 0.015 0.012 0.000 0.007 119000 ECO 0001 0800 6900 1000 1000 3800 OKOO LOO 0.050 0.05 004 030 ODIR 0014 DO12 GRUN COM SODO 1000 0 0.001 0.000 010 0.00 Oost 0024 0012 0 DOD) 0.001 TO 1000 1 1000 O OOTS 001 000 0001 Con 2009 Po 2000 9000 0001 0001 TOOO 0.004 0.00 02 9 0 D D 0 0.003 0.001 Appendix D Present value of an annuity of $1. Pa PV,A1- (1+1 All+ Percent Period W KO OX 3% 0.971 0 X6 101 6060 1 2 a 4 TX 0.990 1.970 2.941 3.902 4853 5.795 6.728 11 0.901 1.73 2444 123 0.893 1.650 2.400 7 0.925 1.808 2.624 3.382 4.100 4707 COLE LEOE 5 4% 0.962 1886 2775 3.630 4452 5242 5002 6733 7.435 8111 8.760 9385 2.829 3717 4.500 5.412 5.230 2.020 7.786 8.530 9.253 0952 1859 2723 3,546 4.329 5.076 5.76 6.163 7:10 7.722 8206 0943 1833 2679 3465 4212 4.917 5582 0219 GO 300 6 7 0917 1.759 3531 3.240 1.800 4486 5.033 5535 1.736 2487 3.170 32791 4355 4.868 0.926 1783 2577 3312 1993 4.627 5200 5.747 6.27 6710 2139 2010 GES 2605 111 4564 4960 5320 3 SEES 592 51 2 0.980 1942 2384 3.808 4.713 5.501 6472 7.325 3162 8.983 9787 10:575 11.348 12.100 12.849 13578 14202 16.992 1567 10351 19:52 9 5665 3.696 231 4.712 5.146 5537 5889 6207 6492 6250 OSSS 7,499 7.04 6.618 6.305 7.16 2487 58 VEO 9866 7904 10 11 12 13 14 15 16 17 18 6.194 6.424 6028 904 5.759 6.145 6.495 6.314 7.103 7367 7.00 2224 02 899 28 2212 16100 10477 24 1.550 69 1652 3.566 9.471 10.368 11 255 12.134 13004 13.865 14718 15.52 16 395 17.226 10046 22.033 25 809 12 39136 3.061 LI 10.635 11 290 11 938 12.561 11166 13.754 14124 1477 ISR 101 44 2.76 T005 FIER 58 7379 7549 3.000 10.100 10.30 11274 1160 12 O 12.402 10 120 2.250 ZERI 0.122 9172 004 LOCA COLE 10.563 11.11 11652 12:16 13.699 13134 13500 15522 1702 1970 2142 256 LD OCEOL 180 7 7.93 19 BIBO 10 594 B510 2460 11150 1140 123 13 LE 06 CCP SE SOB 694 888888 LICE 0036 ES HECHTE St 30 11654 2.400 11732 13.00 101895 12 12 1223 07 5270 15.05 1024 10757 10 17450 1256 2 1364 23.115 35730 042 05 11:44 Nd956 33F RU d Appendix D (concluded) Present value of an annuity of $1 Percent Period 17% 20N MOE CEBO 2 13 0.885 1668 2.361 2974 10 0.840 1.542 2.140 E 1 4 2.639 5 LISE 14% 0877 1.647 2322 2.914 3.433 3889 4203 4.639 4946 5216 5.453 15% 0870 1.626 2.283 2.855 3.352 3.784 4.160 4.437 4772 5019 1528 2.100 2589 2.99 26 1OS 2.436 9 CE 20 0.800 1440 1.952 2362 2689 2:51 161 1329 346 25 SEZ 16% 0.362 1.605 2.246 2.79 3274 3.bas 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5575 0.855 1.585 2.210 2743 3.199 3.589 3922 4.207 4.451 4.659 4836 4.983 5.11 5229 5324 5:40 2 B 9 10 11 12 LERE BLOE 1.998 442) 4.799 5132 5.425 5.687 5918 6.122 6.362 6.462 TON 0.847 1.566 2.174 2690 2127 3.400 3812 4,076 4303 4.494 4.656 4.79 4910 300 5032 5.162 5222 522) 5310 5.253 467 3.058 2410 3.706 3954 4.163 4.290 440 4611 A5 32 403 4,192 . SE VEES LE 35% 40 50% 0.769 0.741 0.714 0.667 1361 1.289 1.224 1111 1.816 1.696 1.589 1.407 2160 1997 1849 1.605 2.220 2.035 1.737 2.64 2.16 1.324 2.802 2 500 2263 3925 2.500 2331 1.932 2665 2279 1940 3092 2715 2.414 1965 2,147 2.752 2.438 1.977 190 279 2/456 1985 3.223 2799 2.469 240 2.40 1993 44 1995 2.23 2014 2.48 1295 2840 2,192 1995 3104 2844 2414 1999 2848 2.496 2010 1990 3.32 2 7400 2.000 205 2500 2.000 2.057 2500 2000 3339 285 2500 2.000 0995 439 5.421 5583 0725 2730 EL TH MISE 5.724 24 VIRE SCH ZVES 23 BICE 14 15 10 12 3.81 1997 09 5.842 6.002 6.142 6265 6373 5457 6.550 6522 6720 5.954 6047 6.125 6108 OVE 5749 318 5827 6663 19 20 34 5.50 5628 56 4573 4710 47075 4812 145 4370 4.94 19 1997 4195 LEE IKE 5569 1929 3.42 3.954 00 1995 4998 503 5070 5101 5.195 5225 9.250 5.252 6265 SC A9 7025 2330 7406 7534 7675 LIS 6454 6.566 6.642 GOS 1037 6.17 52 TEEN EEEE 7001 10 133 12 SAB 14 666E 000+ 0 50