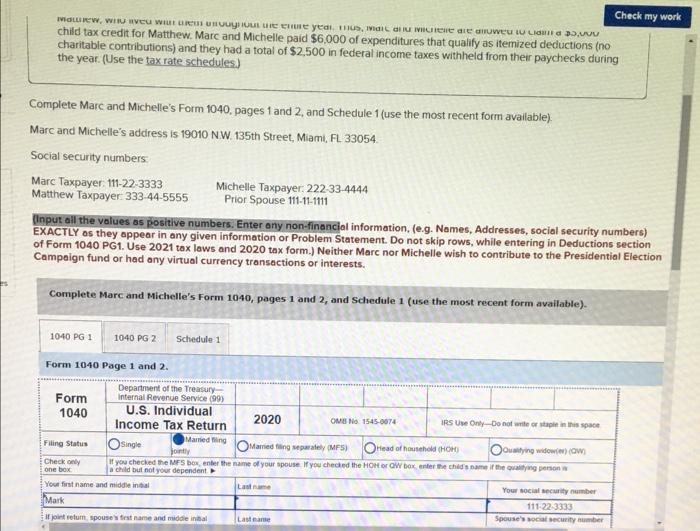

Check my work Mare, Waveu wilt remote enure year. mus, maic au Mere are a child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions (no charitable contributions) and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules) Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available) Marc and Michelle's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Matthew Taxpayer: 333-44-5555 Michelle Taxpayer: 222-33-4444 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. Use 2021 tax laws and 2020 tax form.) Neither Marc nor Michelle wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests. Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available). 1040 PG 1 1040 PG 2 Schedule 1 Form 1040 Page 1 and 2. Form 1040 Department of the Treasury- Internal Revenue Service (99) U.S. Individual Income Tax Return Married fing jointly OMB No 1545-0074 IRS Use Only-Do not write or staple in this space 2020 OMarried filing separately (MFS) Filing Status Osingle OHead of household (HOH) Qualifying widow) (w) Check only one box If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person w a child but not your dependent Your first name and middle intal Last name Your social security number 111-22-3333 Mark Spouse's social security number If joint retum, spouse's first name and middle intal Last name Check my work Mare, Waveu wilt remote enure year. mus, maic au Mere are a child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions (no charitable contributions) and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules) Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available) Marc and Michelle's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Matthew Taxpayer: 333-44-5555 Michelle Taxpayer: 222-33-4444 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. Use 2021 tax laws and 2020 tax form.) Neither Marc nor Michelle wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests. Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available). 1040 PG 1 1040 PG 2 Schedule 1 Form 1040 Page 1 and 2. Form 1040 Department of the Treasury- Internal Revenue Service (99) U.S. Individual Income Tax Return Married fing jointly OMB No 1545-0074 IRS Use Only-Do not write or staple in this space 2020 OMarried filing separately (MFS) Filing Status Osingle OHead of household (HOH) Qualifying widow) (w) Check only one box If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person w a child but not your dependent Your first name and middle intal Last name Your social security number 111-22-3333 Mark Spouse's social security number If joint retum, spouse's first name and middle intal Last name