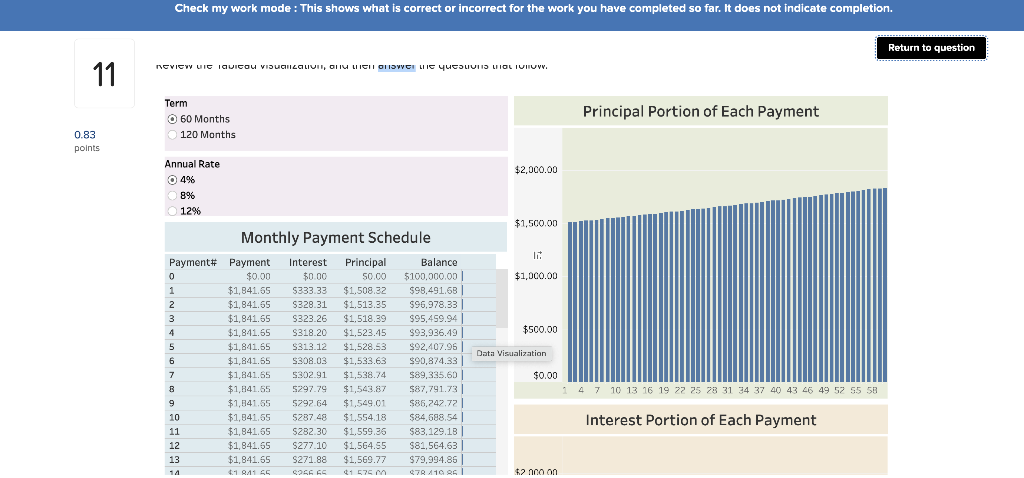

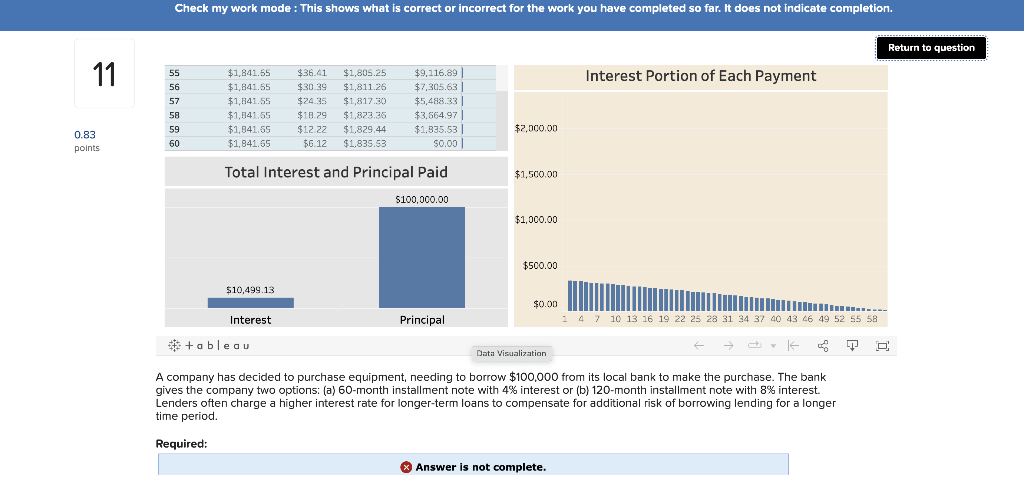

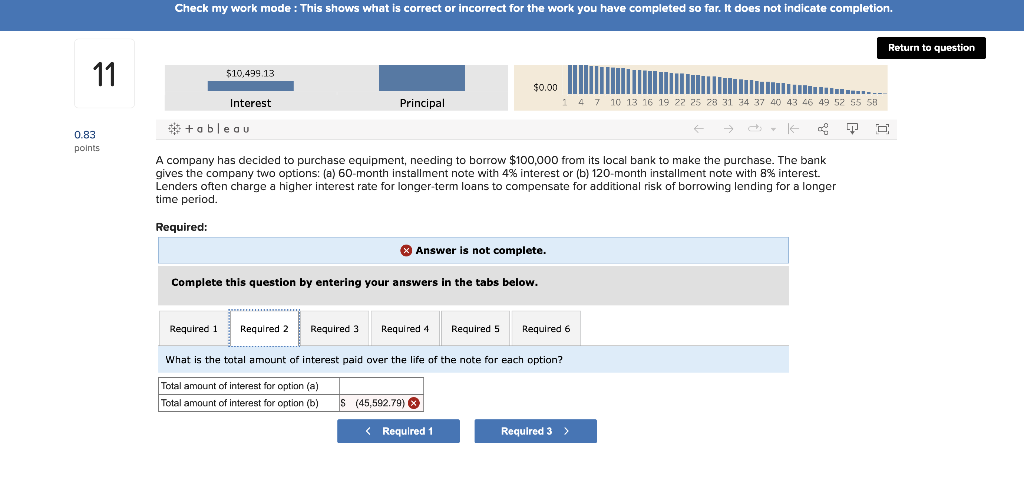

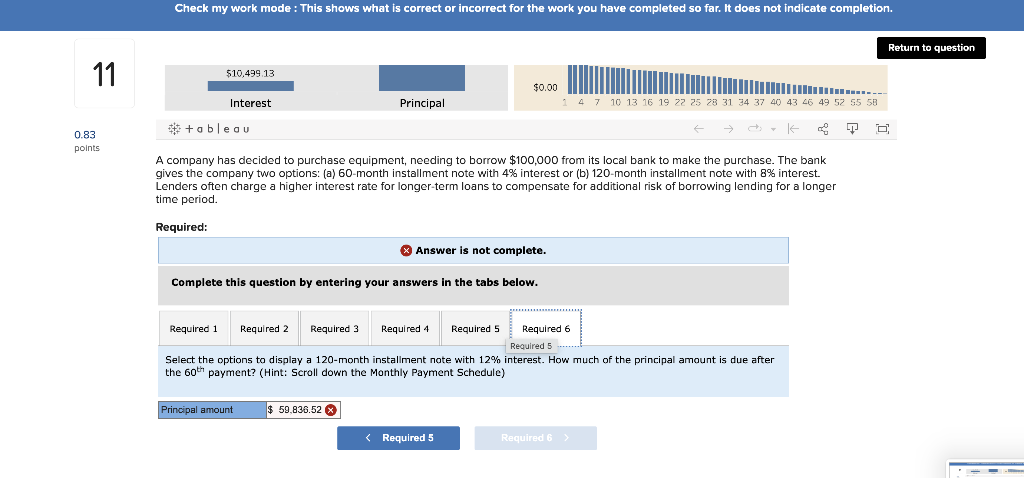

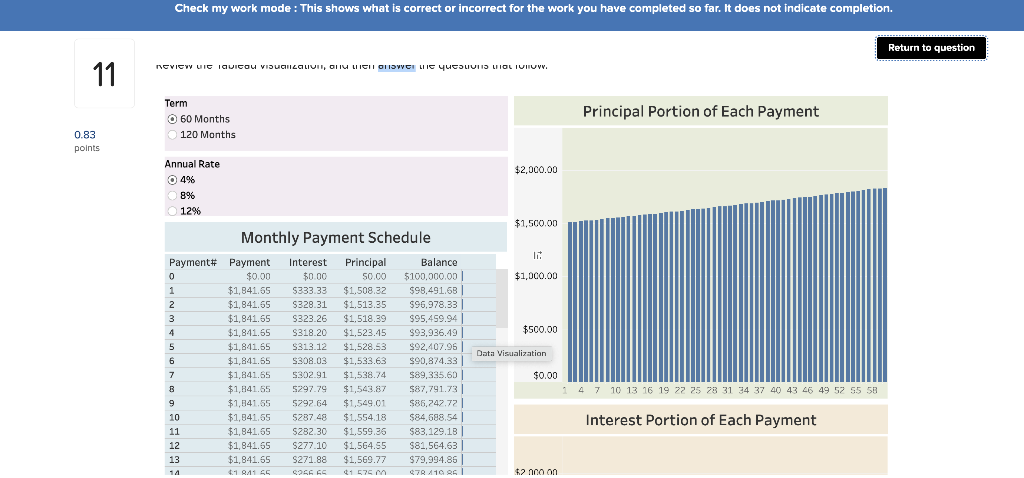

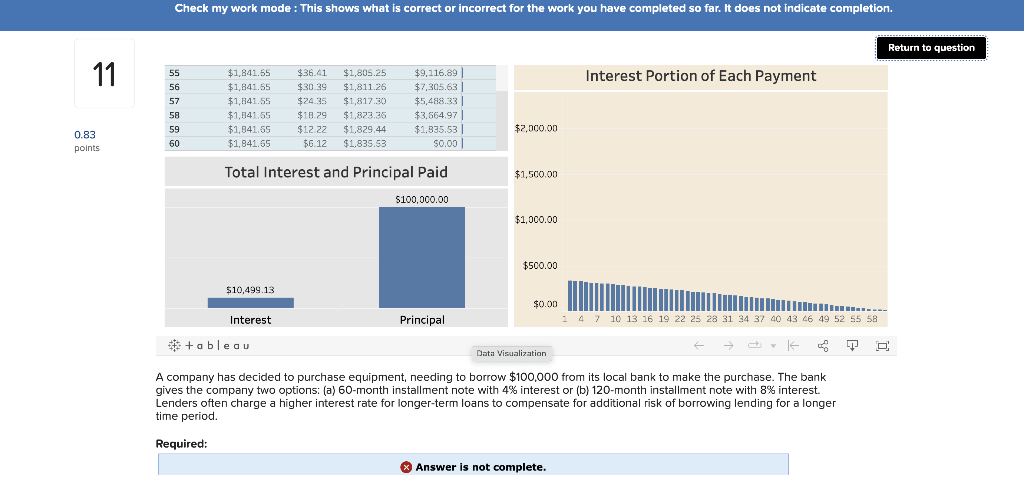

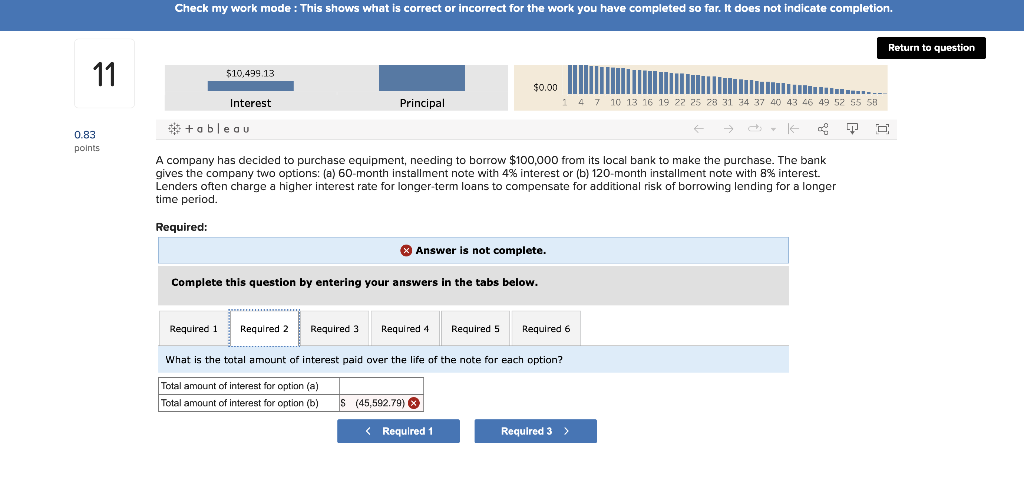

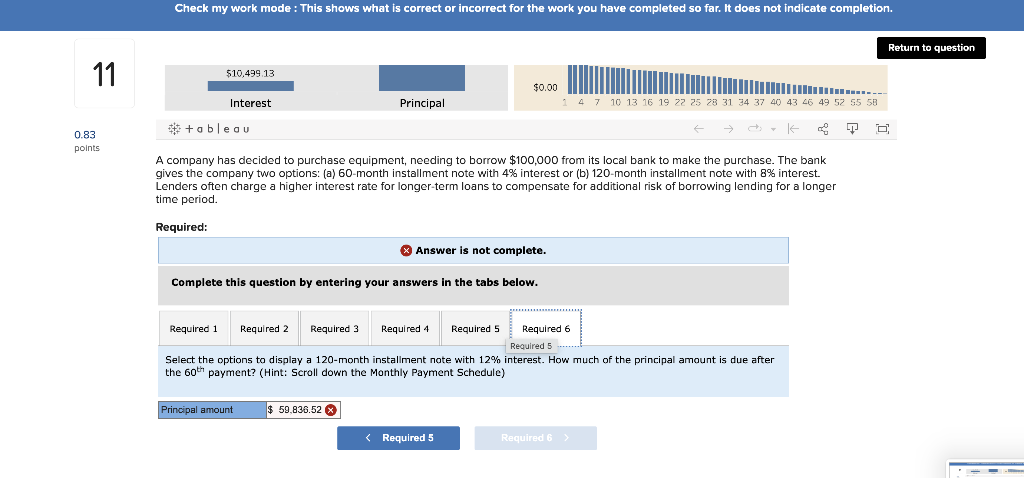

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank jives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. enders often charge a higher interest rate for longer-term loans to compensate for additional risk of borrowing lending for a longer ime period. A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120 -month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of borrowing lending for a longer time period. Required: Answer is not complete. Complete this question by entering your answers in the tabs below. What is the total amount of interest paid over the life of the note for each option? A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120 -month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of borrowing lending for a longer time period. Required: Answer is not complete. Complete this question by entering your answers in the tabs below. Select the options to display a 120 -month installment note with 12% interest. How much of the principal amount is due after the 60th payment? (Hint: Scroll down the Monthly Payment Schedule) Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank jives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. enders often charge a higher interest rate for longer-term loans to compensate for additional risk of borrowing lending for a longer ime period. A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120 -month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of borrowing lending for a longer time period. Required: Answer is not complete. Complete this question by entering your answers in the tabs below. What is the total amount of interest paid over the life of the note for each option? A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120 -month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of borrowing lending for a longer time period. Required: Answer is not complete. Complete this question by entering your answers in the tabs below. Select the options to display a 120 -month installment note with 12% interest. How much of the principal amount is due after the 60th payment? (Hint: Scroll down the Monthly Payment Schedule)