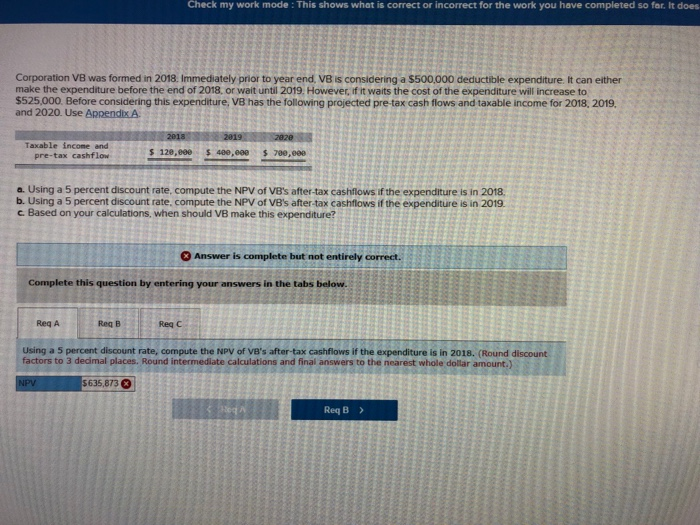

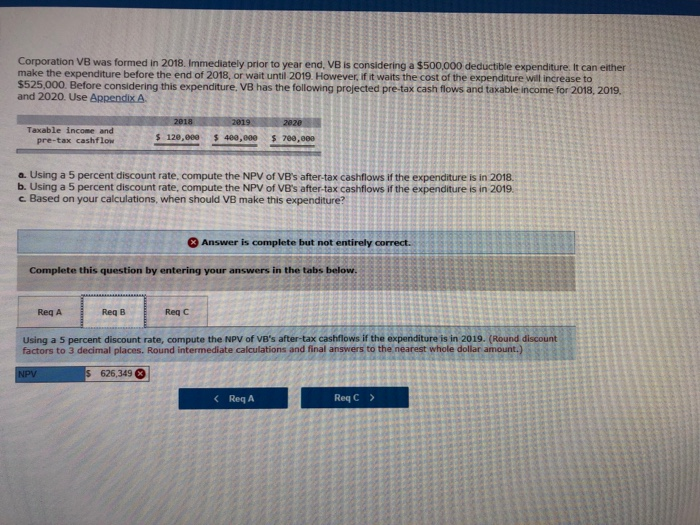

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does Corporation VB was formed in 2018. Immediately prior to year end, VB is considering a $500.000 deductible expenditure. It can either make the expenditure before the end of 2018, or wait until 2019. However, if it waits the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pre-tax cash flows and taxable income for 2018, 2019, and 2020. Use Appendx A. Taxable income and pre-tax cashflow S 128,800 $48e,eee s 700,e02 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2018, b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2019. Based on your calculations, when should VB make this expenditure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A Req B Req C Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2018. (Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.) 635,873 Req B > Corporation VB was formed in 2018. Immediately prior to year end, VB is considering a $500000 deductible expenditure It can either make the expenditure before the end of 2018, or wait until 2019. However, if it waits the cost of the expenditure will increase to $525,000. Before considering this expenditure. VB has the following projected pre-tax cash flows and taxable income for 2018,. 2019 and 2020. Use Appendix A Taxable income and pre-tax cashflow s 128,e00 $ 40e,000 $ 700,000 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2018 b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2019. c Based on your calculations, when should VB make this expenditure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A Req B Req C Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2019. (Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.) s 626,349 Req A