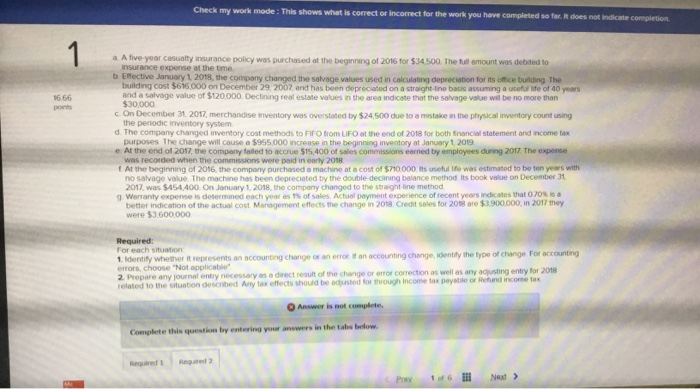

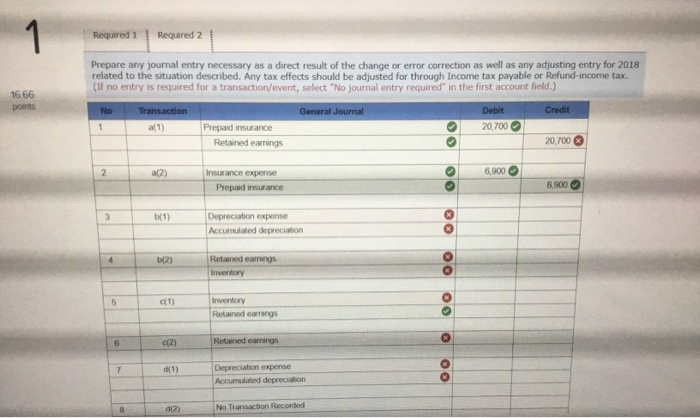

Check my work mode: This shows whet is correct or incomect for the work you have completed so fer. R does not indicate completion 1 a A five-year casualty insurance policy was purchased at the beginning of 2016 for $34,500. The full emount was debited to insurance expense at the time b Effective Januuary 1 2018, the company changed the salvage values used in calculating depreciation for its office building The building cost $616.000 on December 29 2007 and has been depreciated on a straight-ine bacis assuming a useful life of 40 years and a salvage value of $120,000 Declining real estate values in the area indicate that the salvage value will be no more than $30,000 c On December 31, 2017, merchandise inventory was overstated by $24,500 due to a mistake in the physical inventory count using the periodic inventory system d. The company changed inventory cost methods to FIFO from LIFO at the end of 2018 for both financial statement and income tax purposes The change will cause a $955.000 increase in the beginning inventory at January 1, 2019 e At the end of 2017, the company tfailed to accrue $15,400 of sales commissions eerned by employees during 2017 The expense was recorded when the commissions were paid in early 2018 t At the beginning of 2016, the company purchased a machine at a cost of $710.000 Its useful Ife was estimatod to be ten years with no salvage value. The machine has been deprecieted by the double-decining balance method Its book value on December 31, 2017, was $454,400 On January 1, 2018, the compeny changed to the straight-line method g Werranty expense is determined each year as 1% of sales Actual payment experience of recent years indicates that 070% is better indication of the actual cost Management effects the change in 2018 Credit sales for 208 are $3.900,000, in 2017 they were $3,600,000 16.66 ponts Required For eech situation 1 Identity whether it represents an accounting change or an error if an accounting change, identily the type of change For accounting errors, choose "Not applicable 2 Prepare any journal entry necessary as o direct result of the change or error correction as well as any adjusting entry for 2018 related to the situation described Any tax effects shoud be adusted for through Income tax payatle or Refund income tax Answer is not complete Complete this question by entering your answers in the tabs bedow. Regired 2 Required 1 1 of 6 Next Prev 1 Required 1 Required 2 Prepare any journal entry necessary as a direct result of the change or error correction as well as any adjusting entry for 2018 related to the situation described. Any tax effects should be adjusted for through Income tax payable or Refund-income tax. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1666 points Credit No Transaction Debit General Journal 20,700 Prepaid insurance 1 al1) 20,700 Retained eanings 6,900 Insurance expense a(2) 6,900 Prepaid insurance Depreciation expense Accumulated depreciation 3 b(1) Retained earnings Inventory 4 b2) Inventory Retained earmings c1) 5 Retained earmings c(2) 6 Depreciation expense d(1) 7 Accumulated deprecialion No Transaction Recorded d2) Check my work mode: This shows whet is correct or incomect for the work you have completed so fer. R does not indicate completion 1 a A five-year casualty insurance policy was purchased at the beginning of 2016 for $34,500. The full emount was debited to insurance expense at the time b Effective Januuary 1 2018, the company changed the salvage values used in calculating depreciation for its office building The building cost $616.000 on December 29 2007 and has been depreciated on a straight-ine bacis assuming a useful life of 40 years and a salvage value of $120,000 Declining real estate values in the area indicate that the salvage value will be no more than $30,000 c On December 31, 2017, merchandise inventory was overstated by $24,500 due to a mistake in the physical inventory count using the periodic inventory system d. The company changed inventory cost methods to FIFO from LIFO at the end of 2018 for both financial statement and income tax purposes The change will cause a $955.000 increase in the beginning inventory at January 1, 2019 e At the end of 2017, the company tfailed to accrue $15,400 of sales commissions eerned by employees during 2017 The expense was recorded when the commissions were paid in early 2018 t At the beginning of 2016, the company purchased a machine at a cost of $710.000 Its useful Ife was estimatod to be ten years with no salvage value. The machine has been deprecieted by the double-decining balance method Its book value on December 31, 2017, was $454,400 On January 1, 2018, the compeny changed to the straight-line method g Werranty expense is determined each year as 1% of sales Actual payment experience of recent years indicates that 070% is better indication of the actual cost Management effects the change in 2018 Credit sales for 208 are $3.900,000, in 2017 they were $3,600,000 16.66 ponts Required For eech situation 1 Identity whether it represents an accounting change or an error if an accounting change, identily the type of change For accounting errors, choose "Not applicable 2 Prepare any journal entry necessary as o direct result of the change or error correction as well as any adjusting entry for 2018 related to the situation described Any tax effects shoud be adusted for through Income tax payatle or Refund income tax Answer is not complete Complete this question by entering your answers in the tabs bedow. Regired 2 Required 1 1 of 6 Next Prev 1 Required 1 Required 2 Prepare any journal entry necessary as a direct result of the change or error correction as well as any adjusting entry for 2018 related to the situation described. Any tax effects should be adjusted for through Income tax payable or Refund-income tax. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1666 points Credit No Transaction Debit General Journal 20,700 Prepaid insurance 1 al1) 20,700 Retained eanings 6,900 Insurance expense a(2) 6,900 Prepaid insurance Depreciation expense Accumulated depreciation 3 b(1) Retained earnings Inventory 4 b2) Inventory Retained earmings c1) 5 Retained earmings c(2) 6 Depreciation expense d(1) 7 Accumulated deprecialion No Transaction Recorded d2)