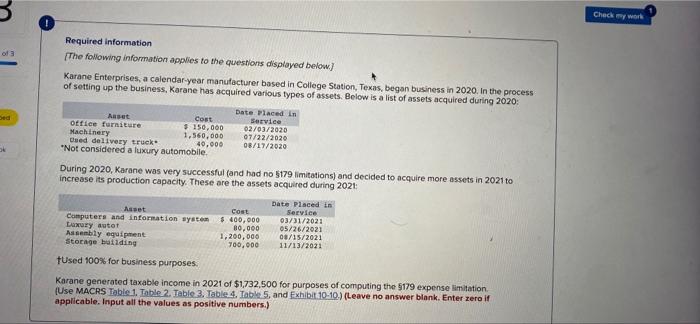

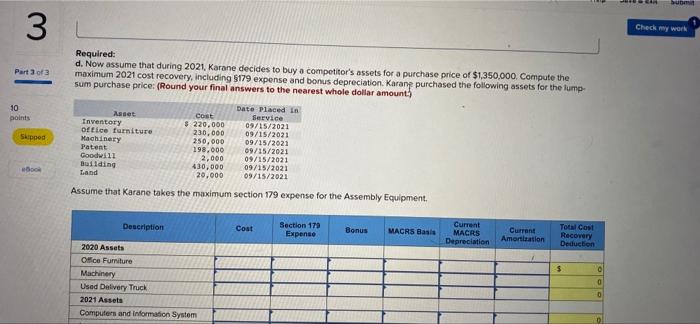

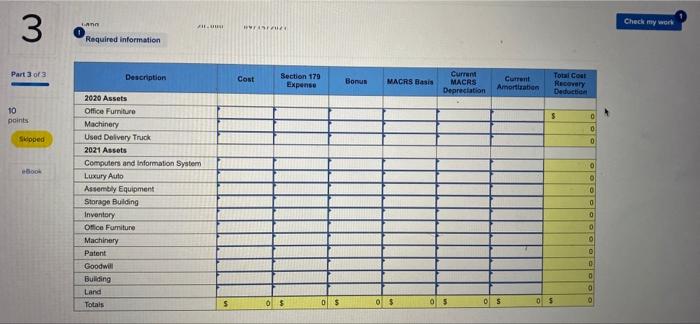

Check my work od 3 Required information The following information applies to the questions displayed below) Karane Enterprises, a calendar year manufacturer based in College Station, Texas, began business in 2020. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2020: Date Placed in Anset Cost Service office furniture $ 150.000 02/03/2020 Machinery 1,560,000 07/22/2020 Used delivery truck 40,000 08/17/2020 "Not considered a luxury automobile. During 2020, Karane was very successful and had no 5179 limitations and decided to acquire more assets in 2021 to increase its production capacity. These are the assets acquired during 2021 Ded Asset Cost Computers and information system 400,000 Luxury autor 80,000 Assembly equipment 1,200,000 Storage building 700,000 Date Placed in Service 03/31/2021 05/26/2021 08/15/2021 11/13/2021 Used 100% for business purposes. Karane generated taxable income in 2021 of $1,732,500 for purposes of computing the 5179 expense limitation (Use MACRS Table 1. Table 2. Table 3. Table 4. Table 5, and Exhibit.10-10.) (Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers.) Sub 3 Checy work Part 3 of 3 Required: d. Now assume that during 2021, Karane decides to buy a competitor's assets for a purchase price of $1,350,000. Compute the maximum 2021 cost recovery, including 5179 expense and bonus depreciation. Karang purchased the following assets for the lump- sum purchase price: (Round your final answers to the nearest whole dollar amount 10 points Skipped Asset Inventory ofice furniture Machinery Patent Goodwill Building Land Cost $ 220.000 230.000 250,000 198,000 2.000 430,000 20,000 Date Placed in Service 09/15/2021 09/15/2021 09/15/2021 69/15/2021 09/15/2021 09/15/2021 09/15/2021 woo Assume that Karane takes the maximum section 179 expense for the Assembly Equipment. Description Cost Section 179 Expense Bonus MACRS Basis Current MACRS Depreciation Current Amortisation Total Cost Recovery Deduction $ 2020 Assets Oce Furniture Machinery Used Delivery Truck 2021 Assets Computers and Information System 0 0 Check my work 3 WASTA Required information Part 3 of 3 Description Cost Section 179 Expense Bonus MACRS Basis Current MACRS Depreciation Current Amortisaties Total Coal Recovery Deduction 10 points $ 0 0 0 Sipped Boos 0 2020 Assets Office Furniture Machinery Used Delivery Truck 2021 Assets Computers and Information System Luxury Auto Assembly Equipment Storage Building Inventory Office Furniture Machinery Patent Goodwin Buliding Land Totals 0 0 0 0 g S 0 $ os 0 $ 05 os 0$