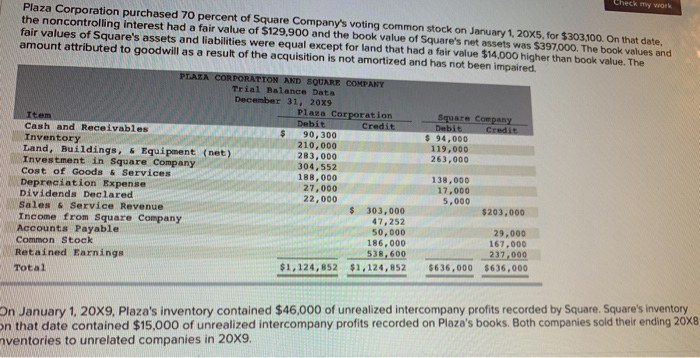

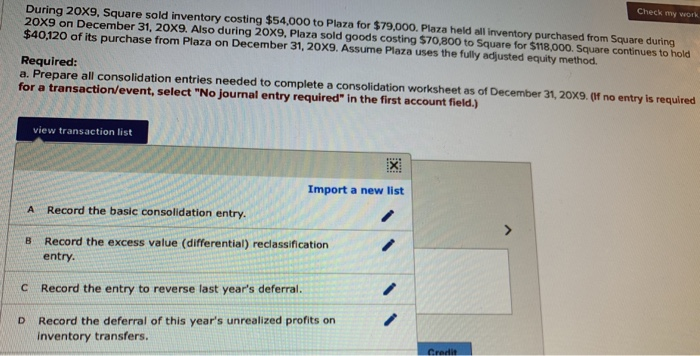

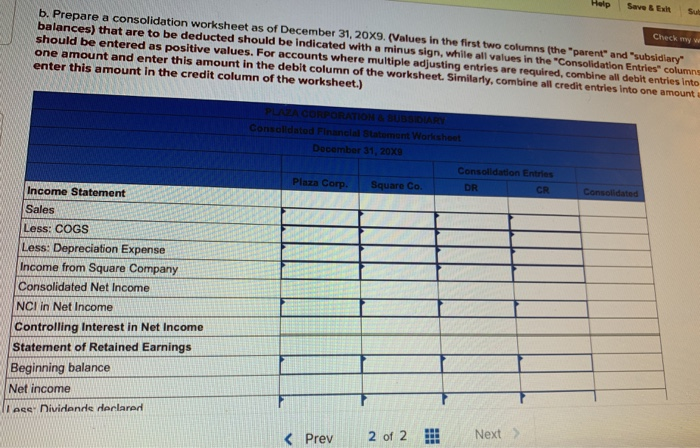

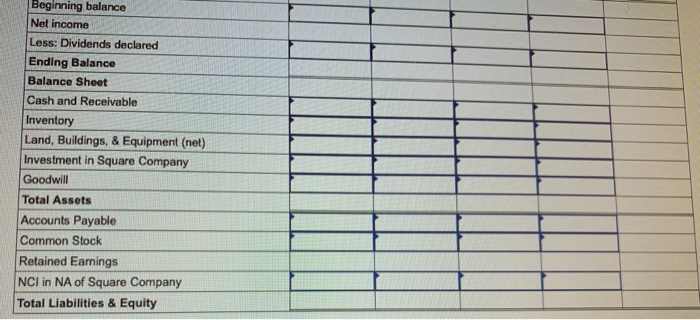

Check my work Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1, 20X5, for $303100. On that date, the noncontrolling interest had a fair value of $129,900 and the book value of Square's net assets was $397,000. The book values and fair values of Square's assets and liabilities were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impaired PLAZA CORPORATION AND SQUARE COMPANY Trial Balance Data December 31, 20x9 Plaza Corporation Debit Square Company Debit Item Credit Credit Cash and Receivables Inventory Land, Buildings, & Equipment (net) Investment in Square Company Cost of Goods &Services Depreciation Expense Dividends Declared Sales & Service Revenue Income from Square Company Accounts Payable 90,300 210,000 283,000 $ 94,000 119,000 263,000 304,552 188,000 27,000 22,000 138,000 17,000 5,000 303,000 47,252 50,000 186,000 $203,000 29,000 167,000 Common Stock 237,000 538,600 Retained Earnings $636,000 $636,000 $1,124,852 $1,124,852 Total On January 1, 20X9, Plaza's inventory contained $46,000 of unrealized intercompany profits recorded by Square. Square's inventory on that date contained $15,000 of unrealized intercompany profits recorded on Plaza's books. Both companies sold their ending 20X8 nventories to unrelated companies in 20X9. Check my work During 20X9, Square sold inventory costing $54,000 to Plaza for $79,000. Plaza held all inventory purchased from Square during 20X9 on December 31, 20X9. Also during 20x9, Plaza sold goods costing $70,800 to Square for $118,000. Square continues to hold $40,120 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equity method. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Import a new list Record the basic consolidation entry. A Record the excess value (differential) reclassification entry. B Record the entry to reverse last year's deferral. Record the deferral of this year's unrealized profits on inventory transfers. Credit Help Save&Exit Sub b. Prepare a consolidation worksheet as of December 31, 20X9. (Values in the first two columns (the "parent" and "subsidlary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into- one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount enter this amount in the credit column of the worksheet.) Check my we RY Consolldated Financial Statoment Workshoet December 31, 20X9 Consolldation Entries Plaza Corp. Square Co. DR CR Consolidated Income Statement Sales Less: COGS Less: Depreciation Expense Income from Square Company Consolidated Net Income NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning balance Net income lese Dividends declared. Next 2 of 2 KPrev Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Cash and Receivable Inventory Land, Buildings, & Equipment (net) Investment in Square Company Goodwill Total Assets Accounts Payable Common Stock Retained Eanings NCI in NA of Square Company Total Liabilities & Equity