Check my work please, is it correct, is anything wrong? Four products, a toaster, electric frying pan, iron, and coffeemaker were developed. (Focus on those 4 only)

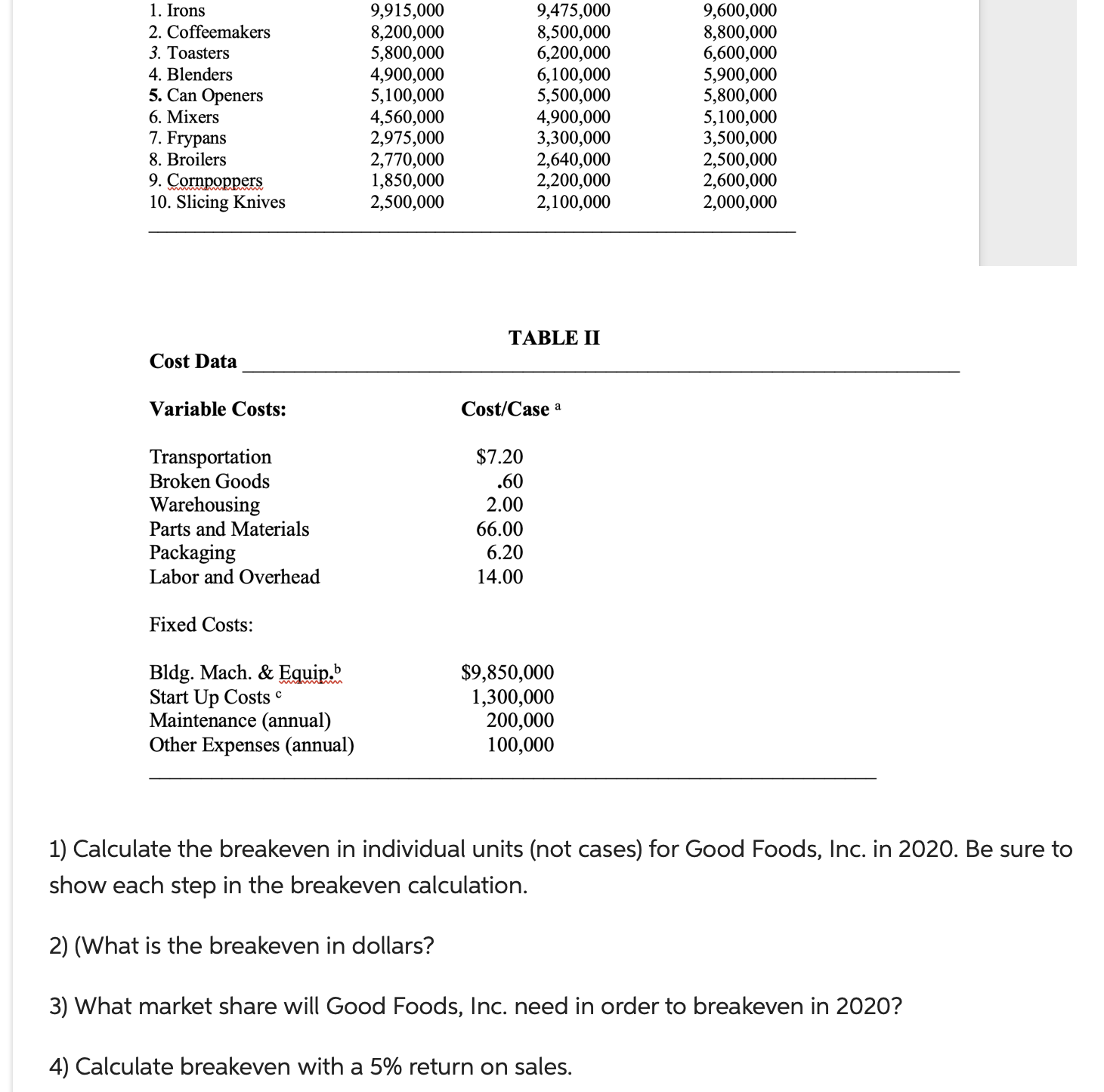

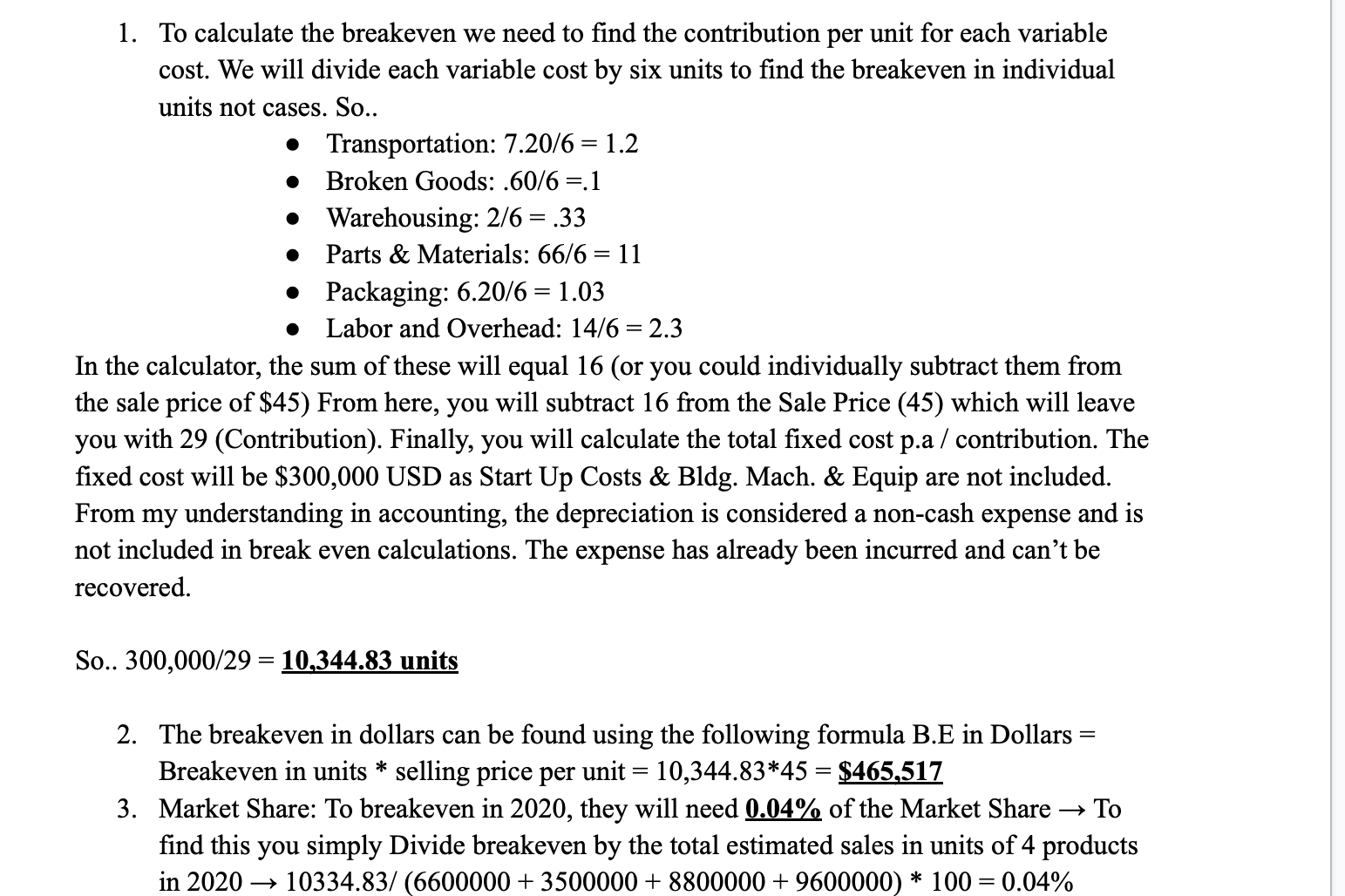

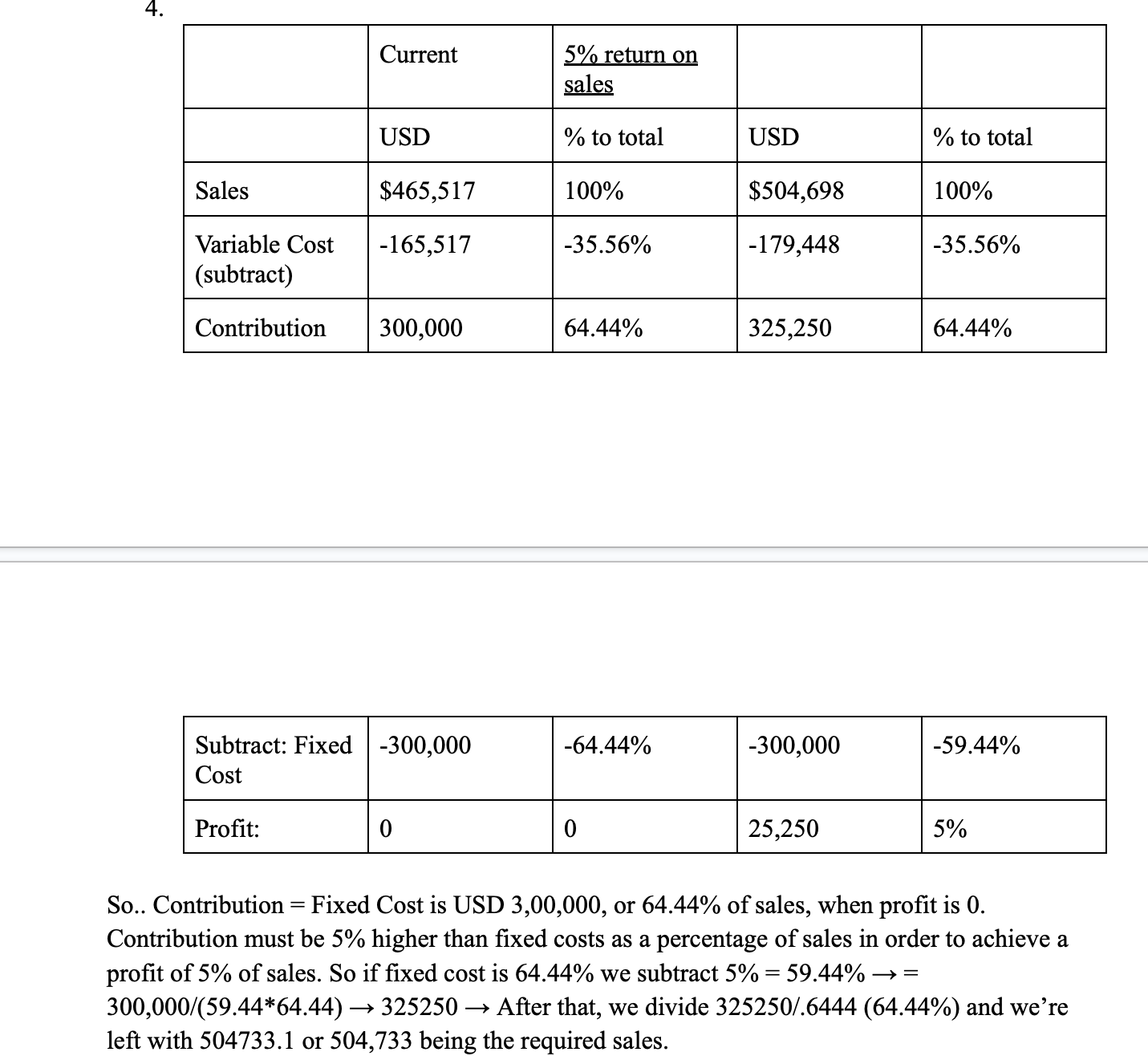

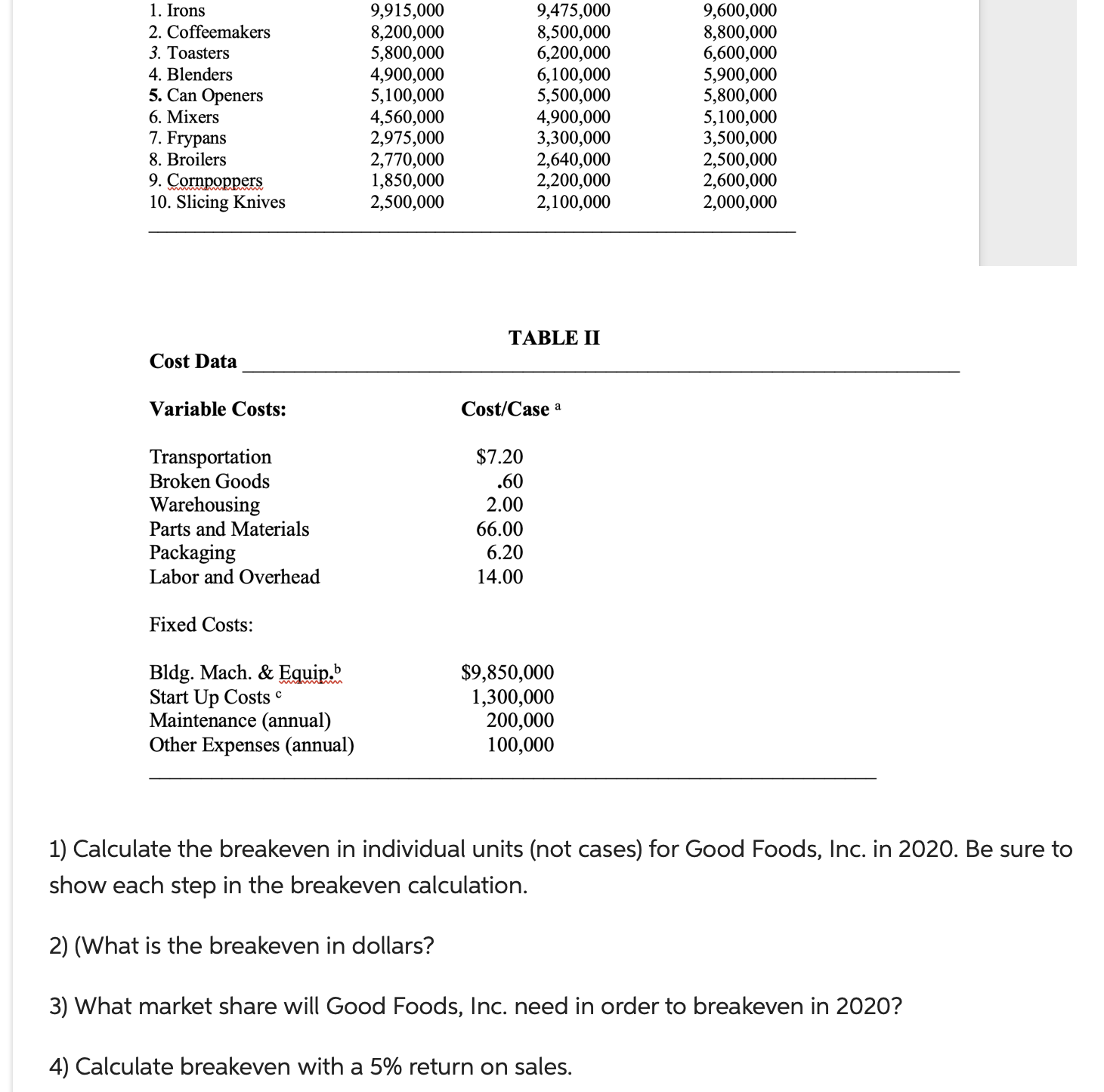

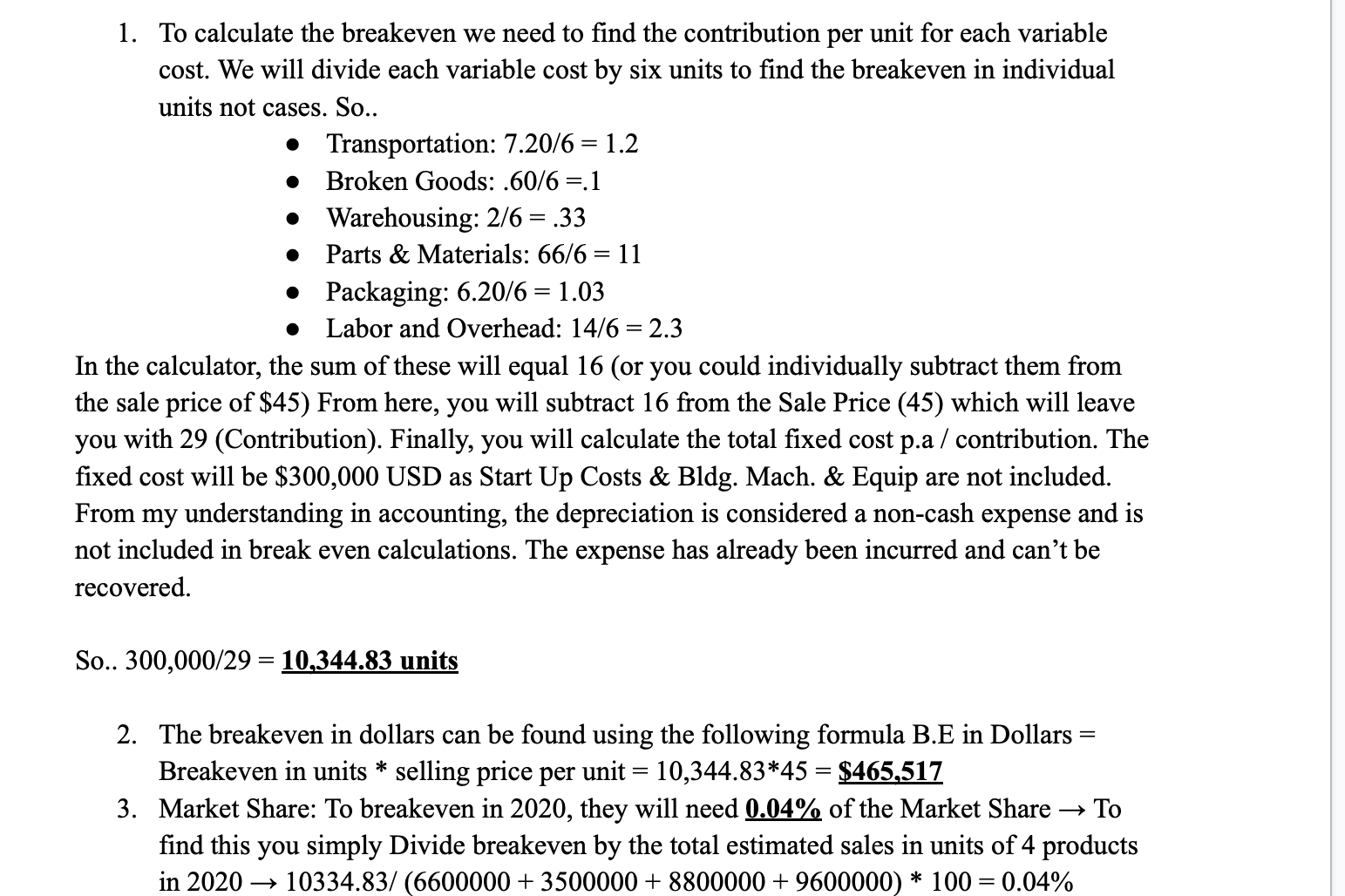

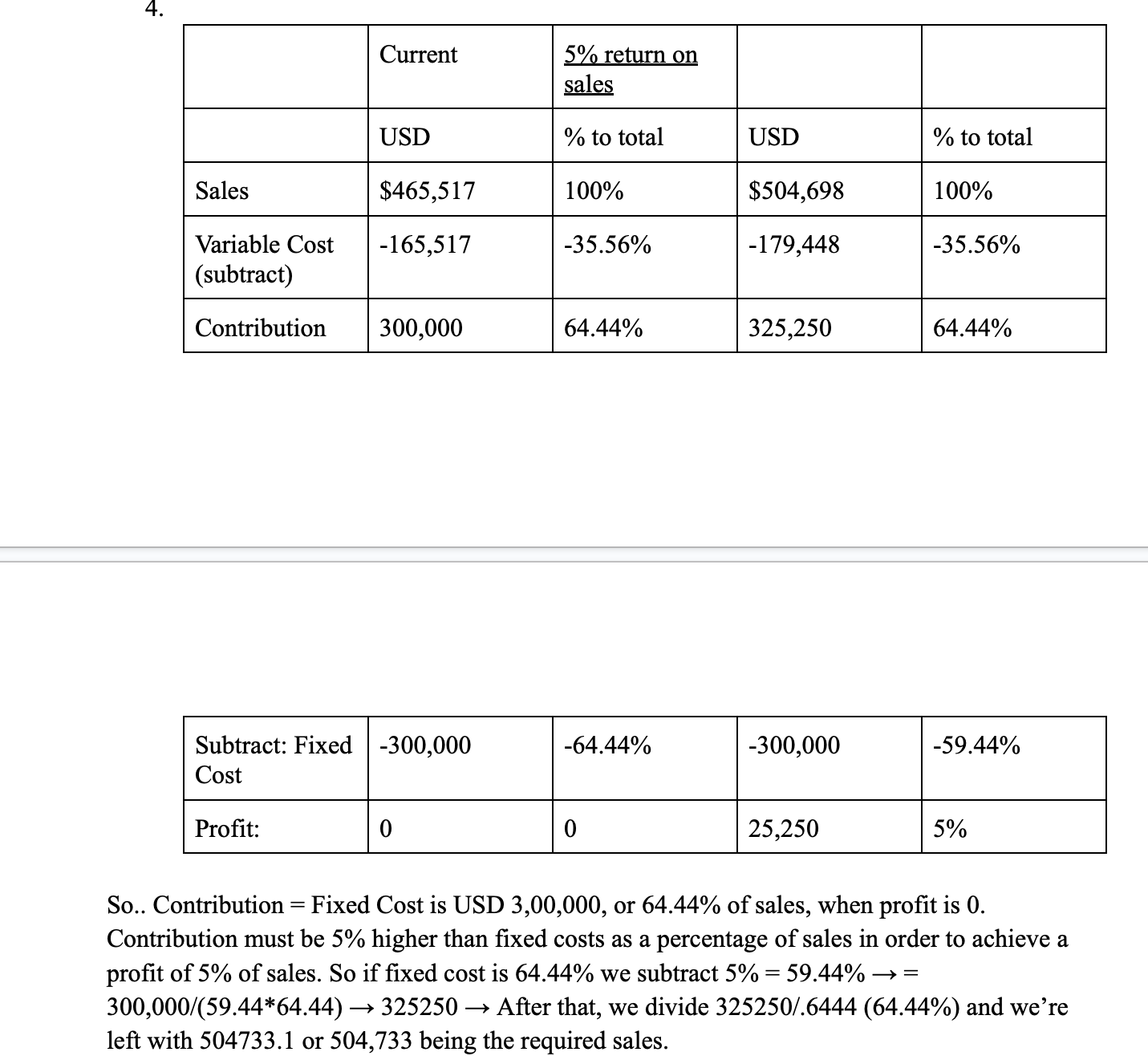

1. To calculate the breakeven we need to find the contribution per unit for each variable cost. We will divide each variable cost by six units to find the breakeven in individual units not cases. So.. - Transportation: 7.20/6=1.2 - Broken Goods: .60/6=.1 - Warehousing: 2/6=.33 - Parts \& Materials: 66/6=11 - Packaging: 6.20/6=1.03 - Labor and Overhead: 14/6=2.3 In the calculator, the sum of these will equal 16 (or you could individually subtract them from the sale price of \$45) From here, you will subtract 16 from the Sale Price (45) which will leave you with 29 (Contribution). Finally, you will calculate the total fixed cost p.a / contribution. The fixed cost will be $300,000 USD as Start Up Costs \& Bldg. Mach. \& Equip are not included. From my understanding in accounting, the depreciation is considered a non-cash expense and is not included in break even calculations. The expense has already been incurred and can't be recovered. So.. 300,000/29=10,344.83 units 2. The breakeven in dollars can be found using the following formula B.E in Dollars = Breakeven in units * selling price per unit =10,344.8345=$465,517 3. Market Share: To breakeven in 2020, they will need 0.04% of the Market Share To find this you simply Divide breakeven by the total estimated sales in units of 4 products in 202010334.83/(6600000+3500000+8800000+9600000)100=0.04% So.. Contribution = Fixed Cost is USD 3,00,000, or 64.44% of sales, when profit is 0 . Contribution must be 5% higher than fixed costs as a percentage of sales in order to achieve a profit of 5% of sales. So if fixed cost is 64.44% we subtract 5%=59.44%= 300,000/(59.4464.44)325250 After that, we divide 325250/.6444 (64.44\%) and we're left with 504733.1 or 504,733 being the required sales. 1) Calculate the breakeven in individual units (not cases) for Good Foods, Inc. in 2020 . Be sure to show each step in the breakeven calculation. 2) (What is the breakeven in dollars? 3) What market share will Good Foods, Inc. need in order to breakeven in 2020 ? 4) Calculate breakeven with a 5% return on sales. 1. To calculate the breakeven we need to find the contribution per unit for each variable cost. We will divide each variable cost by six units to find the breakeven in individual units not cases. So.. - Transportation: 7.20/6=1.2 - Broken Goods: .60/6=.1 - Warehousing: 2/6=.33 - Parts \& Materials: 66/6=11 - Packaging: 6.20/6=1.03 - Labor and Overhead: 14/6=2.3 In the calculator, the sum of these will equal 16 (or you could individually subtract them from the sale price of \$45) From here, you will subtract 16 from the Sale Price (45) which will leave you with 29 (Contribution). Finally, you will calculate the total fixed cost p.a / contribution. The fixed cost will be $300,000 USD as Start Up Costs \& Bldg. Mach. \& Equip are not included. From my understanding in accounting, the depreciation is considered a non-cash expense and is not included in break even calculations. The expense has already been incurred and can't be recovered. So.. 300,000/29=10,344.83 units 2. The breakeven in dollars can be found using the following formula B.E in Dollars = Breakeven in units * selling price per unit =10,344.8345=$465,517 3. Market Share: To breakeven in 2020, they will need 0.04% of the Market Share To find this you simply Divide breakeven by the total estimated sales in units of 4 products in 202010334.83/(6600000+3500000+8800000+9600000)100=0.04% So.. Contribution = Fixed Cost is USD 3,00,000, or 64.44% of sales, when profit is 0 . Contribution must be 5% higher than fixed costs as a percentage of sales in order to achieve a profit of 5% of sales. So if fixed cost is 64.44% we subtract 5%=59.44%= 300,000/(59.4464.44)325250 After that, we divide 325250/.6444 (64.44\%) and we're left with 504733.1 or 504,733 being the required sales. 1) Calculate the breakeven in individual units (not cases) for Good Foods, Inc. in 2020 . Be sure to show each step in the breakeven calculation. 2) (What is the breakeven in dollars? 3) What market share will Good Foods, Inc. need in order to breakeven in 2020 ? 4) Calculate breakeven with a 5% return on sales