Question

Check my work Problem 3.2A (Algo) Using T accounts to record transactions involving assets, liabilities, and owner's equity. LO 3-1, 3-2 16.66 points The following

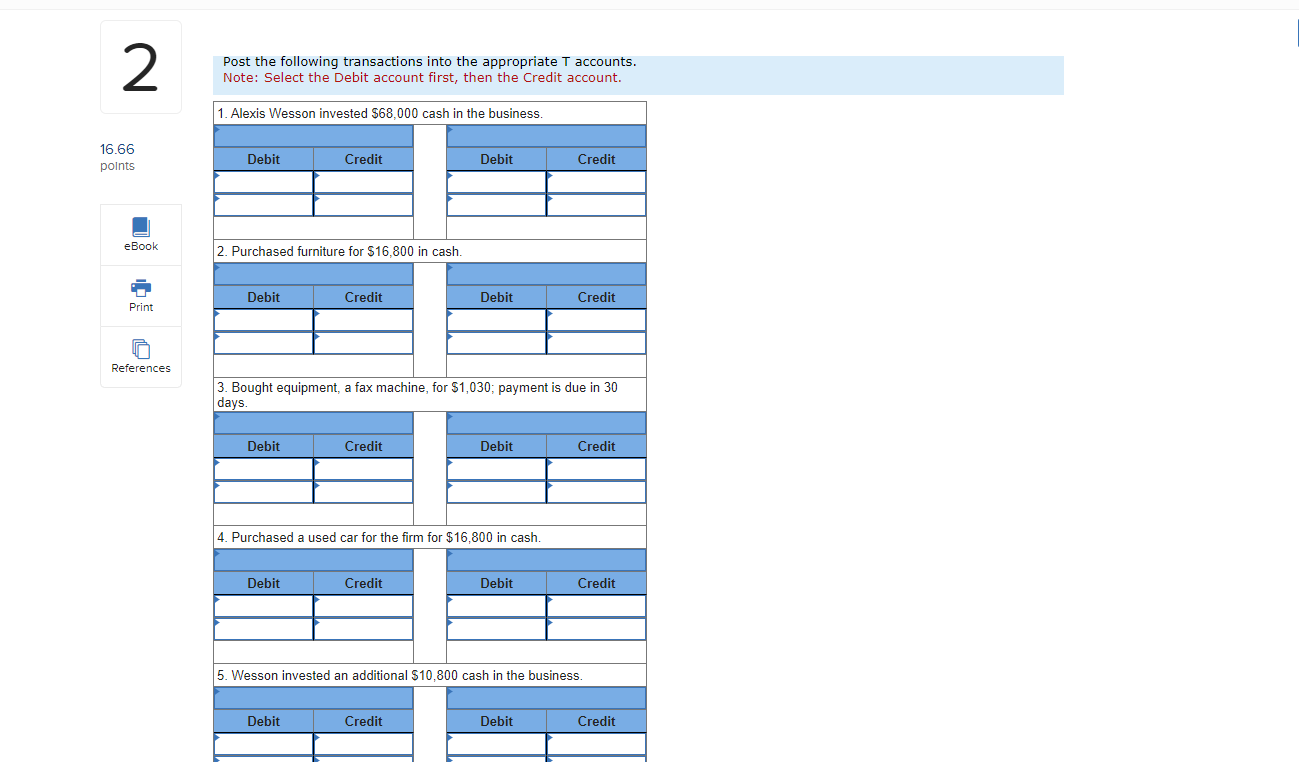

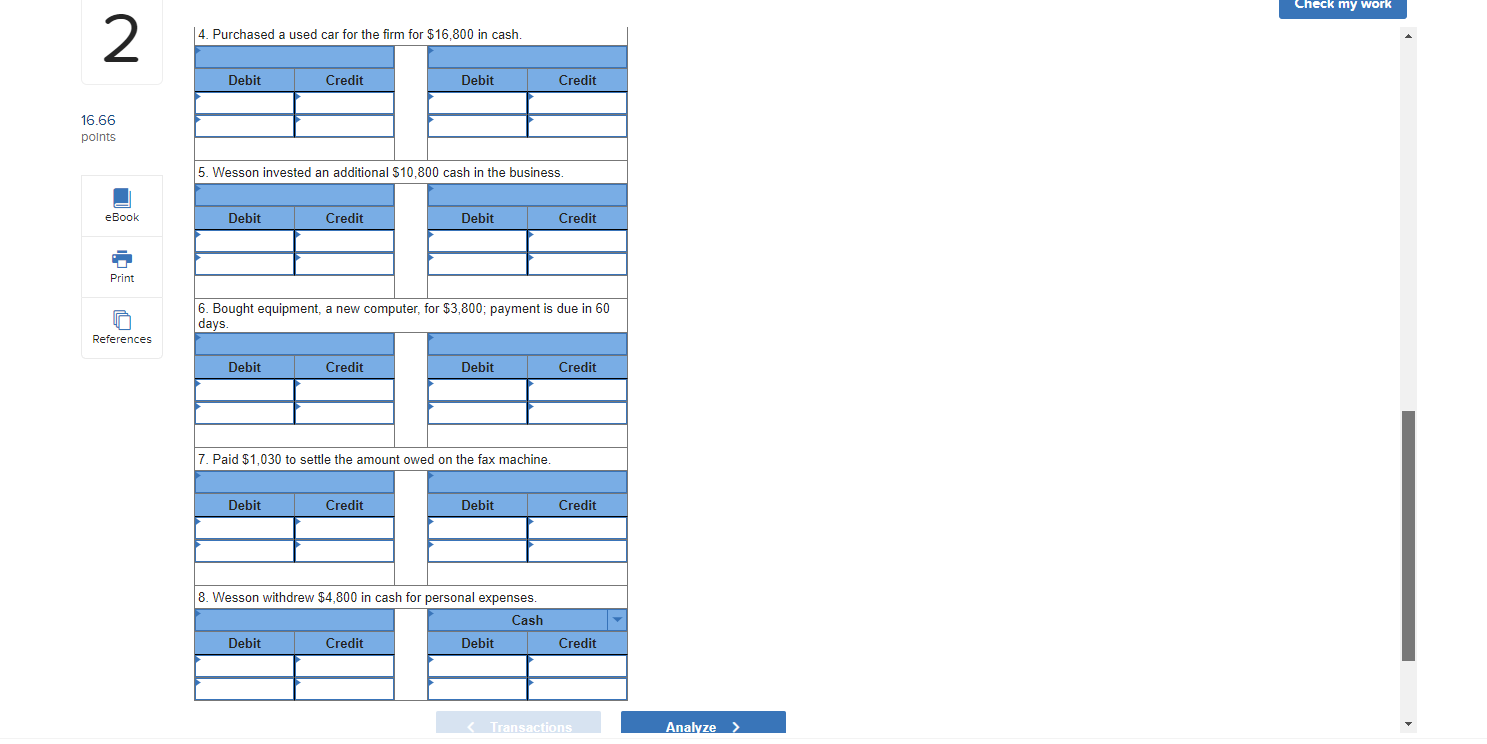

Check my work Problem 3.2A (Algo) Using T accounts to record transactions involving assets, liabilities, and owner's equity. LO 3-1, 3-2 16.66 points The following transactions took place at Wesson Counseling Services, a business established by Alexis Wesson. Post the following transactions into the appropriate T accounts. Transactions: Alexis Wesson invested $68,000 cash in the business. Purchased furniture for $16,800 in cash. Bought equipment, a fax machine, for $1,030; payment is due in 30 days. Purchased a used car for the firm for $16,800 in cash. Wesson invested an additional $10,800 cash in the business. Bought equipment, a new computer, for $3,800; payment is due in 60 days. Paid $1,030 to settle the amount owed on the fax machine. Wesson

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started