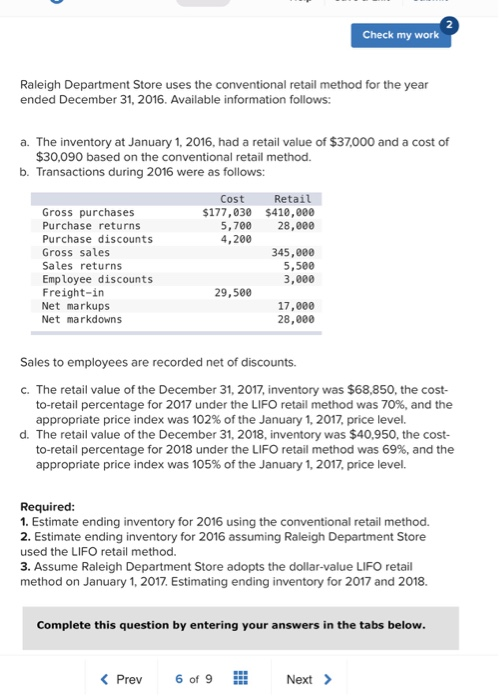

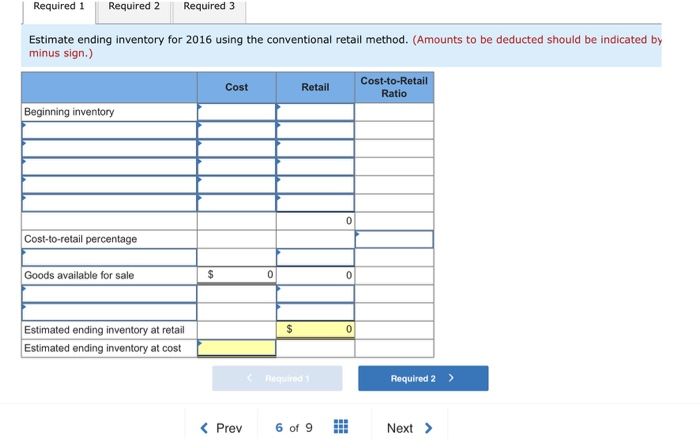

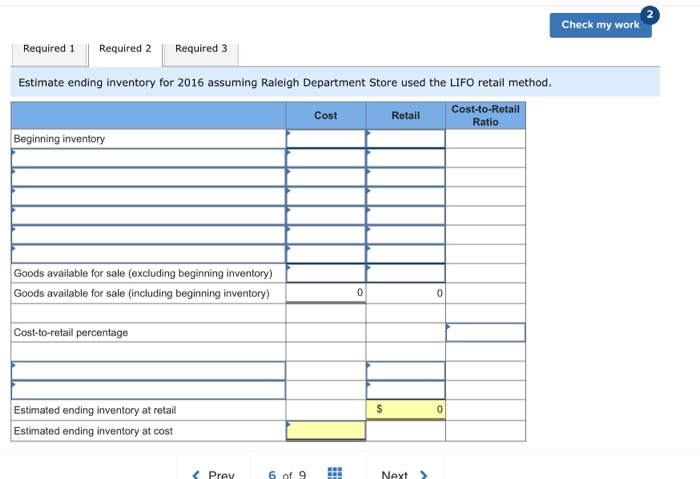

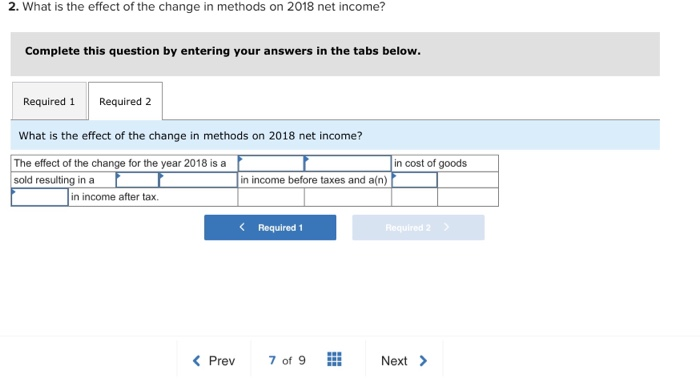

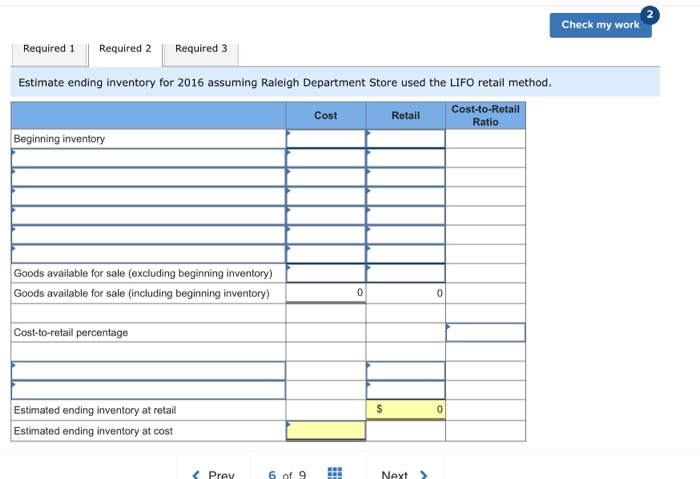

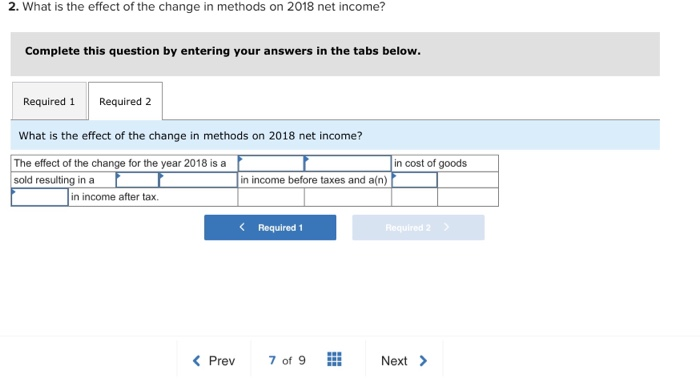

Check my work Raleigh Department Store uses the conventional retail method for the year ended December 31, 2016. Available information follows: a. The inventory at January 1, 2016, had a retail value of $37,000 and a cost of $30,090 based on the conventional retail method. b. Transactions during 2016 were as follows: Cost $177,030 5,700 4,200 Retail $410,000 28,000 Gross purchases Purchase returns Purchase discounts Gross sales Sales returns Employee discounts Freight-in Net markups Net markdowns 345,000 5,500 3,000 29,500 17,000 28,000 Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2017, inventory was $68,850, the cost- to-retail percentage for 2017 under the LIFO retail method was 70%, and the appropriate price index was 102% of the January 1, 2017, price level. d. The retail value of the December 31, 2018, inventory was $40.950, the cost- to-retail percentage for 2018 under the LIFO retail method was 69%, and the appropriate price index was 105% of the January 1, 2017, price level. Required: 1. Estimate ending inventory for 2016 using the conventional retail method. 2. Estimate ending inventory for 2016 assuming Raleigh Department Store used the LIFO retail method. 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2017. Estimating ending inventory for 2017 and 2018. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Estimate ending inventory for 2016 using the conventional retail method. (Amounts to be deducted should be indicated by minus sign.) Cost Retail Cost-to-Retail Ratio Beginning inventory Cost-to-retail percentage Goods available for sale $ $ 0 Estimated ending inventory at retail Estimated ending inventory at cost Required Required 2 > Check my work Required 1 Required 2 Required 3 Estimate ending inventory for 2016 assuming Raleigh Department Store used the LIFO retail method. Cost Retail Cost-to-Retail Beginning inventory Ratio Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) Cost-to-retail percentage Estimated ending inventory at retail Estimated ending inventory at cost Prey 6 of 9 !!! Next > 2. What is the effect of the change in methods on 2018 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the effect of the change in methods on 2018 net income? in cost of goods The effect of the change for the year 2018 is a sold resulting in a in income after tax. in income before taxes and an) ( Required 1 Required 2