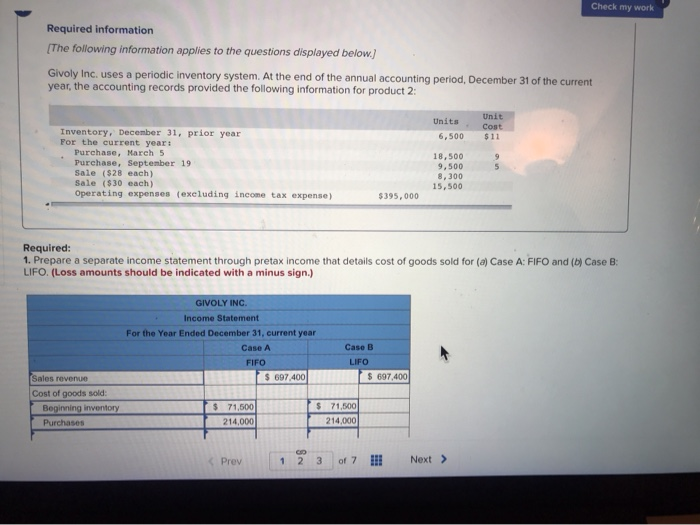

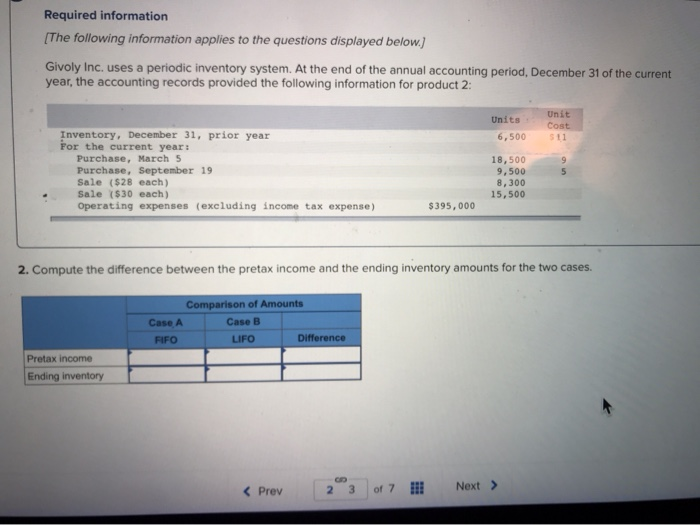

Check my work Required information (The following information applies to the questions displayed below.) Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Units 6,500 Unit Cost $11 Inventory, December 31, prior year For the current year: Purchase, March 5 Purchase, September 19 Sale $28 each) Sale ($30 each) Operating expenses (excluding income tax expense) 18,500 9.500 8,300 15,500 $395,000 Required: 1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (6) Case : LIFO. (Loss amounts should be indicated with a minus sign.) GIVOLY INC. Income Statement For the Year Ended December 31, current year Case A FIFO $ 697,400 Case B LIFO $ 697,400 Sales revenue Cost of goods sold: Beginning inventory Purchases $ 71.500 $ 71,500 214,000 214.000 Required information (The following information applies to the questions displayed below.) Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Units 6,500 Unit Cost St1 Inventory, December 31, prior year For the current year: Purchase, March 5 Purchase, September 19 Sale ($28 each) Sale ($30 each) Operating expenses (excluding income tax expense) 18,500 9,500 8.300 15,500 $395,000 2. Compute the difference between the pretax income and the ending inventory amounts for the two cases. Case A FIFO Comparison of Amounts Case B LIFO Difference Pretax income Ending inventory (The following information applies to the questions displayed below.) Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Units Unit Cost $11 6,500 18,500 Inventory, December 31, prior year For the current year: Purchase, March 5 Purchase, September 19 Sale ($28 each) Sale ($30 each) Operating expenses (excluding income tax expense) 9.500 8.300 15,500 $395,000 3. Which inventory costing method may be preferred for income tax purposes? Which inventory costing method may be preferred for income tax purposes?