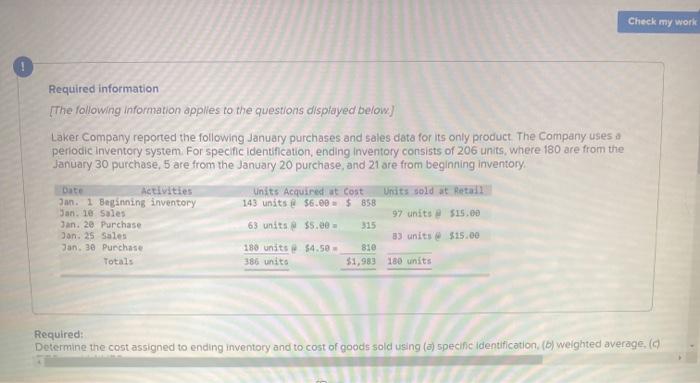

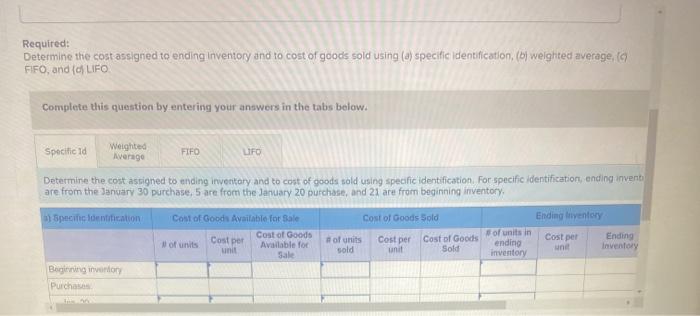

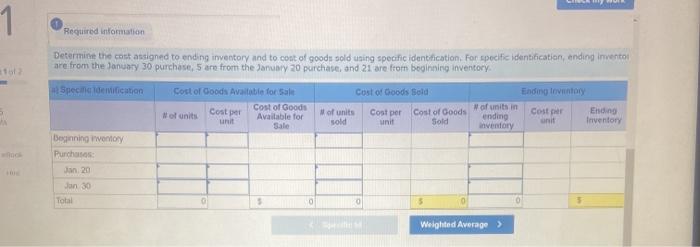

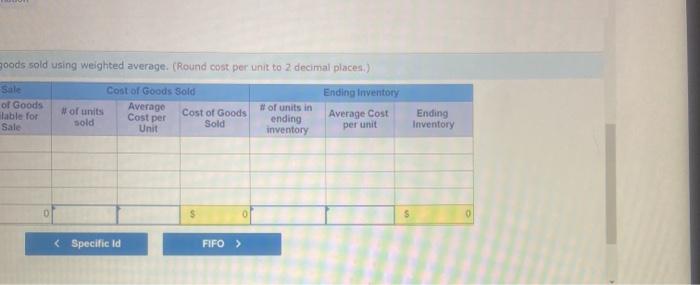

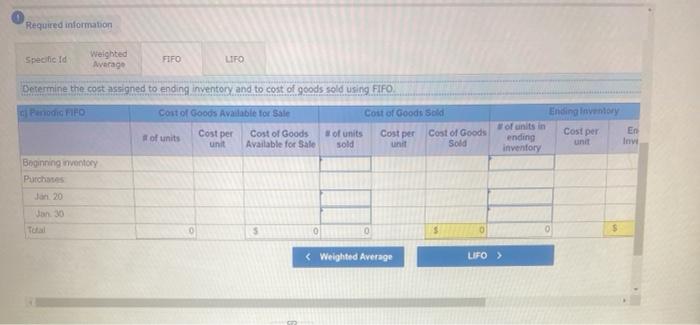

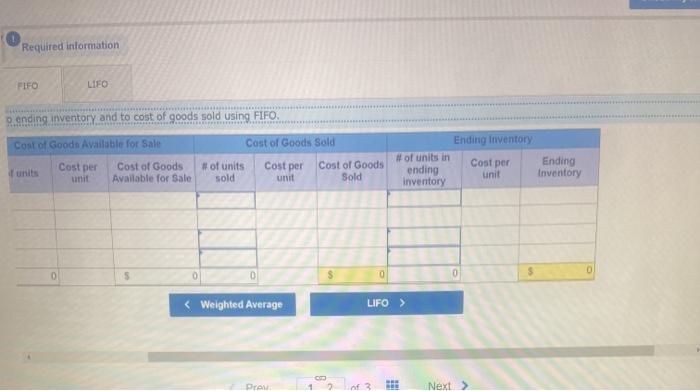

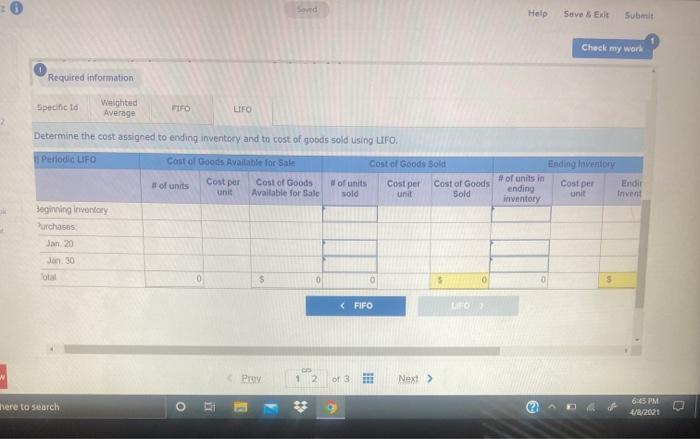

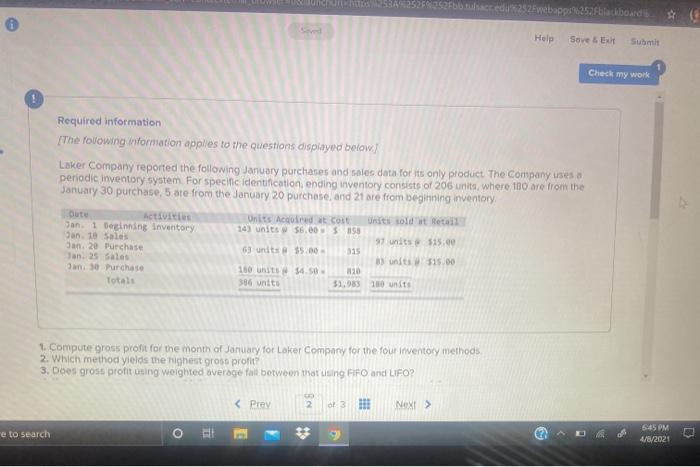

Check my work Required information The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data for its only product The Company uses a periodic inventory system For specific identification, ending Inventory consists of 206 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 21 are from beginning inventory Date Activities Units Acquired at Cost Units sold at Retail Jan. 1 Baganning inventory 143 units 56.00 - $ 858 San. le Sales 97 units $15.00 Jan. 20 Purchase 63 units 55.00 315 Jan. 25 Sales 83 units $15.00 180 units $4.50 Totals 386 units $1,983 180 units Jan. 30 Purchase 810 Required: Determine the cost assigned to ending inventory and to cost of goods sold using a specific identification, (b) weighted average, Required: Determine the cost assigned to ending inventory and to cost of goods sold using (8) specific identification, (b) weighted average, (q FIFO, and (d) LIFO Complete this question by entering your answers in the tabs below. Specificid Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using specific identification For specific identification ending invent are from the January 30 purchase, 5 are from the January 20 purchase, and 21 are from beginning inventory Spiedontification Cost of Goods Available for sale Cost of Goods Sold Ending riventory Cost of Goods of units in Cost per # of units Cost per Cost of Goods Cost per Ending Wof units Available for ending unit sold Sold Inventory inventory Begitring inventory Purchase 1 Required infomation Determine the cost assigned to ending inventory and to cost of goods sold using specific identification for specific identification, ending Inventor are from the January 30 purchase, 5 are from the January 20 purchase, and 21 are from beginning inventory 16 Specin deviation Cost of Goods Sold Cost of Goods Available for Sale Cost per Cost of Goods of units unit Available for Sale M of units sold Cost per cost of Goods unit Sold Ending Invity W of units in Ending Costi ending Inventory inventory Beginning wenty Purchases Jan 20 Jan 30 Total Weighted Average > saved Help Save & Exit Submit Check my work Required information Specific Id Weighted Average FIFO LIFO Cost per Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places) b) Weighted average- Penodis Cost of Goods Available for Sale Cost of Goods Sold Endiola Cost of Goods Average of units in of units Average Cost #of units Available for Cost of Goods ending Average per unit sold Sold Sale per unit Unit inventory Beginning inventory Purchases Jan. 20 Jan 30 Total $ goods sold using weighted average. (Round cost per unit to 2 decimal places) of Goods ilable for Sale Cost of Goods Sold Wof units Average Cost of Goods sold Sold Unit Ending Inventory Average Cost per unit # of units in ending inventory Cost per Ending Inventory D $ Required information Specic Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold of units Cost of Goods of units Cost of Goods unit Available for Sale sold Sold Beginning inventory Purchase Cost per Cost per Ending Inventory of units in Cost per En ending unit Inve inventory Jan 30 0 0 Required information FIFO LIFO o ending inventory and to cost of goods sold using FIFO. Cost of Good Available for Sale Cast of Goods Sold Cost per Cost of Goods Available for Sale # of units sold Cost per Cost of Goods Sold Ending Inventory # of units in Cost per ending unit inventory Ending Inventory unit 0 D S 0 0 Pro # Next > 0 Song Help Save & EX Submit Check my work Required information Specific to Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. Periodi LIFO Cost of Goods Available for Sale of units Cost per Cost of Goods Available for Sale Cost of Goods Bold of units Cost per Cost of Goods sold unit Sold Ending Inventory #of units in Cost per Endir ending unit Invent inventory Beginning inventory Purchases Jan 20 Jon 30 0 $ 5

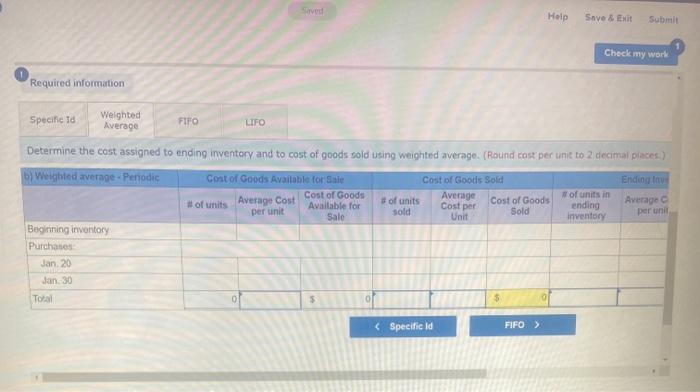

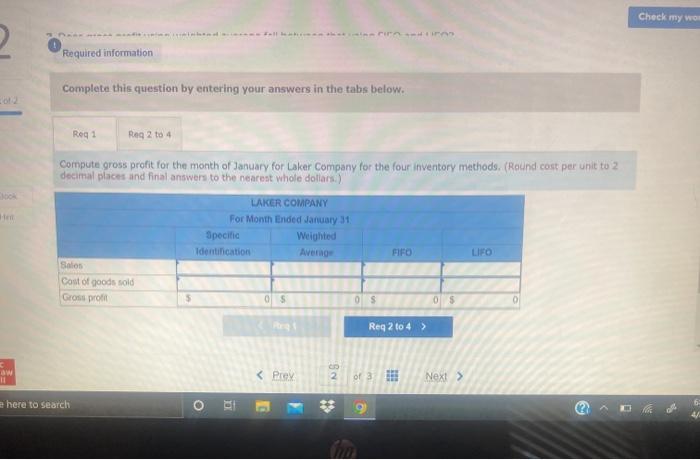

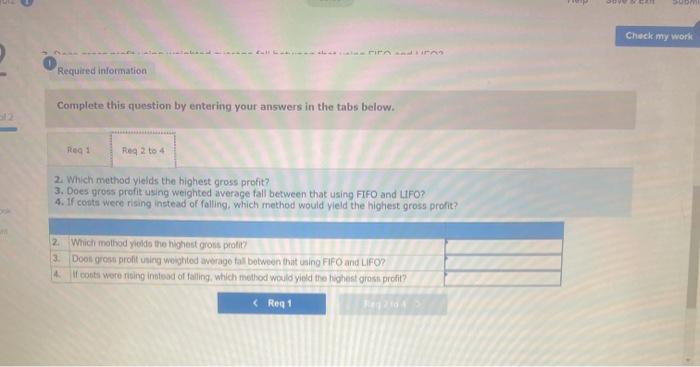

here to search O * 69 6:45 PM 4/8/2021 13 1.252Fblackboards Help Sovet Submit Check my work Required information The following information applies to the questions displayed below! Laker Company reported the following January purchases and sales data for its only product The Company uses a periodic inventory system for specific identification, ending inventory consists of 206 units where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 21 are from beginning inventory cute Activities Units Acquired Cost Unit tot el Jan 1 Beginning inventory 143 units $6.00 58 Jan 10 Sales 97 units 515,00 Jun 20 Purchase 63 units $5.00 335 Jan 25 Sales 1) units $15.00 Purchase 100 units 54.50 Totals 386 units 51,983 100 units 20 1. Compute gross profit for the month of January for Laker Company for the four inventory methods 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fait between that using FIFO and LIFO? e to search 645 PM 4/8/2021 Check my wo 2 Required information Complete this question by entering your answers in the tabs below. Reg1 Reg 2 to 4 Compute gross profit for the month of January for Laker Company for the four inventory methods. (Round cost per unit to 2 decimal places and final answers to the nearest whole dollars) LAKER COMPANY For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO Sales Cost of goods sold Gross pront OS 0 S OS 0 Reg 2 to 4 > here to search Check my work pirn and ironn. Required information Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? 2. Which molod yields the highest gross profily 3. Door grote profit using weighted average tall botween that uning FIFO and LIFO? 4 conts were riding instead of falling, which method would yield the highest gross profit?