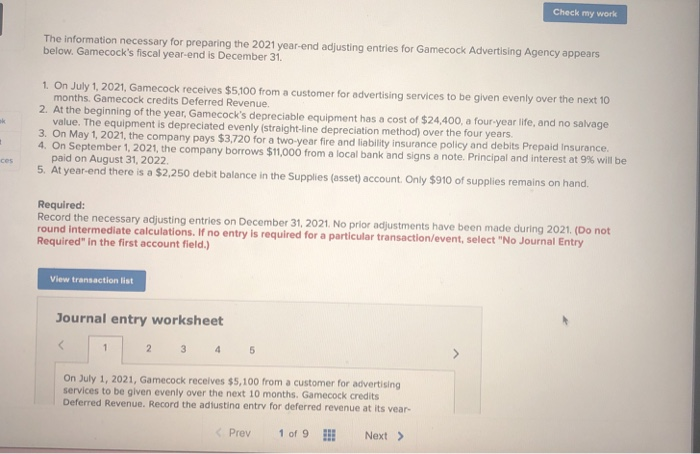

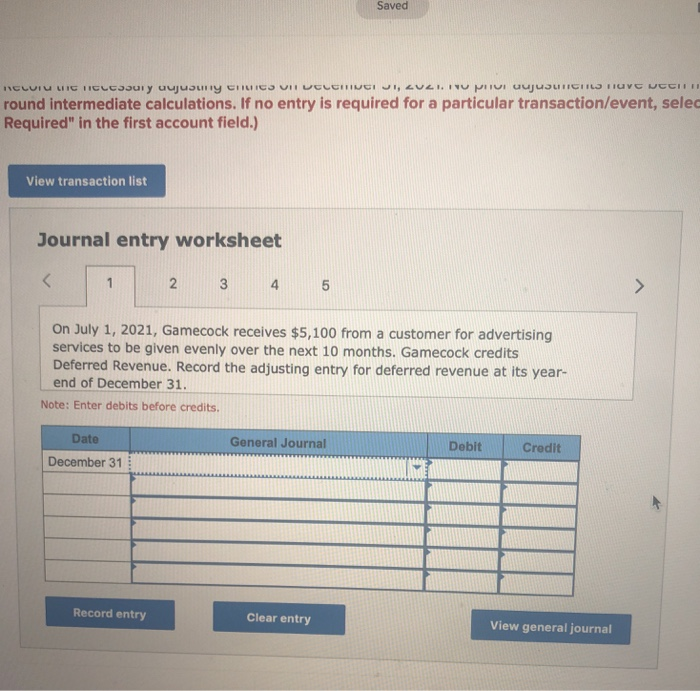

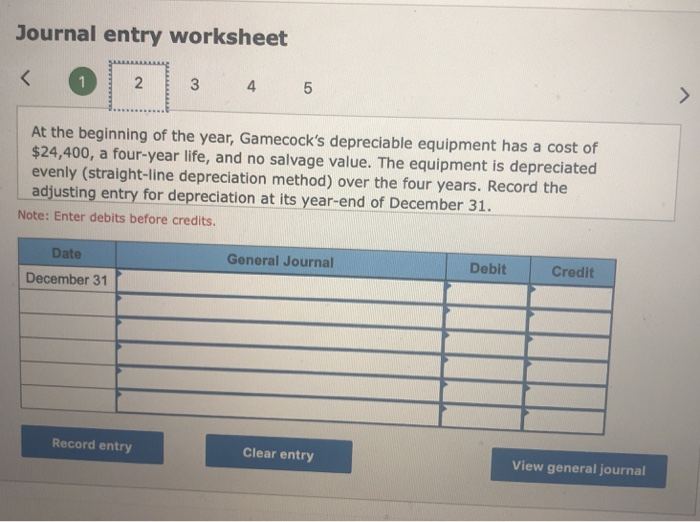

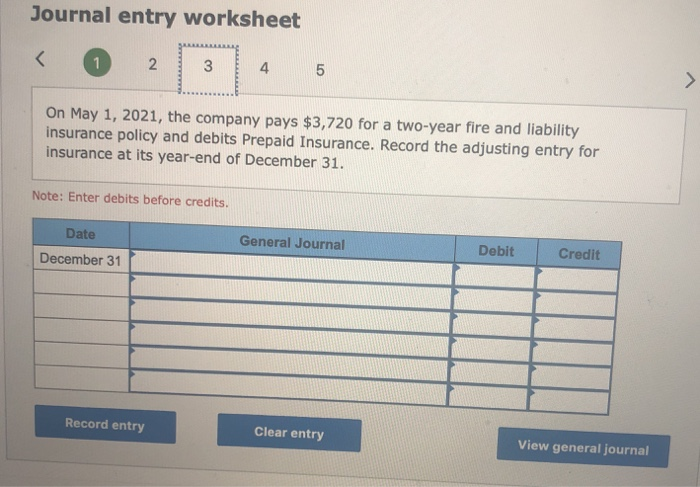

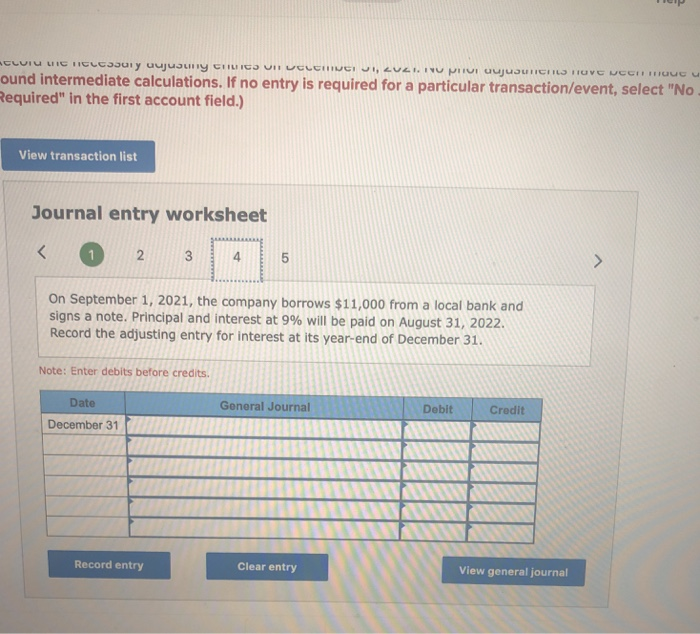

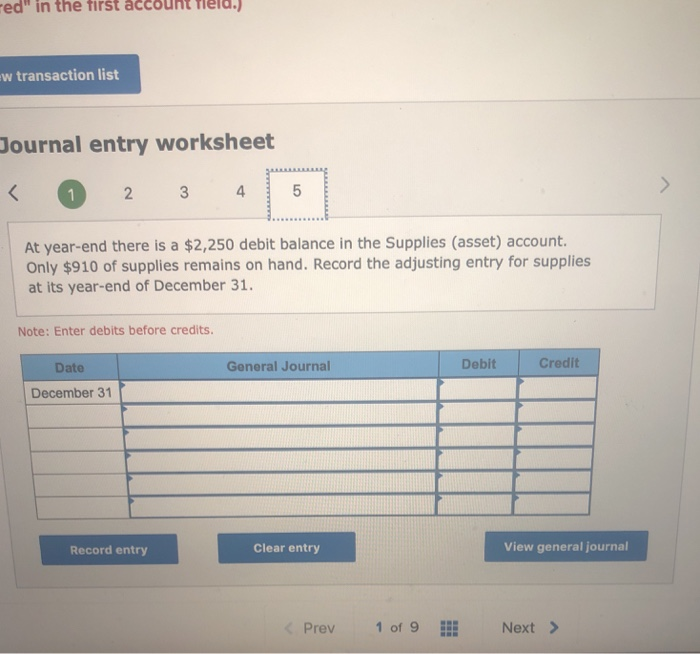

Check my work The information necessary for preparing the 2021 year-end adjusting entries for Gamecock Advertising Agency appears below. Gamecock's fiscal year-end is December 31 1. On July1 2021, Gamecock receives $5,100 from a customer for advertising services to be given evenly over the next 1o months. Gamecock credits Deferred Revenue. 2. At the beginning of the year, Gamecock's depreciable equipment has a cost of $24,400, a four-year life, a value. The equipment is depreciated evenly (straight-line depreciation method) over the four years 3. On May 1, 2021, the company pays $3,720 for a two-year fire an 4. On September 1,202 the company borrows $11,000 from a local bank and signs a note. Principal and interest at d liability insurance policy and debits Prepaid Insurance. % will be paid on August 31, 2022. 5. At year-end there is a $2,250 debit balance in the Supplies (asset) account Only $910 of supplies remains on hand Required: Record the necessary adjusting entries on December 31, 2021. No prior adjustments have been made during 2021. (Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No Journal E Required" in the first account field.) View transaction list Journal entry worksheet On July 1, 2021, Gamecock receives $5, 100 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. Record the adlustina entry for deferred revenue at its vear- Prev 1 of 9 Next> Saved round intermediate calculations. If no entry is required for a particular transaction/event, selec Required" in the first account field.) View transaction list Journal entry worksheet 2 4 On July 1, 2021, Gamecock receives $5,100 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. Record the adjusting entry for deferred revenue at its year- end of December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal Journal entry worksheet 4 5 At the beginning of the year, Gamecock's depreciable equipment has a cost of $24,400, a four-year life, and no salvage value. The equipment is depreciated evenly (straight-line depreciation method) over the four years. Record the adjusting entry for depreciation at its year-end of December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal Journal entry worksheet 2 4 On May 1, 2021, the company pays $3,720 for a two-year fire and liability insurance policy and debits Prepaid Insurance. Record the adjusting entry for insurance at its year-end of December 31 Note: Enter debits before credits Date General Journal Debit Credit December 31 Record entry Clear entry View general journal ed" in the first account tieid.) w transaction list ournal entry worksheet 2 4 At year-end there is a $2,250 debit balance in the Supplies (asset) account Only $910 of supplies remains on hand. Record the adjusting entry for supplies at its year-end of December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal Prev1 of 9Next>