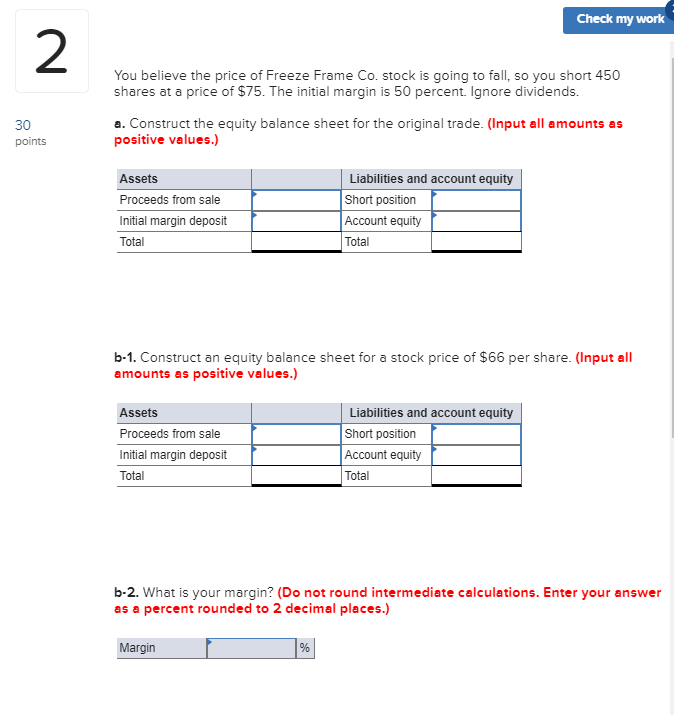

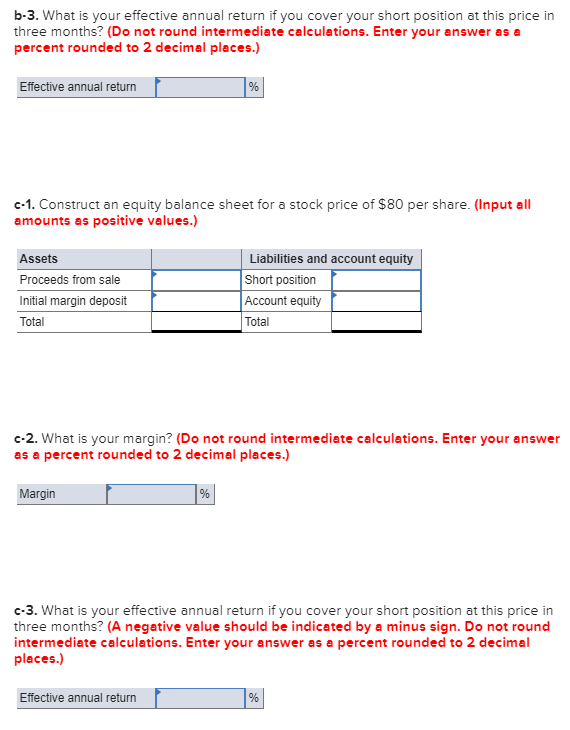

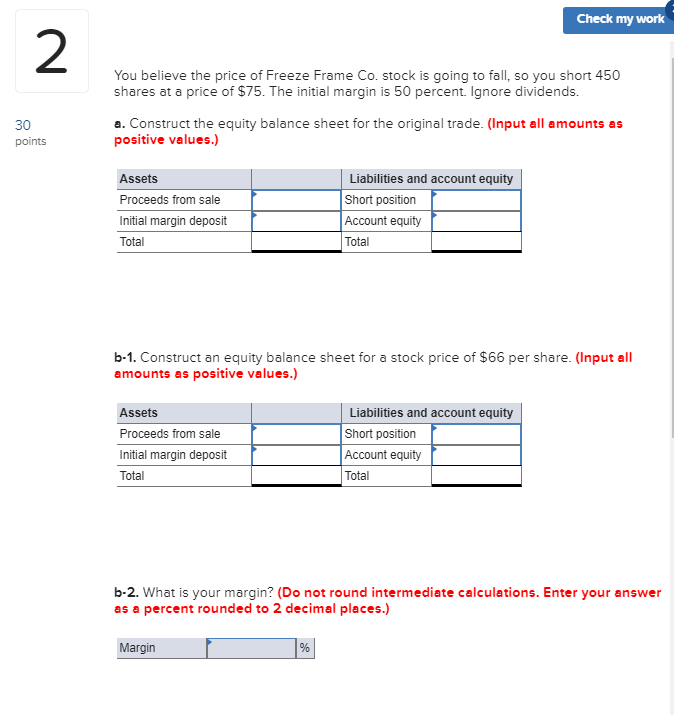

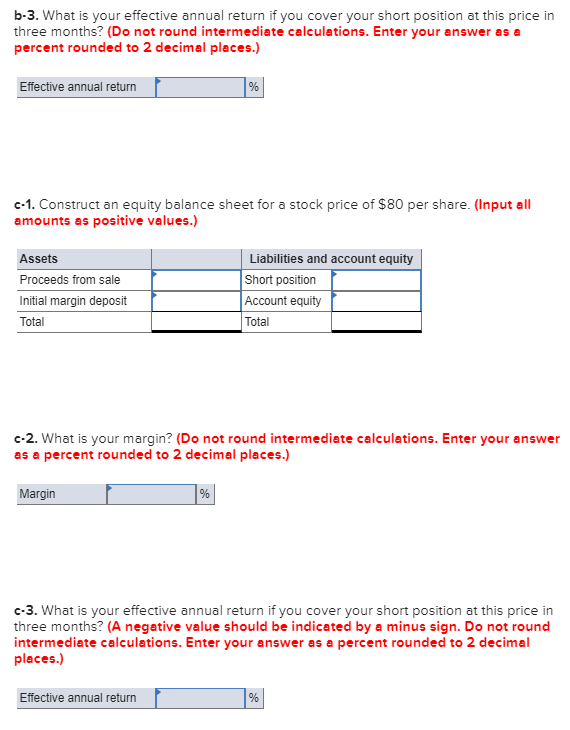

Check my work You believe the price of Freeze Frame Co. stock is going to fall, so you short 450 shares at a price of $75. The initial margin is 50 percent. Ignore dividends. 30 points a. Construct the equity balance sheet for the original trade. (Input all amounts as positive values.) Assets Proceeds from sale Initial margin deposit Total Liabilities and account equity Short position Account equity Total b-1. Construct an equity balance sheet for a stock price of $66 per share. (Input all amounts as positive values.) Assets Proceeds from sale Initial margin deposit Total Liabilities and account equity Short position Account equity Total b-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin % b-3. What is your effective annual return if you cover your short position at this price in three months? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return c-1. Construct an equity balance sheet for a stock price of $80 per share. (Input all amounts as positive values.) Assets Proceeds from sale Initial margin deposit Total Liabilities and account equity Short position Account equity Total c-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin 1 c-3. What is your effective annual return if you cover your short position at this price in three months? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return % Check my work You believe the price of Freeze Frame Co. stock is going to fall, so you short 450 shares at a price of $75. The initial margin is 50 percent. Ignore dividends. 30 points a. Construct the equity balance sheet for the original trade. (Input all amounts as positive values.) Assets Proceeds from sale Initial margin deposit Total Liabilities and account equity Short position Account equity Total b-1. Construct an equity balance sheet for a stock price of $66 per share. (Input all amounts as positive values.) Assets Proceeds from sale Initial margin deposit Total Liabilities and account equity Short position Account equity Total b-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin % b-3. What is your effective annual return if you cover your short position at this price in three months? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return c-1. Construct an equity balance sheet for a stock price of $80 per share. (Input all amounts as positive values.) Assets Proceeds from sale Initial margin deposit Total Liabilities and account equity Short position Account equity Total c-2. What is your margin? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Margin 1 c-3. What is your effective annual return if you cover your short position at this price in three months? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return %