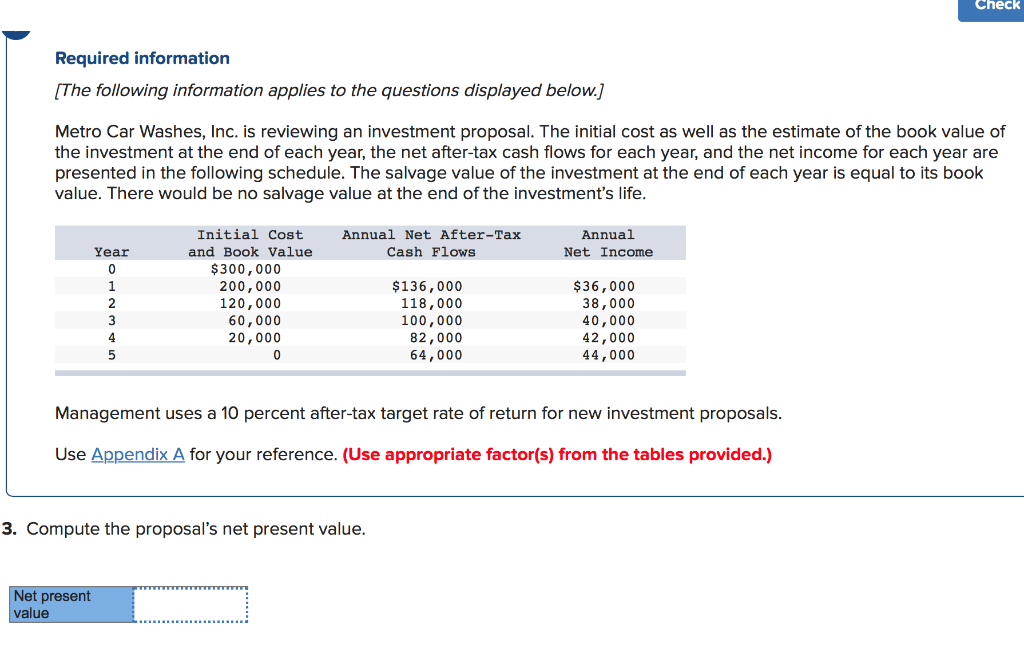

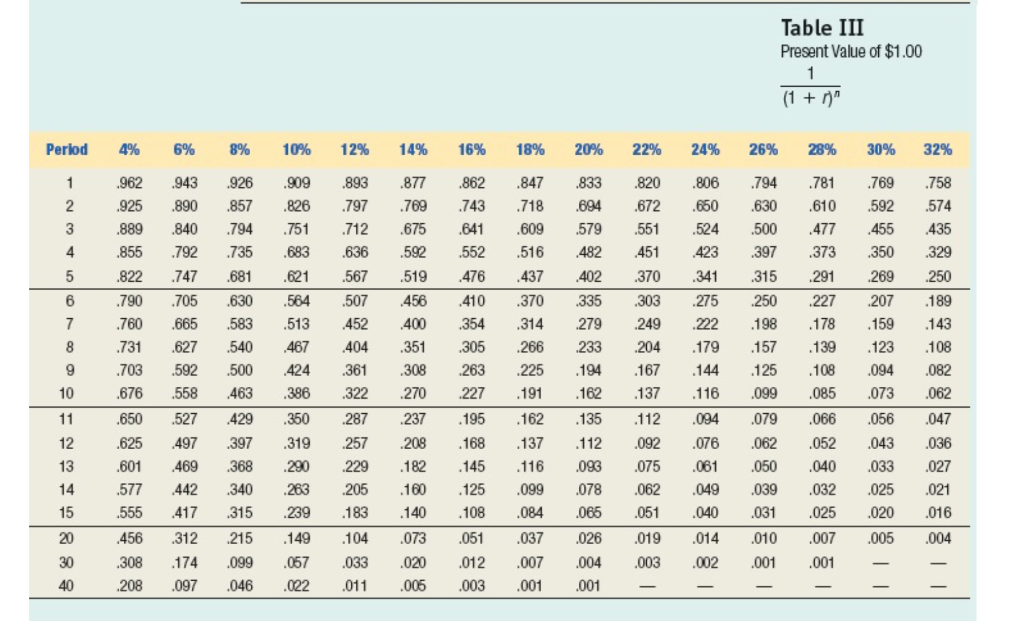

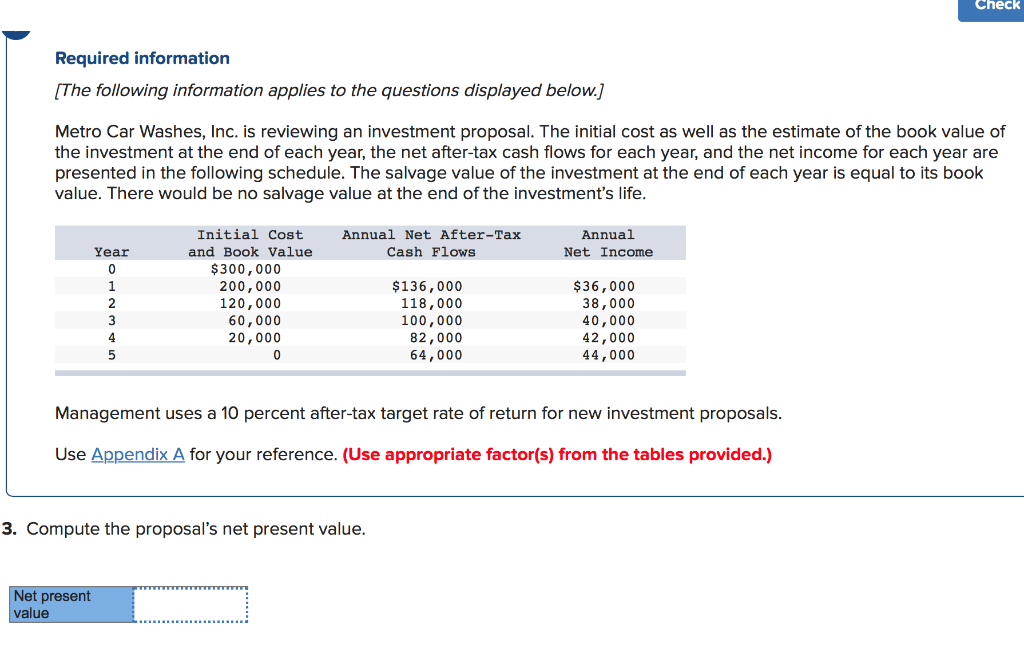

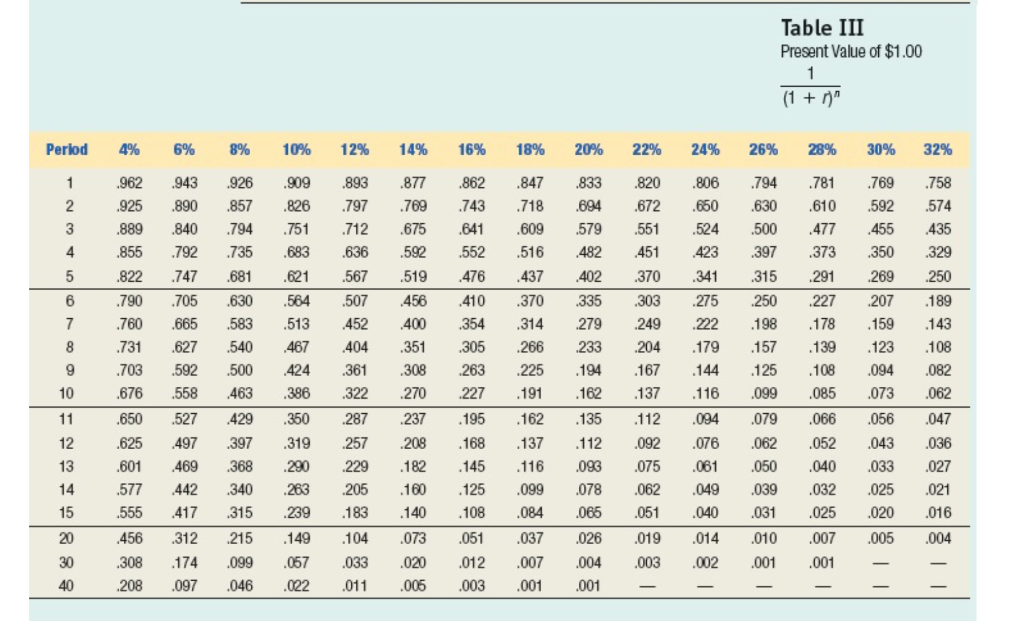

Check Required information [The following information applies to the questions displayed below. Metro Car Washes, Inc. is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Annual Net After-Tax Cash Flows Annual Net Income Year UWNPO Initial Cost and Book Value $300,000 200,000 120,000 60,000 20,000 $136,000 118,000 100,000 82,000 64,000 $36,000 38,000 40,000 42,000 44,000 Management uses a 10 percent after-tax target rate of return for new investment proposals. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) 3. Compute the proposal's net present value. Net present value Net present * *** from Table III Present Value of $1.00 (1 + " Period 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 20 30 40 962 .943 925 890 889 840 .855 .792 .822 .747 790 705 760 .665 731 .627 .703 592 .676 558 .650527 .625 497 .601 469 .577 442 555 417 .456 .312 .308 174 208 .097 .926 .857 .794 735 .681 .630 583 540 .500 463 429 397 .368 .340 315 215 .099 .046 909 826 751 .683 .621 564 513 467 424 386 350 .319 290 2 63 239 149 .057 .022 .893 797 712 .636 .567 507 452 404 361 .322 287 257 229 205 183 1 04 .033 .011 .877 769 .675 592 519 .456 400 .351 308 2 70 237 208 182 160 140 .073 .020 .005 862 .743 .641 .552 476 410 354 305 263 227 195 168 .145 .125 108 .051 .012 .003 .847 718 .609 .516 437 .370 314 266 225 191 162 137 116 .099 .084 .037 .007 .001 .833 .694 .579 482 402 335 279 233 194 162 .135 112 .093 .078 .065 .026 .004 .001 .820 .672 .551 451 370 3 03 249 2 04 167 137 .112 .092 .075 .062 .051 .019 .003 - 806 .650 .524 423 341 275 222 179 144 116 .094 .076 .061 .049 .040 .014 .002 - 7 94 .630 .500 .397 315 250 198 157 125 .099 .079 .062 .050 .039 .031 .010 .001 - 781 .610 477 373 291 227 178 139 108 .085 .066 .052 .040 .032 .025 .007 .001 - 769 .592 455 .350 269 207 1 59 123 .094 .073 .056 .043 .033 .025 .020 .005 - .758 .574 435 .329 250 189 143 108 .082 .062 047 .036 .027 .021 .016 .004