Answered step by step

Verified Expert Solution

Question

1 Approved Answer

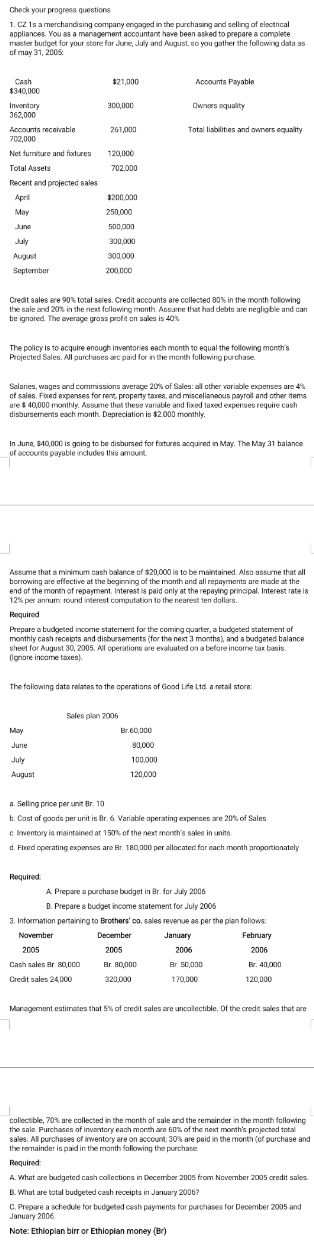

Check your progress questions 1. CZ1s a merchandising company engaged in the purchasing and selling of electrical appliances. You as a management accountant have

Check your progress questions 1. CZ1s a merchandising company engaged in the purchasing and selling of electrical appliances. You as a management accountant have been asked to prepare a complete master budget for your store for June, July and August, so you gather the following data as of may 31, 2005: Cash $21,000 Accounts Payable 300,000 Owners equality 261,000 Total liabilities and owners equality $340,000 Inventory 362,000 Accounts receivable 702,000 Net furniture and fixtures 120,000 Total Assets 702,000 Recent and projected sales April $200,000 May 250,000 June 500,000 July 300,000 300,000 200,000 August September Credit sales are 90% total sales. Credit accounts are collected 80% in the month following the sale and 20% in the next following month. Assume that had debts are negligible and can be ignored. The average gross profit on sales is 40% The policy is to acquire enough inventories each month to equal the following month's Projected Sales. All purchases are paid for in the month following purchase. Salaries, wages and commissions average 20% of Sales: all other variable expenses are 4% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $ 40,000 monthly. Assume that these variable and fixed taxed expenses require cash disbursements each month. Depreciation is $2.000 monthly. In June, $40,000 is going to be disbursed for fixtures acquired in May. The May 31 balance of accounts payable includes this amount. Assume that a minimum cash balance of $20,000 is to be maintained. Also assume that all borrowing are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is paid only at the repaying principal. Interest rate is 12% per annum: round interest computation to the nearest ten dollars. Required Prepare a budgeted income statement for the coming quarter, a budgeted statement of monthly cash receipts and disbursements (for the next 3 months), and a budgeted balance sheet for August 30, 2005. All operations are evaluated on a before income tax basis. (Ignore income taxes). The following data relates to the operations of Good Life Ltd. a retail store: Sales plan 2006 May Br.60,000 June 80,000 July 100,000 August 120,000 a. Selling price per unit Br. 10 b. Cost of goods per unit is Br. 6. Variable operating expenses are 20% of Sales c. Inventory is maintained at 150% of the next month's sales in units. d. Fixed operating expenses are Br. 180,000 per allocated for each month proportionately Required: A. Prepare a purchase budget in Br. for July 2006 B. Prepare a budget income statement for July 2006 3. Information pertaining to Brothers' co. sales revenue as per the plan follows: February November 2005 December 2005 January 2006 2006 Cash sales Br. 80,000 Br. 80,000 Br. 50,000 Br. 40,000 Credit sales 24,000 320,000 170,000 120,000 Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 70% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory each month are 60% of the next month's projected total sales. All purchases of inventory are on account: 30% are paid in the month (of purchase and the remainder is paid in the month following the purchase. Required: A. What are budgeted cash collections in December 2005 from November 2005 credit sales. B. What are total budgeted cash receipts in January 2006? C. Prepare a schedule for budgeted cash payments for purchases for December 2005 and January 2006. Note: Ethiopian birr or Ethiopian money (Br)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started