Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check your understanding of FV and PV Annuity. Excel would do, thanks Question 1 1 pts You can afford to pay $500 per month for

Check your understanding of FV and PV Annuity.

Excel would do, thanks

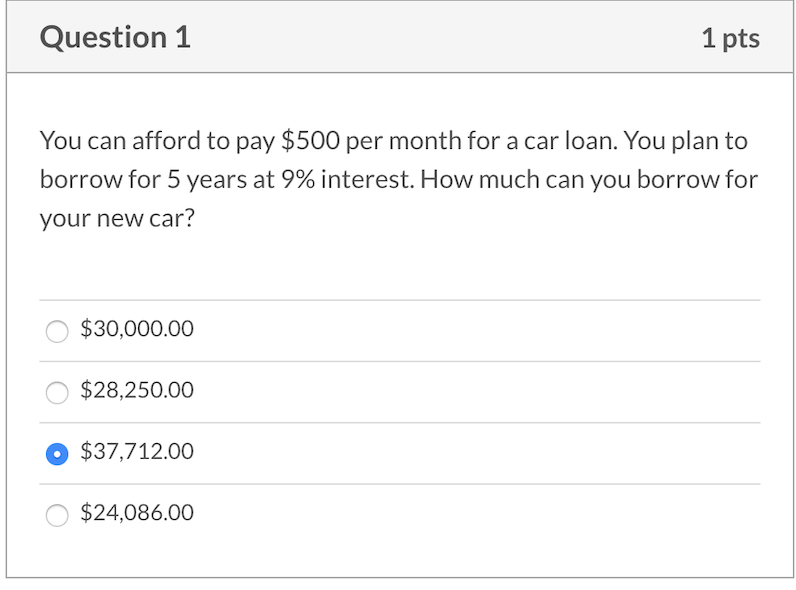

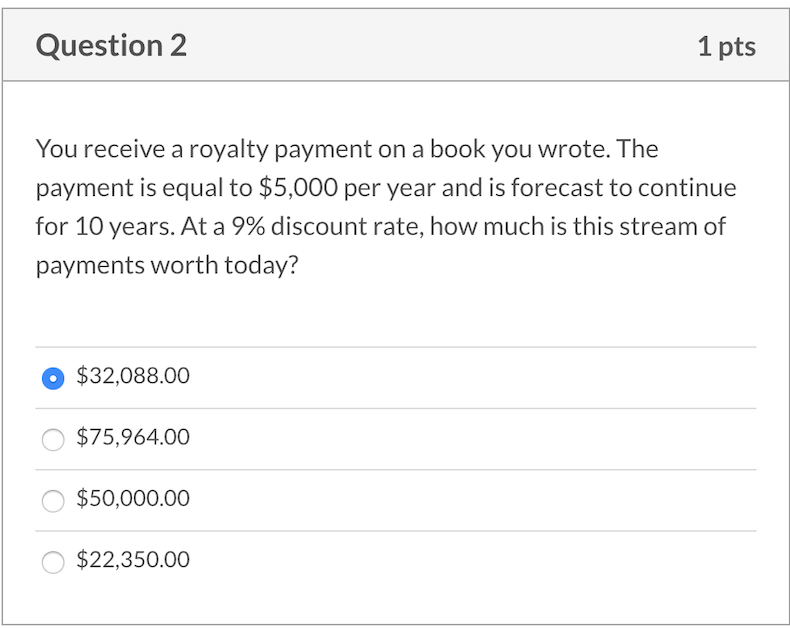

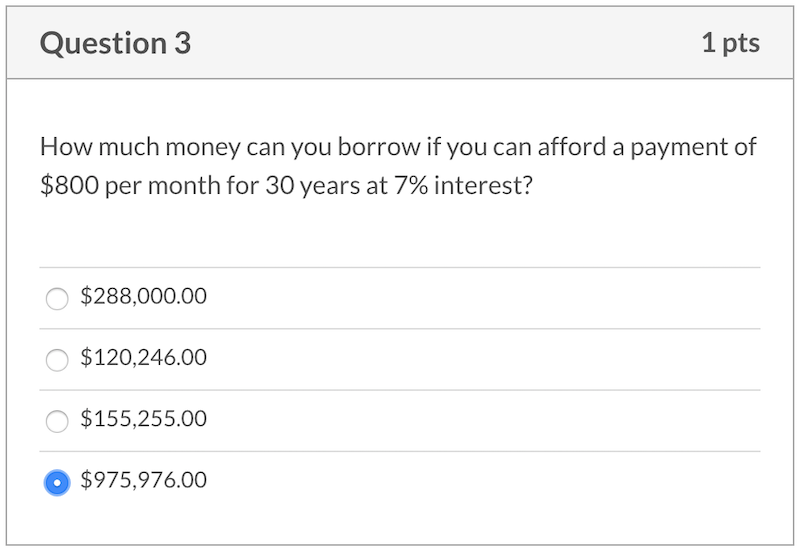

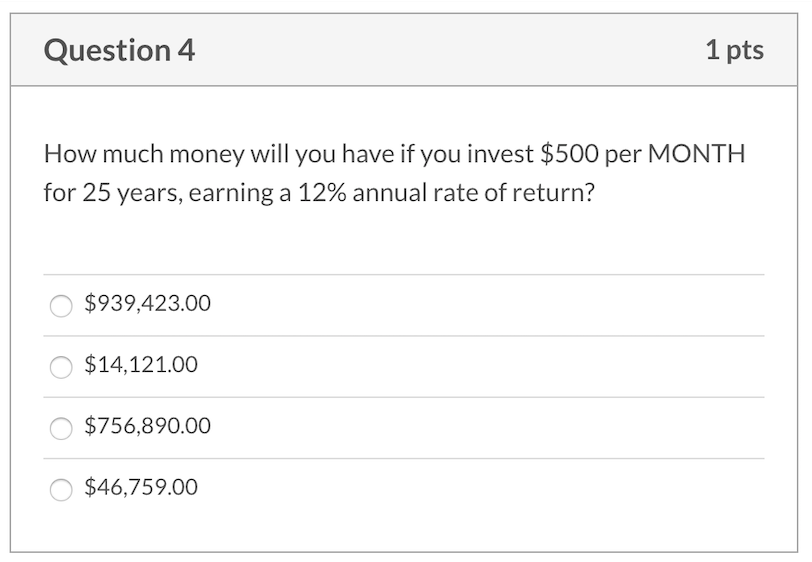

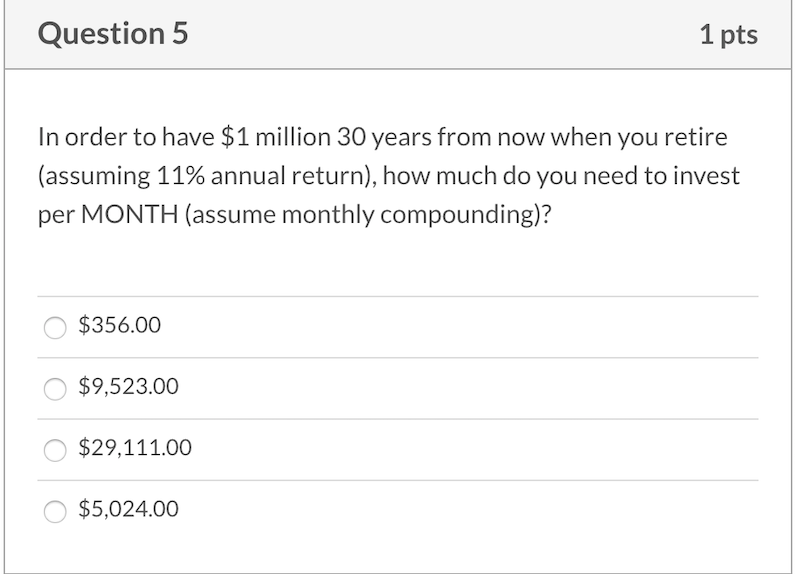

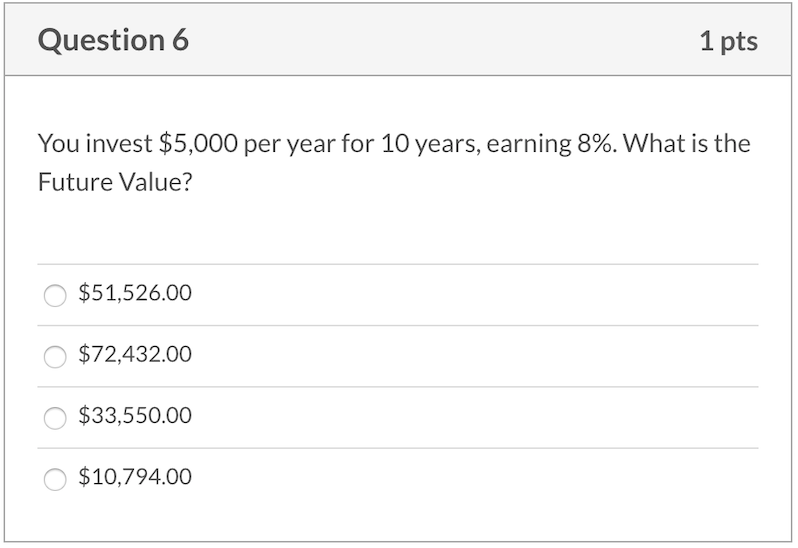

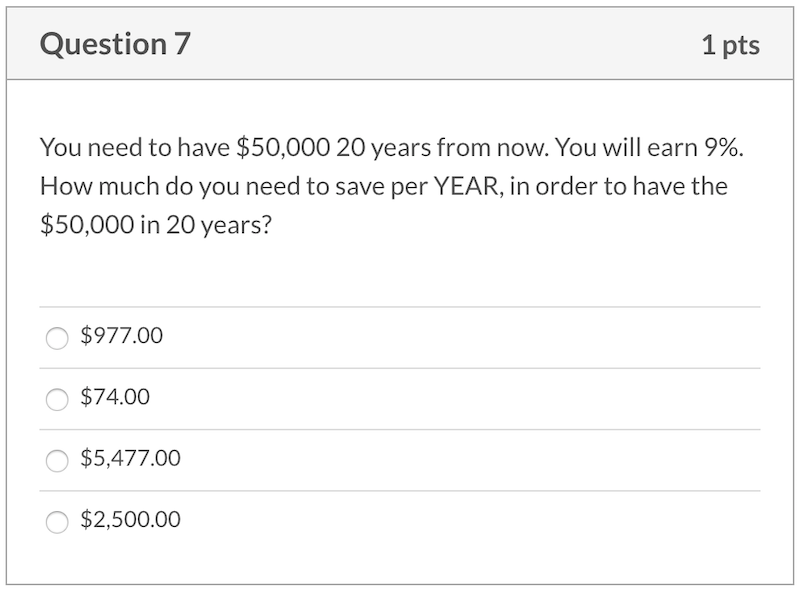

Question 1 1 pts You can afford to pay $500 per month for a car loan. You plan to borrow for 5 years at 9% interest. How much can you borrow for your new car? 0 $30,000.00 $28,250.00 $37,712.00 O $24,086.00 Question 2 1 pts You receive a royalty payment on a book you wrote. The payment is equal to $5,000 per year and is forecast to continue for 10 years. At a 9% discount rate, how much is this stream of payments worth today? $32,088.00 0 $75,964.00 O $50,000.00 $22,350.00 Question 3 1 pts How much money can you borrow if you can afford a payment of $800 per month for 30 years at 7% interest? $288,000.00 $120,246.00 $155,255.00 $975,976.00 Question 4 1 pts How much money will you have if you invest $500 per MONTH for 25 years, earning a 12% annual rate of return? $939,423.00 0 $14,121.00 $756,890.00 O $46,759.00 Question 5 1 pts In order to have $1 million 30 years from now when you retire (assuming 11% annual return), how much do you need to invest per MONTH (assume monthly compounding)? O $356.00 $9,523.00 $29,111.00 O $5,024.00 Question 6 1 pts You invest $5,000 per year for 10 years, earning 8%. What is the Future Value? $51,526.00 $72,432.00 $33,550.00 $10,794.00 Question 7 1 pts You need to have $50,000 20 years from now. You will earn 9%. How much do you need to save per YEAR, in order to have the $50,000 in 20 years? O $977.00 $74.00 O $5,477.00 $2,500.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started