Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check your worksheet by changing the units sold in the Data to 6 , 0 0 0 for Year 2 The cost of goods sold

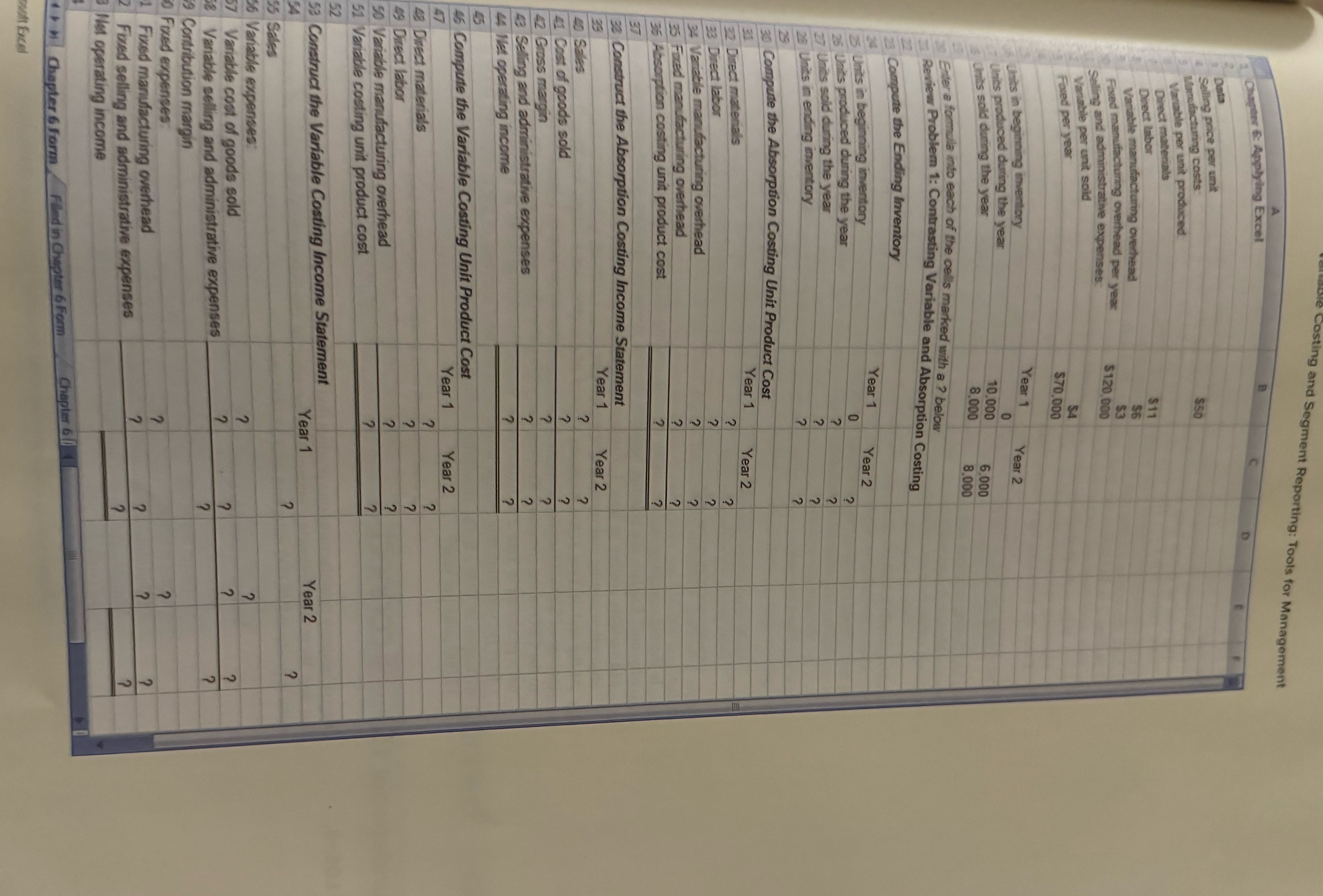

Check your worksheet by changing the units sold in the Data to for Year The cost of goods sold under absorption costing for Year should now be $ If it isn't, check cell C The formula in this cell should be IFC CCBCC If your worksheet is operating properly, the net operating income under both absorption costing and variable costing should be $ for Year That is the loss in Year is $ under both methods. If you do not get these answers, find the errors in your worksheet and correct them.Why is the absorption costing net operating income now equal to the variable costing net operating income in Year Enter the following data from a different company into your worksheet:DataSelling price per unitManufacturing costs:Variable per unit produced:Direct materialsDirect labor.Variable manufacturing overheadFixed manufacturing overhead per yearSelling and administrative expenses:Variable per unit soldFixed per year$$$$$$$Year Year Units in beginning inventory.Units produced during the yearUnits sold during the year... Is the net operating income under variable costing different in Year and Year Why or why not? Explain the relation between the net operating income under absorption costing and variable costing in Year Explain the relation between the net operating income under absorption costing and variable costing in Year At the end of Year the company's board of directors set a target for Year net operating income of $ under absorption costing. If this target is met, a large bonus would be paid. to the CEO of the company. Keeping everything else the same from part above, change the units produced in Year to units. Would this change result in a bonus being paid to the CEO? Do you think this change would be in the best interests of the company? What is likely en in Year to the absorption costing net operating income i sates remain constant al units per year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started