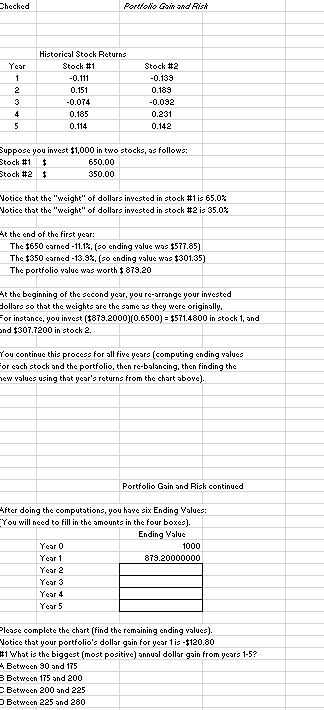

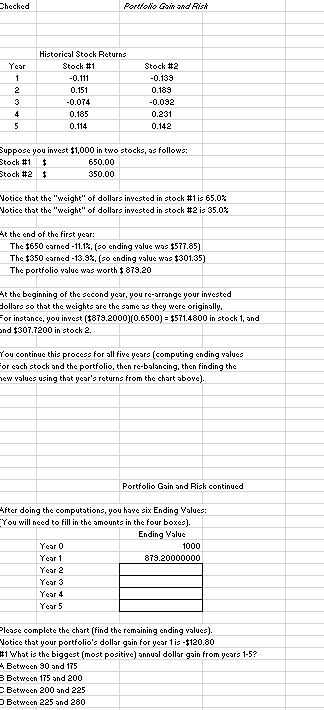

Checked Portfolio d'AiSA Year Historical Stock Returns Stock #1 -0.111 0.151 -0.074 0.185 0.114 Stock #2 -0.139 0.189 -0.092 0.231 0.142 Suppose you invest $1,000 in two stocks, as follows: Stock #1 $ 650.00 Stock #2 $ 350.00 Votice that the "weight" of dollars invested in stock #1 is 65.0% Votice that the "weight" of dollar invested in stock #2 is 35.0% At the end of the first year: The $650 carncd - 11.1%, (so ending value was $577.85) The $350 earned -13.9%, (do ending value was $301.35) The portfolio value was worth $ 879.20 At the beginning of the second yeur, you re-arrange your invested Dollars so that the weights are the dome as they were originally. For instance, you invest ($879.2000]0.6500) = $571.4800 in stock 1, and and $307.7200 in stock 2. You continue this process for all five years (computing ending values For each stock and the portfolio, then re-balancing, then finding the new values using that year'a returns from the chart above). Portfolio Gain and Risk continued After doing the computations, you have six Ending Values: You will need to fill in the amounts in the four boxes). Ending Value Year o 1000 Year 1 879.20000000 Year 2 Year 3 Year 4 Year 5 Please complete the chart (find the remaining ending valucs). Votice that your portfolio's dollar gain for year 1 is -$120.80 #1 What is the biggest (most positive) annual dollar gain from years 1-5? Between 90 and 175 3 Between 175 and 200 Between 200 and 225 Between 225 and 280 Checked Portfolio d'AiSA Year Historical Stock Returns Stock #1 -0.111 0.151 -0.074 0.185 0.114 Stock #2 -0.139 0.189 -0.092 0.231 0.142 Suppose you invest $1,000 in two stocks, as follows: Stock #1 $ 650.00 Stock #2 $ 350.00 Votice that the "weight" of dollars invested in stock #1 is 65.0% Votice that the "weight" of dollar invested in stock #2 is 35.0% At the end of the first year: The $650 carncd - 11.1%, (so ending value was $577.85) The $350 earned -13.9%, (do ending value was $301.35) The portfolio value was worth $ 879.20 At the beginning of the second yeur, you re-arrange your invested Dollars so that the weights are the dome as they were originally. For instance, you invest ($879.2000]0.6500) = $571.4800 in stock 1, and and $307.7200 in stock 2. You continue this process for all five years (computing ending values For each stock and the portfolio, then re-balancing, then finding the new values using that year'a returns from the chart above). Portfolio Gain and Risk continued After doing the computations, you have six Ending Values: You will need to fill in the amounts in the four boxes). Ending Value Year o 1000 Year 1 879.20000000 Year 2 Year 3 Year 4 Year 5 Please complete the chart (find the remaining ending valucs). Votice that your portfolio's dollar gain for year 1 is -$120.80 #1 What is the biggest (most positive) annual dollar gain from years 1-5? Between 90 and 175 3 Between 175 and 200 Between 200 and 225 Between 225 and 280