Answered step by step

Verified Expert Solution

Question

1 Approved Answer

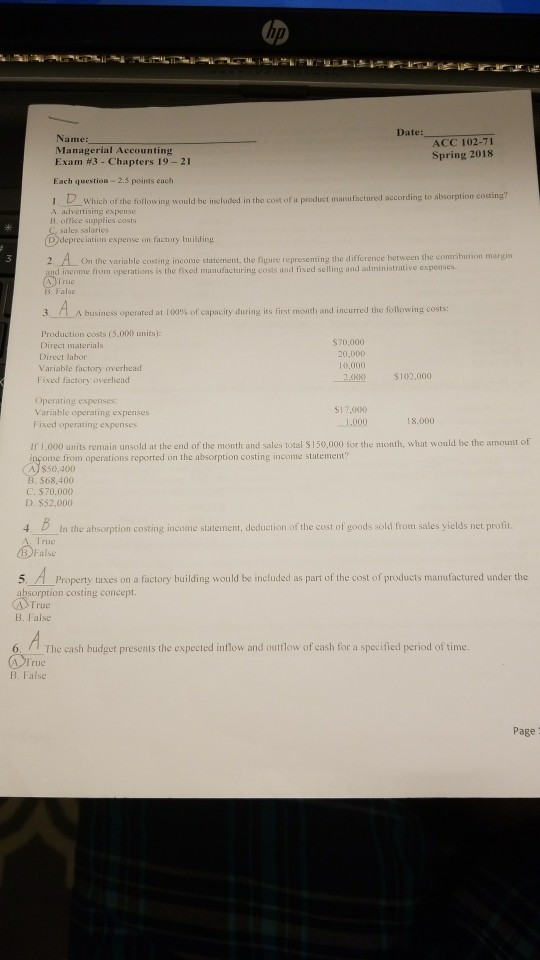

checking if this are correct or not Date: Name: Managerial Accounting Exa m #3-Chapters 19-21 Each question 2.5 points each ACC 102-71 Spring 2018 I

checking if this are correct or not

Date: Name: Managerial Accounting Exa m #3-Chapters 19-21 Each question 2.5 points each ACC 102-71 Spring 2018 I Which of the following would be included in the cost of a product manufactured according to absorption cossing" A advertising expense B. office supplies costs sales sslaries D)depreciation expense on factory builkding 2A On the variable costing inconie statement, the figure representing the difference between the contribution margisn income from operations is the fixed manufacturing costs and fixed selling and administrative expenses. False 3. A business operated at 100% of capacity during its first month and incurred the following costs: Production costs (5,000 units): S70,000 20,000 Direct materials irect labor Variable factory overbead Fixed factory overhead 2.0XK$102,000 Operating expenses Varinble operating expenses S17.00%0 1.000 18.000 Fixed operating expenses If 1.000 units remain unsold at the end of the month and sales total S150,000 for the month, what would be the amount of A) $50,400 C. $70.000 income from operations reported on the absorption costing income statement D. $52,00O 4 D In the absorption costing income statement. deduction of the cost of goods sold irom sales yields net profit. I rue False 5. A Property taxes on a factory building would be included as part of the cost of products manufactured under the absorption costing concept B. False 1 The cash budget presents the expected inflow and outflow of cash for a specified period of time True B. False Page Date: Name: Managerial Accounting Exa m #3-Chapters 19-21 Each question 2.5 points each ACC 102-71 Spring 2018 I Which of the following would be included in the cost of a product manufactured according to absorption cossing" A advertising expense B. office supplies costs sales sslaries D)depreciation expense on factory builkding 2A On the variable costing inconie statement, the figure representing the difference between the contribution margisn income from operations is the fixed manufacturing costs and fixed selling and administrative expenses. False 3. A business operated at 100% of capacity during its first month and incurred the following costs: Production costs (5,000 units): S70,000 20,000 Direct materials irect labor Variable factory overbead Fixed factory overhead 2.0XK$102,000 Operating expenses Varinble operating expenses S17.00%0 1.000 18.000 Fixed operating expenses If 1.000 units remain unsold at the end of the month and sales total S150,000 for the month, what would be the amount of A) $50,400 C. $70.000 income from operations reported on the absorption costing income statement D. $52,00O 4 D In the absorption costing income statement. deduction of the cost of goods sold irom sales yields net profit. I rue False 5. A Property taxes on a factory building would be included as part of the cost of products manufactured under the absorption costing concept B. False 1 The cash budget presents the expected inflow and outflow of cash for a specified period of time True B. False PageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started