Question

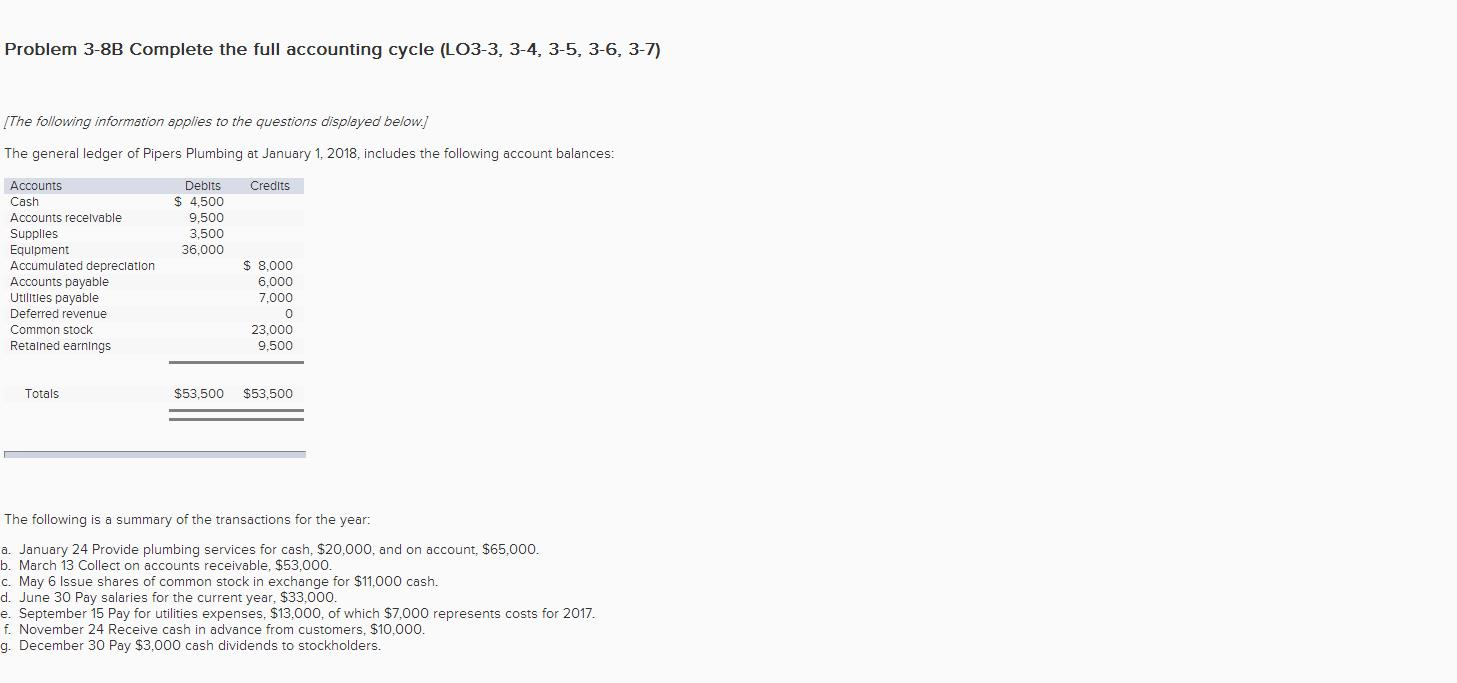

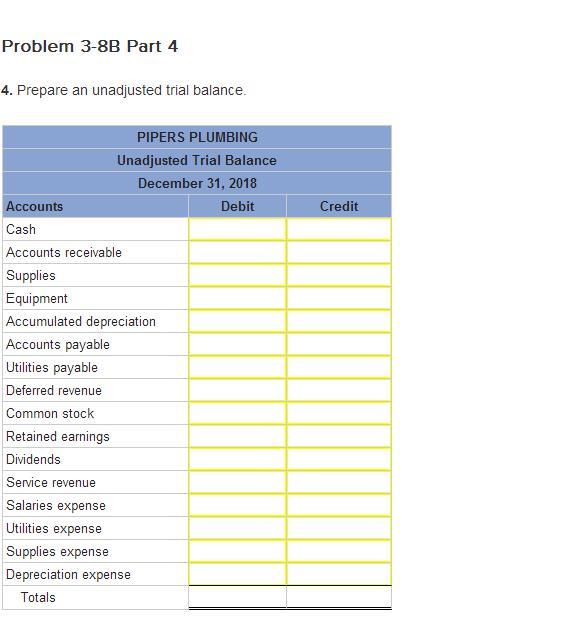

The general ledger of Pipers Plumbing at January 1, 2018, includes the following account balances: Accounts Debits Credits Cash $ 4,500 Accounts receivable 9,500 Supplies

The general ledger of Pipers Plumbing at January 1, 2018, includes the following account balances:

| Accounts | Debits | Credits | ||||

| Cash | $ | 4,500 | ||||

| Accounts receivable | 9,500 | |||||

| Supplies | 3,500 | |||||

| Equipment | 36,000 | |||||

| Accumulated depreciation | $ | 8,000 | ||||

| Accounts payable | 6,000 | |||||

| Utilities payable | 7,000 | |||||

| Deferred revenue | 0 | |||||

| Common stock | 23,000 | |||||

| Retained earnings | 9,500 | |||||

|

|

|

|

|

|

| |

| Totals | $ | 53,500 | $ | 53,500 | ||

|

|

|

|

|

|

| |

|

| ||||||

The following is a summary of the transactions for the year:

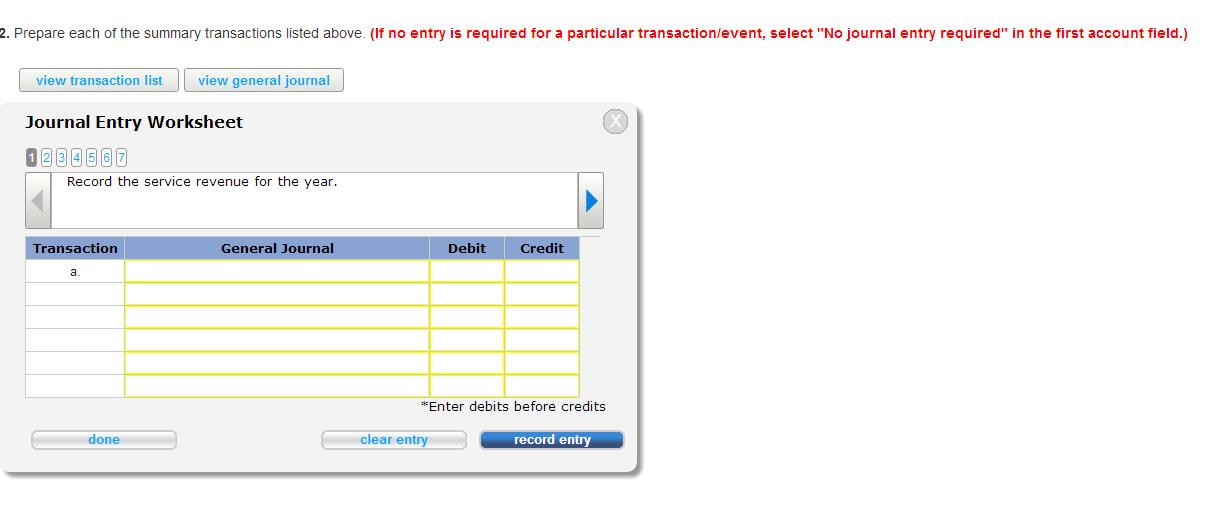

January 24 Provide plumbing services for cash, $20,000, and on account, $65,000.

March 13 Collect on accounts receivable, $53,000.

May 6 Issue shares of common stock in exchange for $11,000 cash.

June 30 Pay salaries for the current year, $33,000.

September 15 Pay for utilities expenses, $13,000, of which $7,000 represents costs for 2017.

November 24 Receive cash in advance from customers, $10,000.

December 30 Pay $3,000 cash dividends to stockholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started