Answered step by step

Verified Expert Solution

Question

1 Approved Answer

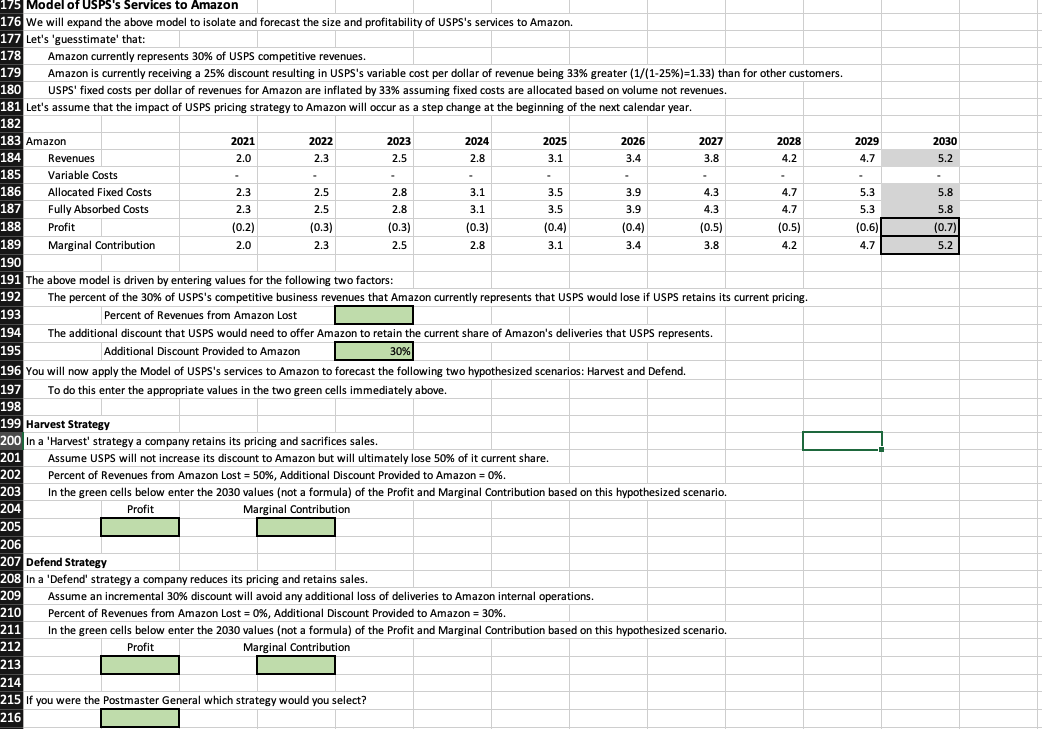

cheers 2029 4.7 2030 5.2 5.3 5.3 10.6) 5.8 5.8 (0.5) (0.7) 5.2 4.7 195 175 Model of USPS's Services to Amazon 176 We will

cheers

2029 4.7 2030 5.2 5.3 5.3 10.6) 5.8 5.8 (0.5) (0.7) 5.2 4.7 195 175 Model of USPS's Services to Amazon 176 We will expand the above model to isolate and forecast the size and profitability of USPS's services to Amazon. 177 Let's 'guesstimate' that: 178 Amazon currently represents 30% of USPS competitive revenues. 179 Amazon is currently receiving a 25% discount resulting in USPS's variable cost per dollar of revenue being 33% greater (1/(1-25%)=1.33) than for other customers. 180 USPS' fixed costs per dollar of revenues for Amazon are inflated by 33% assuming fixed costs are allocated based on volume not revenues. 181 Let's assume that the impact of USPS pricing strategy to Amazon will occur as a step change at the beginning of the next calendar year. 182 183 Amazon 2021 2022 2023 2024 2025 2026 2027 2028 184 Revenues 2.0 2.3 2.5 2.8 3.1 3.4 3.8 4.2 185 Variable Costs 186 Allocated Fixed Costs 2.3 2.5 2.8 3.1 3.5 3.9 4.3 4.7 187 Fully Absorbed Costs 2.3 2.5 2.8 3.1 3.5 3.9 4.3 4.7 188 Profit (0.2) (0.3) (0.3) (0.3) (0.4) (0.4) (0.5) 189 Marginal Contribution 2.0 2.3 2.5 2.8 3.1 3.4 3.8 4.2 190 191 The above model is driven by entering values for the following two factors: 192 The percent of the 30% of USPS's competitive business revenues that Amazon currently represents that USPS would lose if USPS retains its current pricing. 193 Percent of Revenues from Amazon Lost 194 The additional discount that USPS would need to offer Amazon to retain the current share of Amazon's deliveries that USPS represents. Additional Discount Provided to Amazon 30% 196 You will now apply the Model of USPS's services to Amazon to forecast the following two hypothesized scenarios: Harvest and Defend. 197 To do this enter the appropriate values in the two green cells immediately above. 198 199 Harvest Strategy 200 in a 'Harvest' strategy a company retains its pricing and sacrifices sales. 201 Assume USPS will not increase its discount to Amazon but will ultimately lose 50% of it current share. 202 Percent of Revenues from Amazon Lost = 50%, Additional Discount Provided to Amazon = 0%. 203 In the green cells below enter the 2030 values (not a formula) of the Profit and Marginal Contribution based on this hypothesized scenario. 204 Profit Marginal Contribution 205 206 207 Defend Strategy 208 In a 'Defend' strategy a company reduces its pricing and retains sales. 209 Assume an incremental 30% discount will avoid any additional loss of deliveries to Amazon internal operations. 210 Percent of Revenues from Amazon Lost = 0%, Additional Discount Provided to Amazon = 30%. = 211 In the green cells below enter the 2030 values (not a formula) of the Profit and Marginal Contribution based on this hypothesized scenario. 212 Profit Marginal Contribution 213 214 215 if you were the Postmaster General which strategy would you select? 216 2029 4.7 2030 5.2 5.3 5.3 10.6) 5.8 5.8 (0.5) (0.7) 5.2 4.7 195 175 Model of USPS's Services to Amazon 176 We will expand the above model to isolate and forecast the size and profitability of USPS's services to Amazon. 177 Let's 'guesstimate' that: 178 Amazon currently represents 30% of USPS competitive revenues. 179 Amazon is currently receiving a 25% discount resulting in USPS's variable cost per dollar of revenue being 33% greater (1/(1-25%)=1.33) than for other customers. 180 USPS' fixed costs per dollar of revenues for Amazon are inflated by 33% assuming fixed costs are allocated based on volume not revenues. 181 Let's assume that the impact of USPS pricing strategy to Amazon will occur as a step change at the beginning of the next calendar year. 182 183 Amazon 2021 2022 2023 2024 2025 2026 2027 2028 184 Revenues 2.0 2.3 2.5 2.8 3.1 3.4 3.8 4.2 185 Variable Costs 186 Allocated Fixed Costs 2.3 2.5 2.8 3.1 3.5 3.9 4.3 4.7 187 Fully Absorbed Costs 2.3 2.5 2.8 3.1 3.5 3.9 4.3 4.7 188 Profit (0.2) (0.3) (0.3) (0.3) (0.4) (0.4) (0.5) 189 Marginal Contribution 2.0 2.3 2.5 2.8 3.1 3.4 3.8 4.2 190 191 The above model is driven by entering values for the following two factors: 192 The percent of the 30% of USPS's competitive business revenues that Amazon currently represents that USPS would lose if USPS retains its current pricing. 193 Percent of Revenues from Amazon Lost 194 The additional discount that USPS would need to offer Amazon to retain the current share of Amazon's deliveries that USPS represents. Additional Discount Provided to Amazon 30% 196 You will now apply the Model of USPS's services to Amazon to forecast the following two hypothesized scenarios: Harvest and Defend. 197 To do this enter the appropriate values in the two green cells immediately above. 198 199 Harvest Strategy 200 in a 'Harvest' strategy a company retains its pricing and sacrifices sales. 201 Assume USPS will not increase its discount to Amazon but will ultimately lose 50% of it current share. 202 Percent of Revenues from Amazon Lost = 50%, Additional Discount Provided to Amazon = 0%. 203 In the green cells below enter the 2030 values (not a formula) of the Profit and Marginal Contribution based on this hypothesized scenario. 204 Profit Marginal Contribution 205 206 207 Defend Strategy 208 In a 'Defend' strategy a company reduces its pricing and retains sales. 209 Assume an incremental 30% discount will avoid any additional loss of deliveries to Amazon internal operations. 210 Percent of Revenues from Amazon Lost = 0%, Additional Discount Provided to Amazon = 30%. = 211 In the green cells below enter the 2030 values (not a formula) of the Profit and Marginal Contribution based on this hypothesized scenario. 212 Profit Marginal Contribution 213 214 215 if you were the Postmaster General which strategy would you select? 216Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started