Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chegg guidelines says you can answer a total of 4 questions. Please help with these questions. Wiill thumbs up! (Related to Checkpoint 11.1 and Checkpoint

chegg guidelines says you can answer a total of 4 questions. Please help with these questions.

Wiill thumbs up!

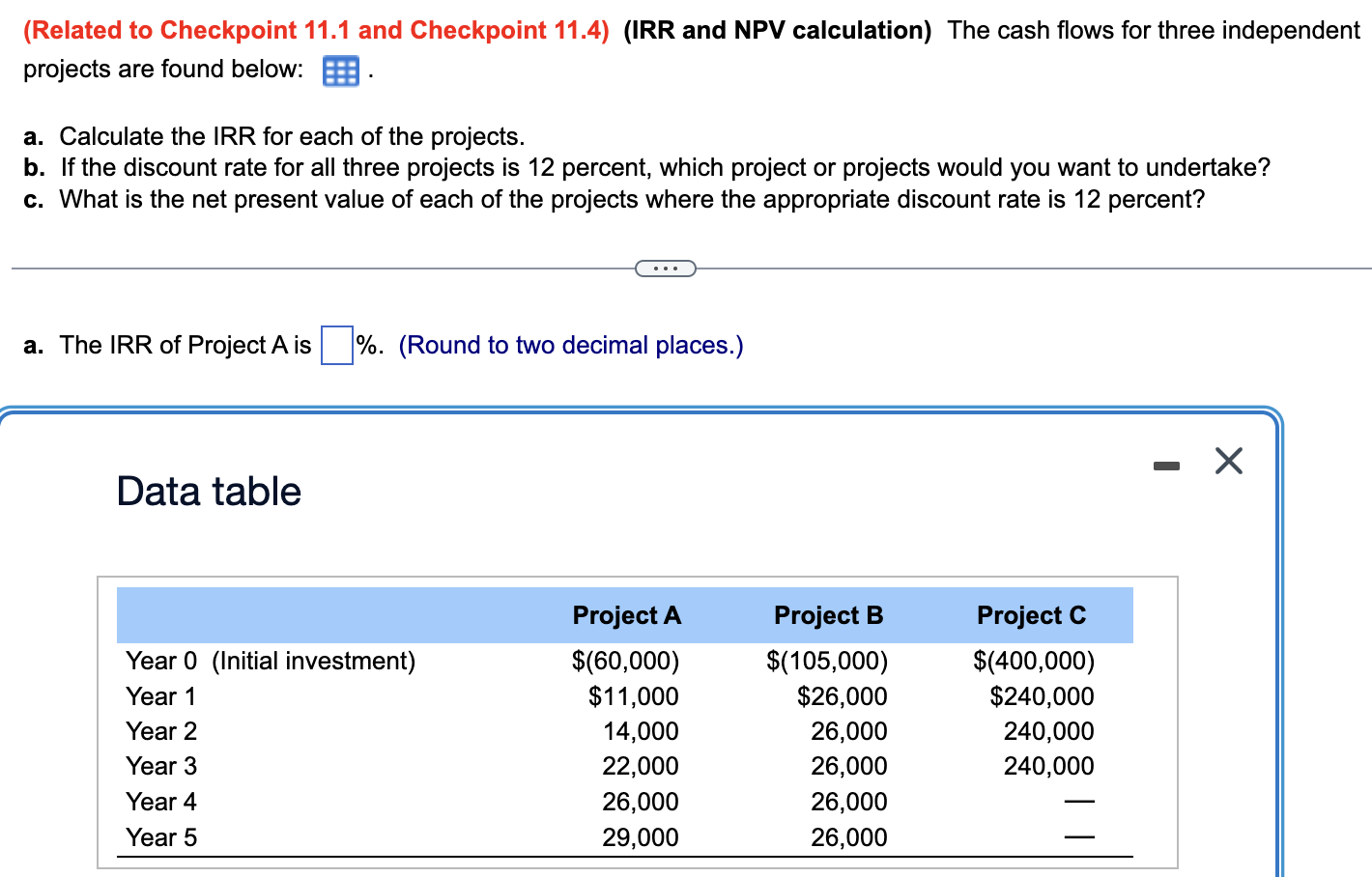

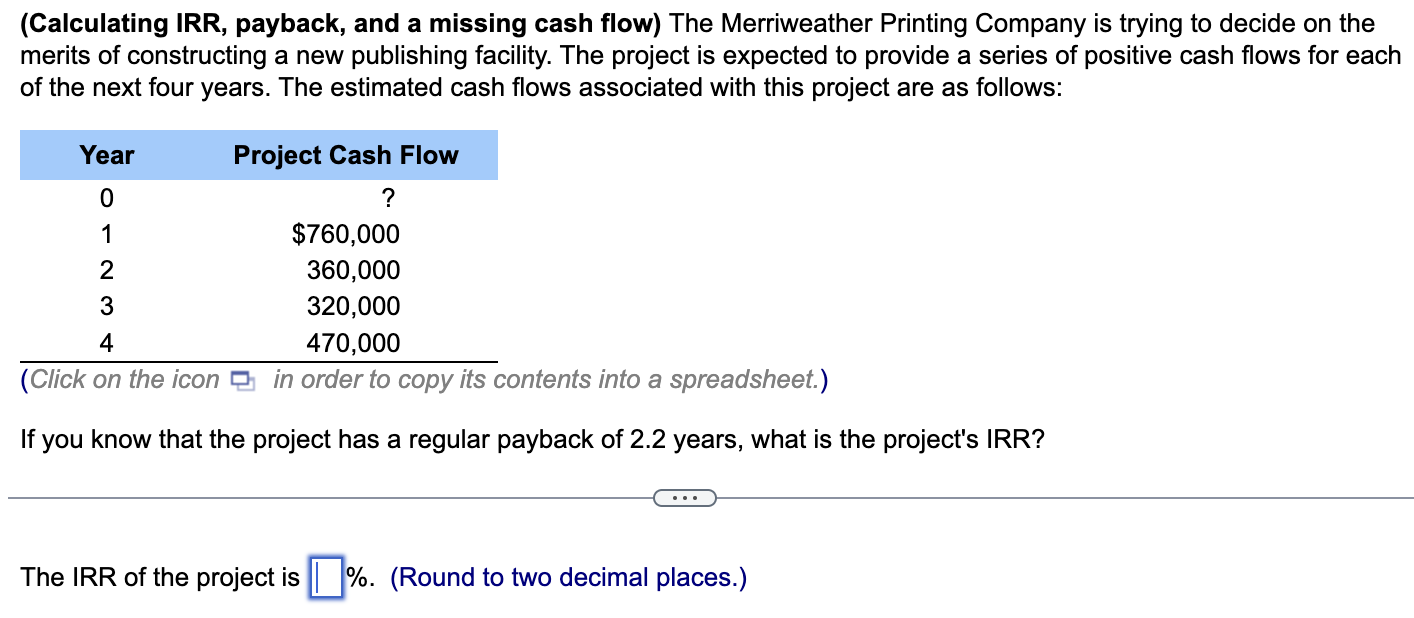

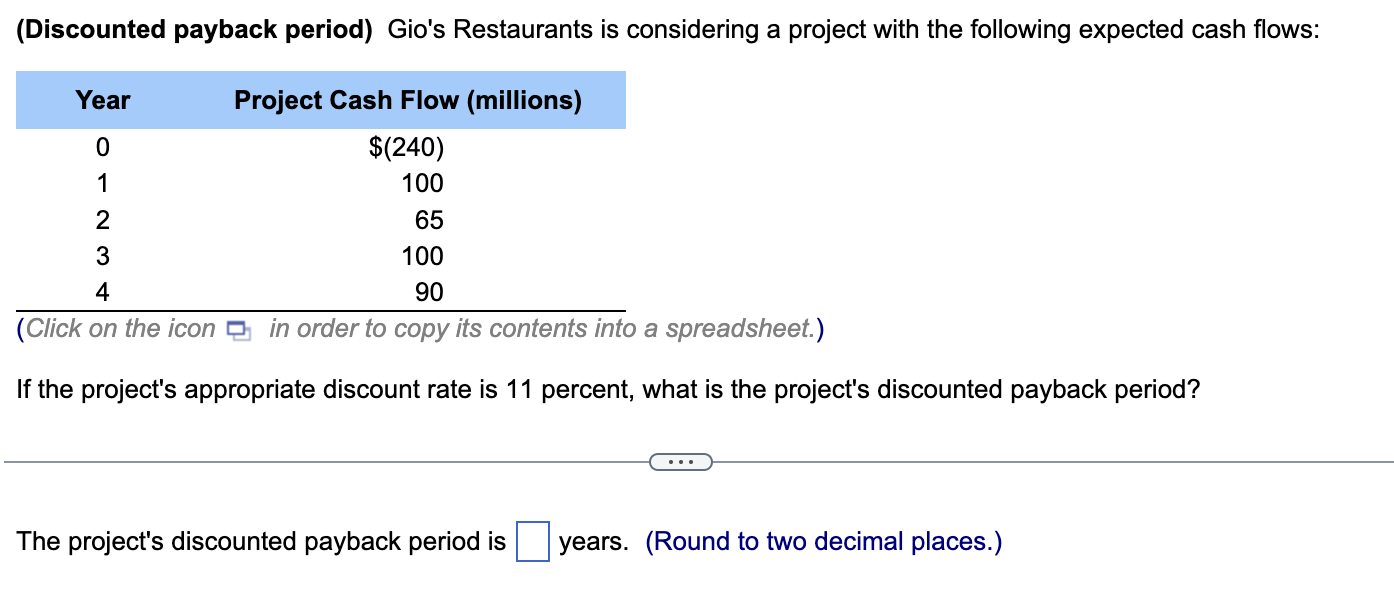

(Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects are found below: a. Calculate the IRR for each of the projects. b. If the discount rate for all three projects is 12 percent, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 12 percent? a. The IRR of Project A is \%. (Round to two decimal places.) Data table (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: (Click on the icon in order to copy its contents into a spreadsheet.) If you know that the project has a regular payback of 2.2 years, what is the project's IRR? The IRR of the project is \%. (Round to two decimal places.) (Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: (Click on the icon in order to copy its contents into a spreadsheet.) If the project's appropriate discount rate is 11 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started