Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chegg has been slacking... awful explantions and many incorrect. Why i am paying Photos - IMG 0732JPEG painting which is vasingle and had used up

chegg has been slacking... awful explantions and many incorrect. Why i am paying

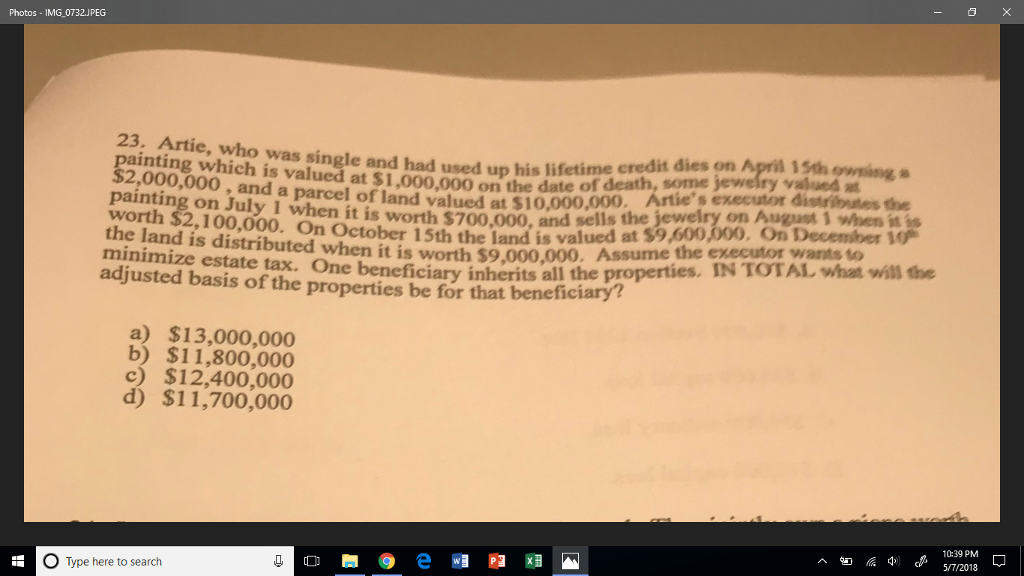

Photos - IMG 0732JPEG painting which is vasingle and had used up his lifetime credit dies on Apri 1 ime credit dies on April 15th owsing a of jewelry valued at rtie's executor disributes the ewelry on August 1 when it is 00, and a parcel of land valued at $10,000,000 painting on July I when it is worth $700,000, and sells the d00 On Decemiber 10 worth $2,100,000. On October 15th the land is valued at $9 the land is distributed when it is worth $9,000,000. Assune minimize estate tax. benefici the e xecutor wants o adjusted bOne beneficiary inherits all the properties. IN TOTAL what will the adjusted basis of the properties be for that beneficiary? a) $13,000,000 b) $11,800,000 c) $12,400,000 d) $11,700,000 10:39 PMM 5/7/2018 O Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started