Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chegg has stated that multipart questions are fine to submit, if you are not going to help me obtain the WHOLE answer, please do not

Chegg has stated that multipart questions are fine to submit, if you are not going to help me obtain the WHOLE answer, please do not comment.

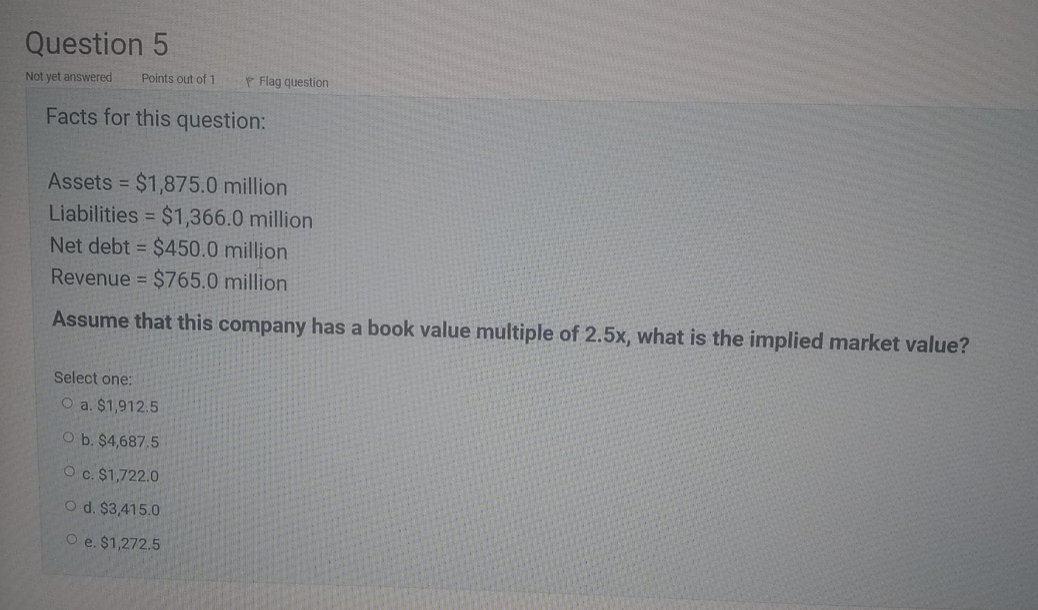

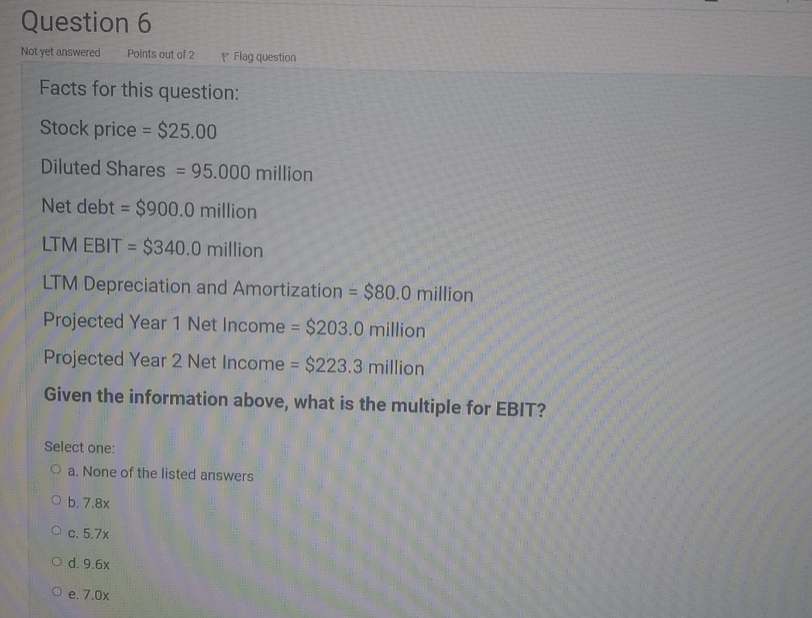

Question 5 Not yet answered Points out of 1 p Flag question Facts for this question: Assets = $1,875.0 million Liabilities = $1,366.0 million Net debt = $450.0 million Revenue = $765.0 million Assume that this company has a book value multiple of 2.5x, what is the implied market value? Select one: O a. $1,912.5 O b. $4,687,5 O c. $1,722.0 O d. $3,415.0 O e. $1,272.5 Question 6 Not yet answered Points out of 2 Flag question Facts for this question: Stock price = $25.00 Diluted Shares = 95.000 million Net debt = $900.0 million LTM EBIT = $340.0 million LTM Depreciation and Amortization = $80.0 million Projected Year 1 Net Income = $203.0 million Projected Year 2 Net Income = $223.3 million Given the information above, what is the multiple for EBIT? Select one: O a. None of the listed answers O b.7.8x O c. 5.7x d. 9,6x O e. 7.0xStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started