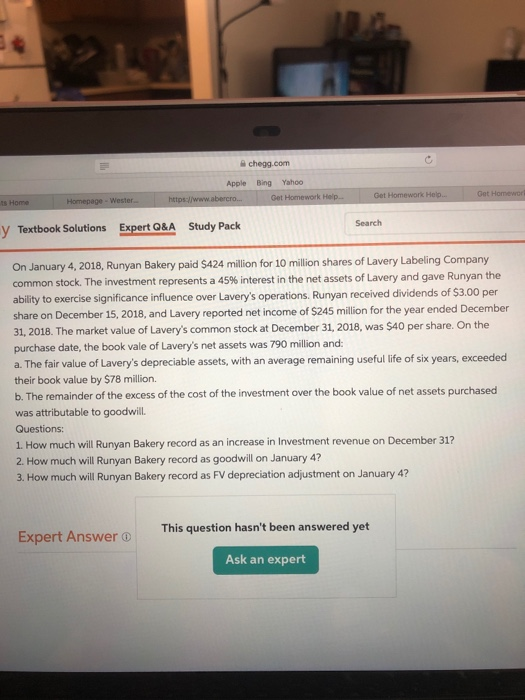

chegg.com Apple Bing Yahoo Get Homework Help Get Homework Help ts Home Homepage - Wester https://www.abercro... y Textbook Solutions Expert Q&A Search Study Pack On January 4, 2018, Runyan Bakery paid $424 million for 10 million shares of Lavery Labeling Company common stock. The investment represents a 45% interest in the net assets of Lavery and gave Runyan the ability to exercise significance influence over Lavery's operations. Runyan received dividends of $3.00 per share on December 15, 2018, and Lavery reported net income of $245 million for the year ended December 31, 2018. The market value of Lavery's common stock at December 31, 2018, was $40 per share. On the purchase date, the book vale of Lavery's net assets was 790 million and a. The fair value of Lavery's depreciable assets, with an average remaining useful life of six years, exceeded their book value by $78 million. b. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill. Questions: 1. How much will Runyan Bakery record as an increase in Investment revenue on December 31? 2. How much will Runyan Bakery record as goodwill on January 4? 3. How much will Runyan Bakery record as FV depreciation adjustment on January 4? This question hasn't been answered yet Expert Answer Ask an expert chegg.com Apple Bing Yahoo Get Homework Help Get Homework Help ts Home Homepage - Wester https://www.abercro... y Textbook Solutions Expert Q&A Search Study Pack On January 4, 2018, Runyan Bakery paid $424 million for 10 million shares of Lavery Labeling Company common stock. The investment represents a 45% interest in the net assets of Lavery and gave Runyan the ability to exercise significance influence over Lavery's operations. Runyan received dividends of $3.00 per share on December 15, 2018, and Lavery reported net income of $245 million for the year ended December 31, 2018. The market value of Lavery's common stock at December 31, 2018, was $40 per share. On the purchase date, the book vale of Lavery's net assets was 790 million and a. The fair value of Lavery's depreciable assets, with an average remaining useful life of six years, exceeded their book value by $78 million. b. The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill. Questions: 1. How much will Runyan Bakery record as an increase in Investment revenue on December 31? 2. How much will Runyan Bakery record as goodwill on January 4? 3. How much will Runyan Bakery record as FV depreciation adjustment on January 4? This question hasn't been answered yet Expert Answer Ask an expert