Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chelsey opens a margin account and purchases 2000 shares of 3609 .HKU at $35 per share. She borrows $25,000 from his broker to help pay

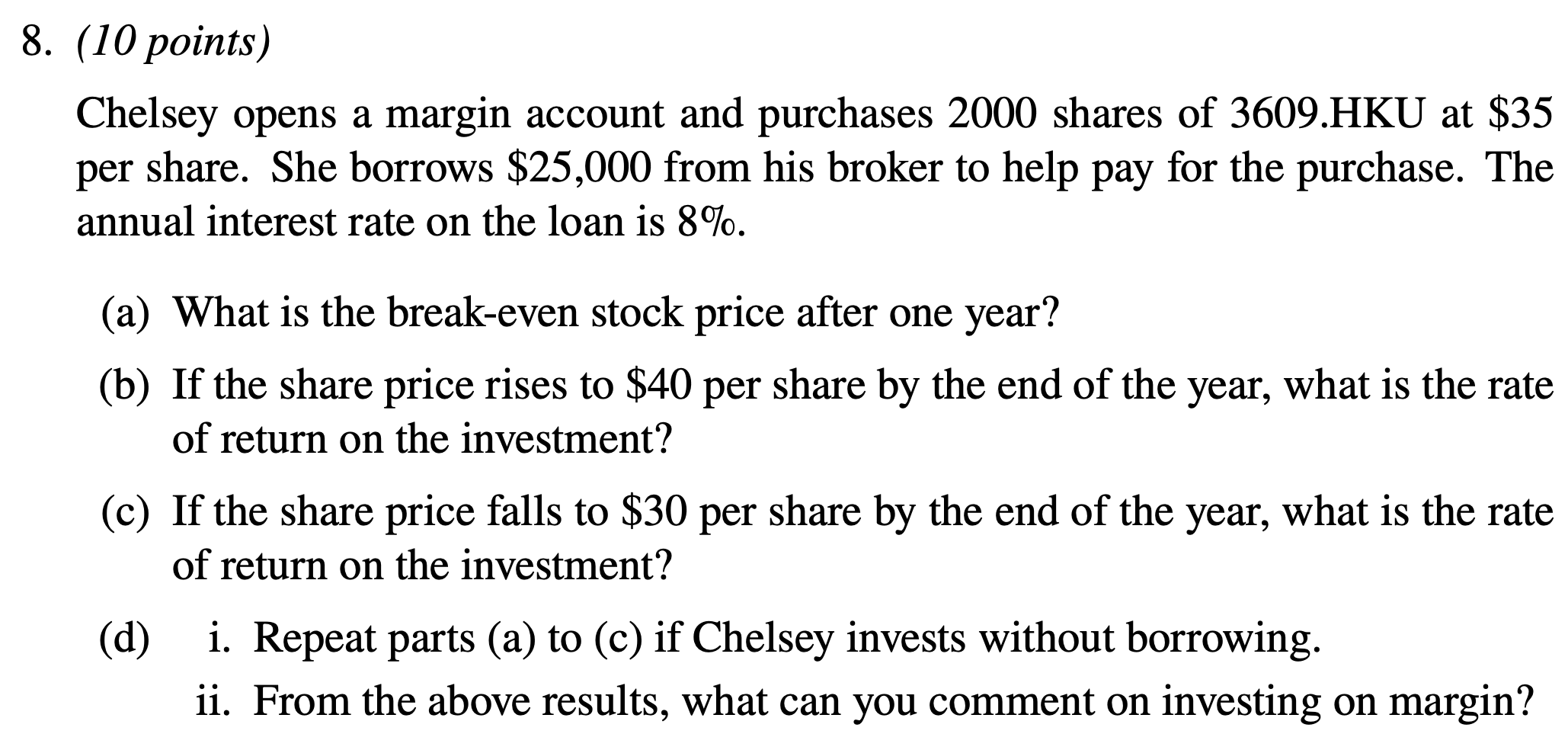

Chelsey opens a margin account and purchases 2000 shares of 3609 .HKU at $35 per share. She borrows $25,000 from his broker to help pay for the purchase. The annual interest rate on the loan is 8%. (a) What is the break-even stock price after one year? (b) If the share price rises to $40 per share by the end of the year, what is the rate of return on the investment? (c) If the share price falls to $30 per share by the end of the year, what is the rate of return on the investment? (d) i. Repeat parts (a) to (c) if Chelsey invests without borrowing. ii. From the above results, what can you comment on investing on margin

Chelsey opens a margin account and purchases 2000 shares of 3609 .HKU at $35 per share. She borrows $25,000 from his broker to help pay for the purchase. The annual interest rate on the loan is 8%. (a) What is the break-even stock price after one year? (b) If the share price rises to $40 per share by the end of the year, what is the rate of return on the investment? (c) If the share price falls to $30 per share by the end of the year, what is the rate of return on the investment? (d) i. Repeat parts (a) to (c) if Chelsey invests without borrowing. ii. From the above results, what can you comment on investing on margin Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started