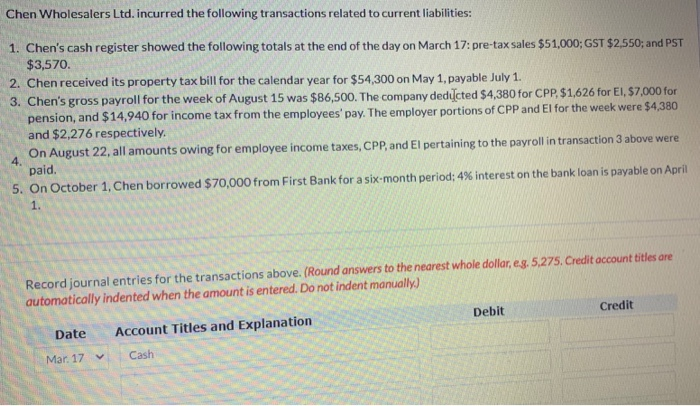

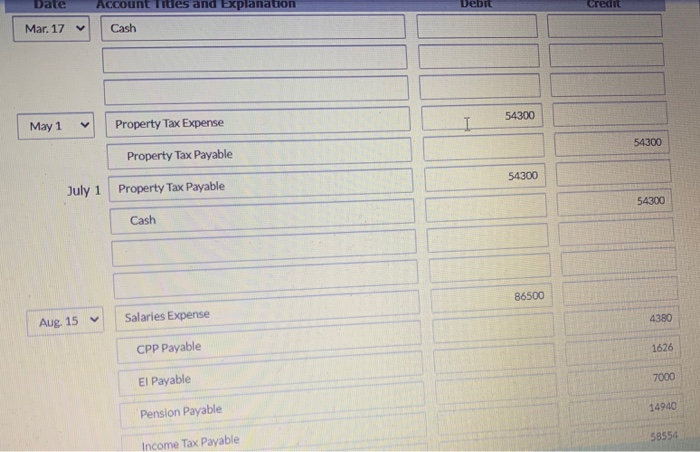

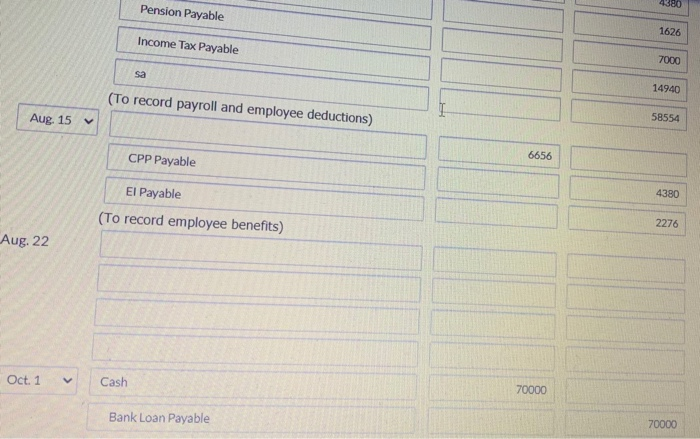

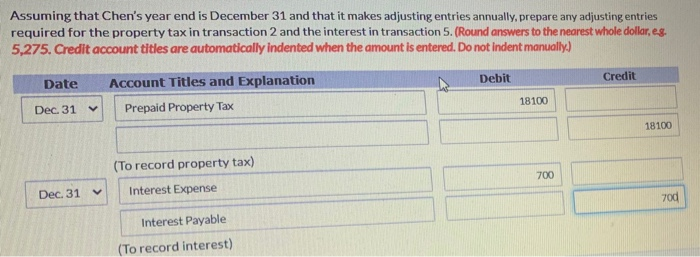

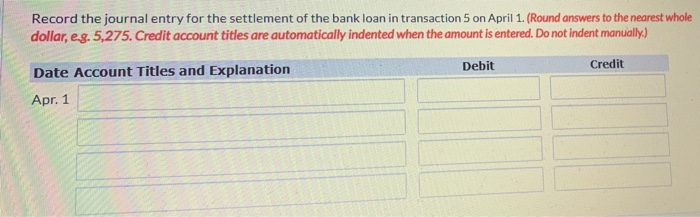

Chen Wholesalers Ltd. incurred the following transactions related to current liabilities: 1. Chen's cash register showed the following totals at the end of the day on March 17: pre-tax sales $51,000; GST $2,550; and PST $3,570. 2. Chen received its property tax bill for the calendar year for $54,300 on May 1, payable July 1. 3. Chen's gross payroll for the week of August 15 was $86,500. The company deducted $4,380 for CPP $1,626 for El, $7,000 for pension, and $14,940 for income tax from the employees' pay. The employer portions of CPP and El for the week were $4,380 and $2,276 respectively. On August 22, all amounts owing for employee income taxes, CPP, and El pertaining to the payroll in transaction 3 above were 4. paid. 5. On October 1, Chen borrowed $70,000 from First Bank for a six-month period: 4% interest on the bank loan is payable on April 1. Record journal entries for the transactions above. (Round answers to the nearest whole dollar, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation Mar. 17 Cash Date Account Tides and Explanation Debi Credit Mar. 17 Cash 54300 May 1 Property Tax Expense 54300 Property Tax Payable 54300 July 1 Property Tax Payable 54300 Cash 86500 Aug. 15 Salaries Expense 4380 CPP Payable 1626 El Payable 7000 14940 Pension Payable 58554 Income Tax Payable 4380 Pension Payable 1626 Income Tax Payable 7000 sa 14940 (To record payroll and employee deductions) Aug. 15 58554 CPP Payable 6656 4380 El Payable (To record employee benefits) 2276 Aug. 22 Oct. 1 Cash 70000 Bank Loan Payable 70000 Assuming that Chen's year end is December 31 and that it makes adjusting entries annually, prepare any adjusting entries required for the property tax in transaction 2 and the interest in transaction 5. (Round answers to the nearest whole dollar, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 18100 Dec. 31 Prepaid Property Tax 18100 (To record property tax) Interest Expense 700 Dec. 31 70d Interest Payable (To record interest) Record the journal entry for the settlement of the bank loan in transaction 5 on April 1. (Round answers to the nearest whole dollar, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Apr. 1