Answered step by step

Verified Expert Solution

Question

1 Approved Answer

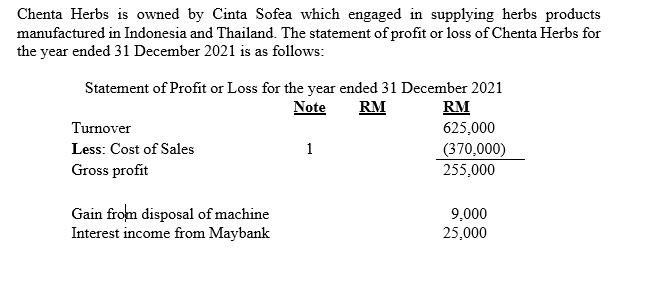

Chenta Herbs is owned by Cinta Sofea which engaged in supplying herbs products manufactured in Indonesia and Thailand. The statement of profit or loss

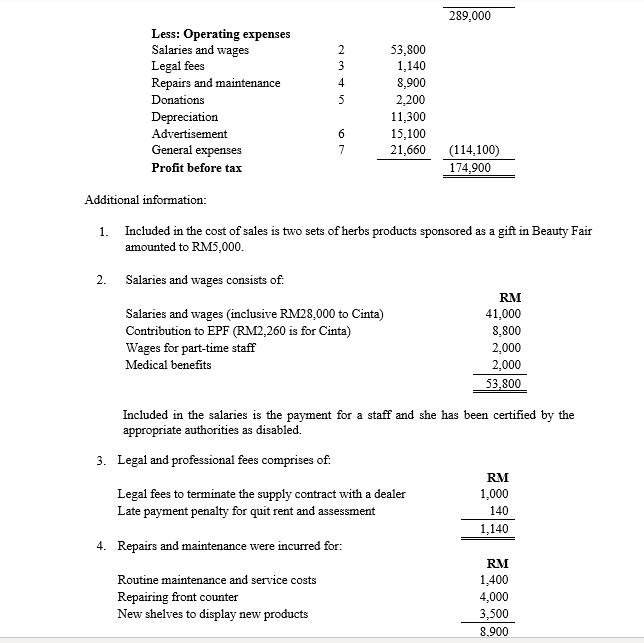

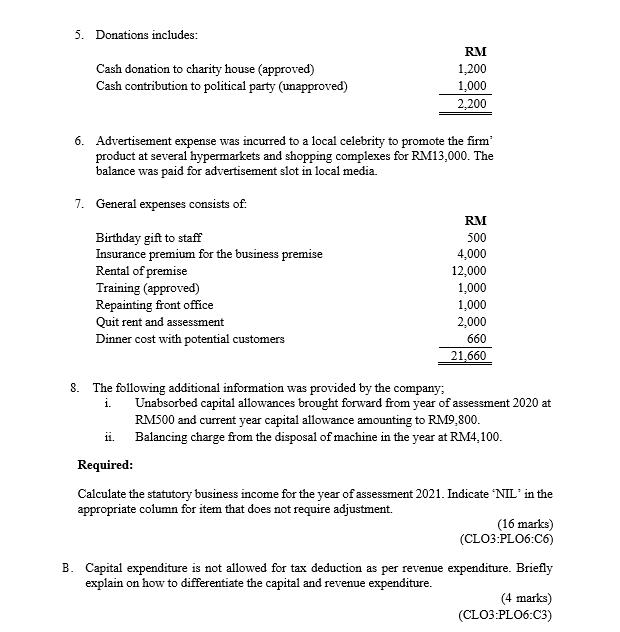

Chenta Herbs is owned by Cinta Sofea which engaged in supplying herbs products manufactured in Indonesia and Thailand. The statement of profit or loss of Chenta Herbs for the year ended 31 December 2021 is as follows: Statement of Profit or Loss for the year ended 31 December 2021 Note RM RM Turnover 625,000 Less: Cost of Sales 1 (370,000) Gross profit 255,000 Gain from disposal of machine 9,000 Interest income from Maybank 25,000 289,000 Less: Operating expenses 53,800 Salaries and wages Legal fees 1,140 Repairs and maintenance 8,900 Donations 2,200 Depreciation Advertisement 11,300 15,100 General expenses 21,660 (114,100) 174,900 Profit before tax Additional information: 1. Included in the cost of sales is two sets of herbs products sponsored as a gift in Beauty Fair amounted to RM5,000. 2. Salaries and wages consists of: RM 41,000 Salaries and wages (inclusive RM28,000 to Cinta) Contribution to EPF (RM2,260 is for Cinta) 8,800 Wages for part-time staff 2,000 Medical benefits 2,000 53,800 Included in the salaries is the payment for a staff and she has been certified by the appropriate authorities as disabled. 3. Legal and professional fees comprises of: RM 1,000 Legal fees to terminate the supply contract with a dealer Late payment penalty for quit rent and assessment 140 1,140 4. Repairs and maintenance were incurred for: RM 1,400 Routine maintenance and service costs Repairing front counter 4,000 New shelves to display new products 3,500 8.900 2 3 4 in 5 67 5. Donations includes: RM 1,200 Cash donation to charity house (approved) Cash contribution to political party (unapproved) 1,000 2,200 6. Advertisement expense was incurred to a local celebrity to promote the firm' product at several hypermarkets and shopping complexes for RM13,000. The balance was paid for advertisement slot in local media. 7. General expenses consists of: RM Birthday gift to staff 500 Insurance premium for the business premise 4,000 Rental of premise 12,000 1,000 Training (approved) Repainting front office 1,000 Quit rent and assessment 2,000 Dinner cost with potential customers 660 21,660 8. The following additional information was provided by the company; i. Unabsorbed capital allowances brought forward from year of assessment 2020 at RM500 and current year capital allowance amounting to RM9,800. 11. Balancing charge from the disposal of machine in the year at RM4,100. Required: Calculate the statutory business income for the year of assessment 2021. Indicate 'NIL' in the appropriate column for item that does not require adjustment. (16 marks) (CLO3:PLO6:C6) B. Capital expenditure is not allowed for tax deduction as per revenue expenditure. Briefly explain on how to differentiate the capital and revenue expenditure. (4 marks) (CLO3:PLO6:C3)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation I ADJUSTMENTS 1 Cost of sale icost of sale included goods worth 5000 sent to Beauty Fair as Advertisement expense is deducted from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started