Answered step by step

Verified Expert Solution

Question

1 Approved Answer

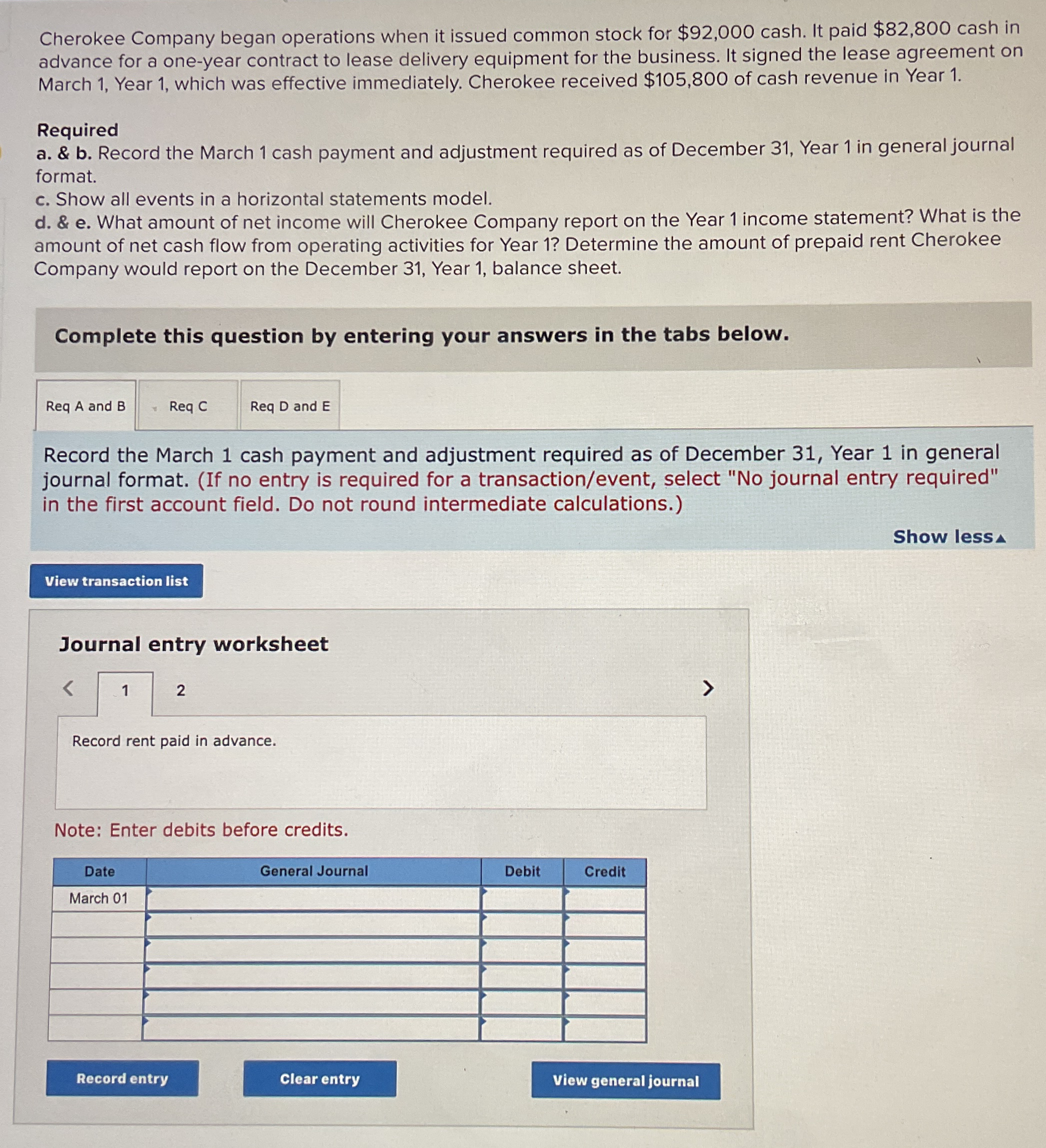

Cherokee Company began operations when it issued common stock for $ 9 2 , 0 0 0 cash. It paid $ 8 2 , 8

Cherokee Company began operations when it issued common stock for $ cash. It paid $ cash in advance for a oneyear contract to lease delivery equipment for the business. It signed the lease agreement on March Year which was effective immediately. Cherokee received $ of cash revenue in Year

Required

a & b Record the March cash payment and adjustment required as of December Year in general journal format.

c Show all events in a horizontal statements model.

d & e What amount of net income will Cherokee Company report on the Year income statement? What is the amount of net cash flow from operating activities for Year Determine the amount of prepaid rent Cherokee Company would report on the December Year balance sheet.

Complete this question by entering your answers in the tabs below.

Req A and

Req and

Record the March cash payment and adjustment required as of December Year in general journal format. If no entry is required for a transactionevent select No journal entry required" in the first account field. Do not round intermediate calculations.

Show less

Journal entry worksheet

Record rent paid in advance.

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditMarch

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started