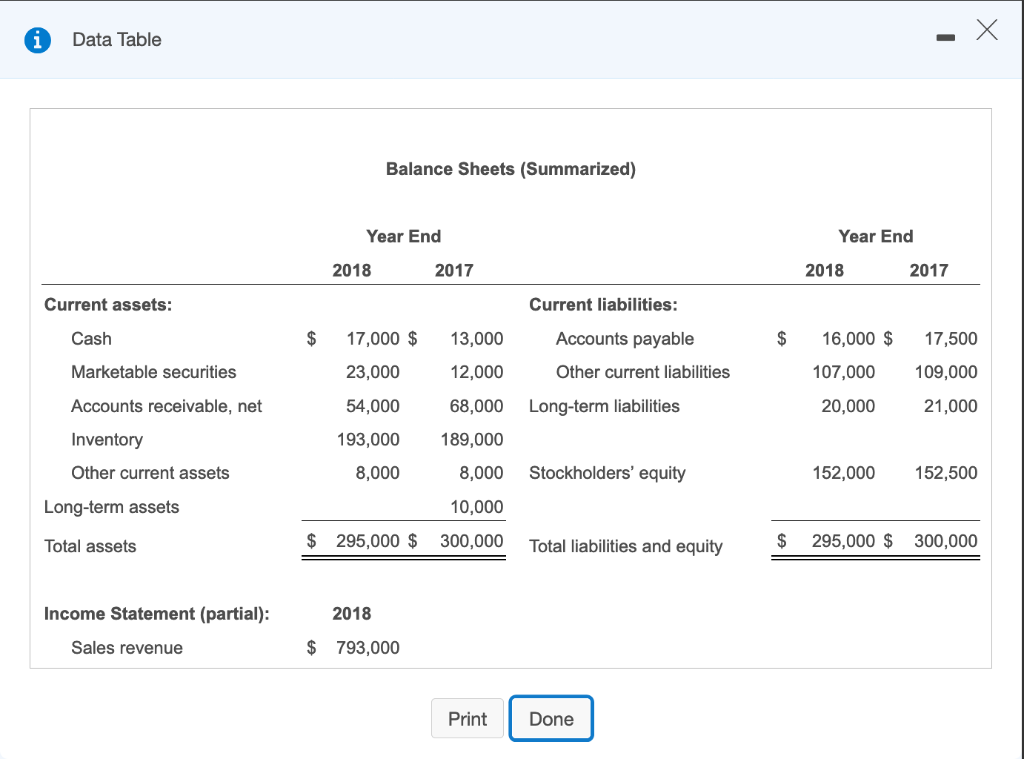

Cherokee Corporation reported the following items at December 31, 2018, and 2017:

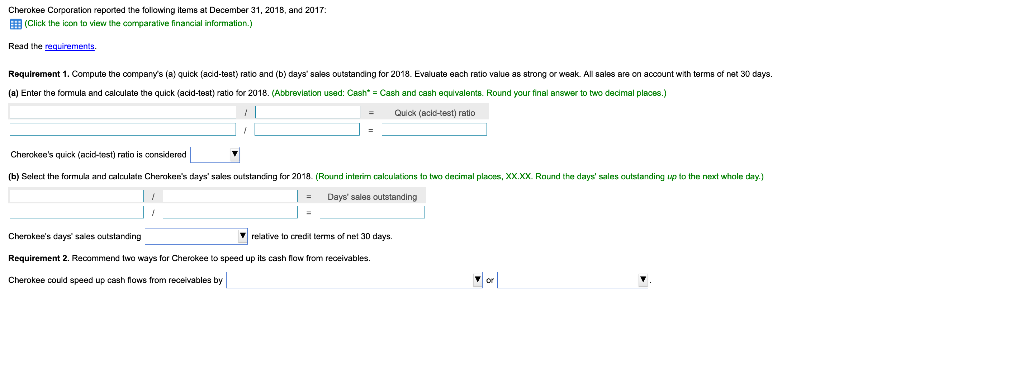

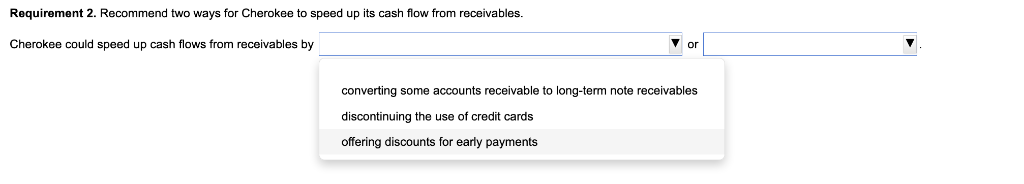

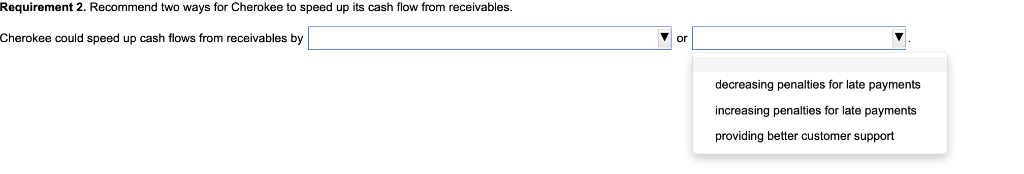

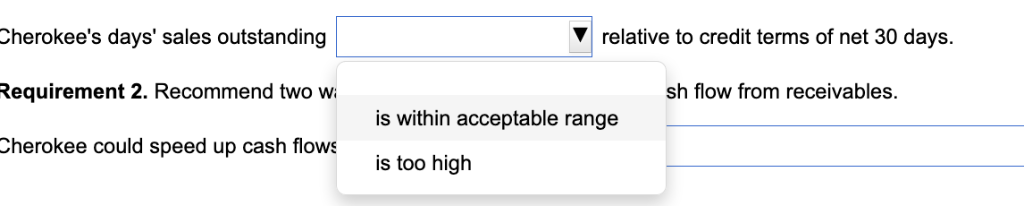

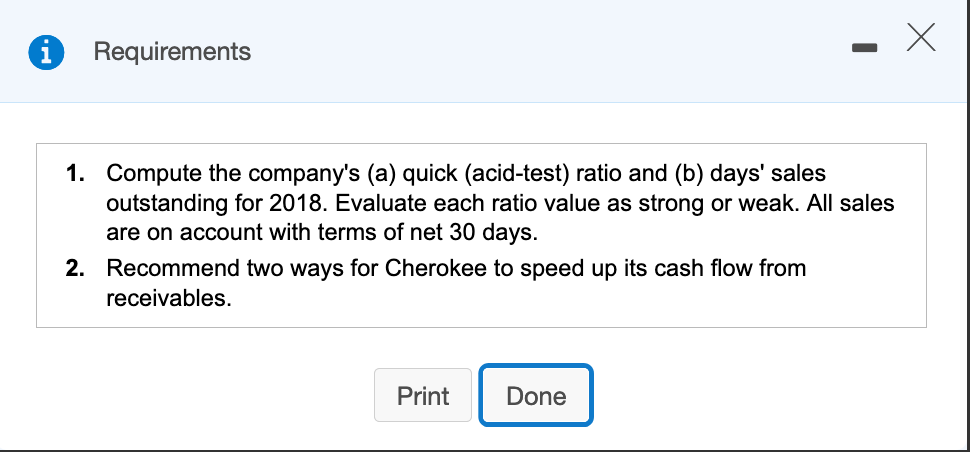

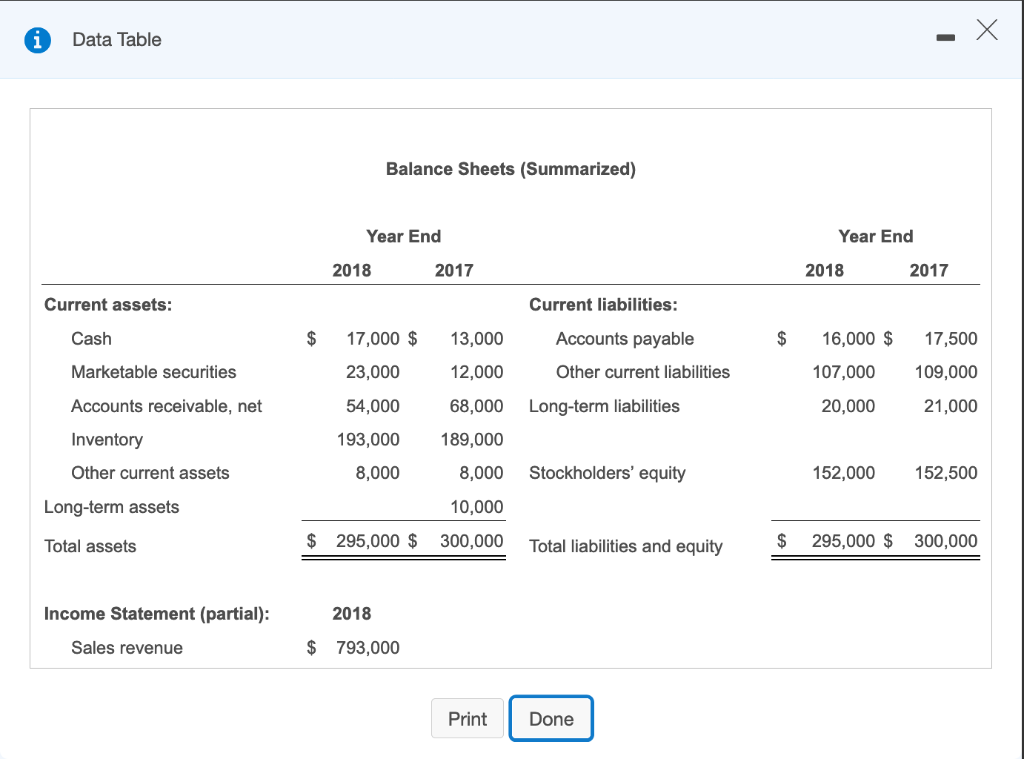

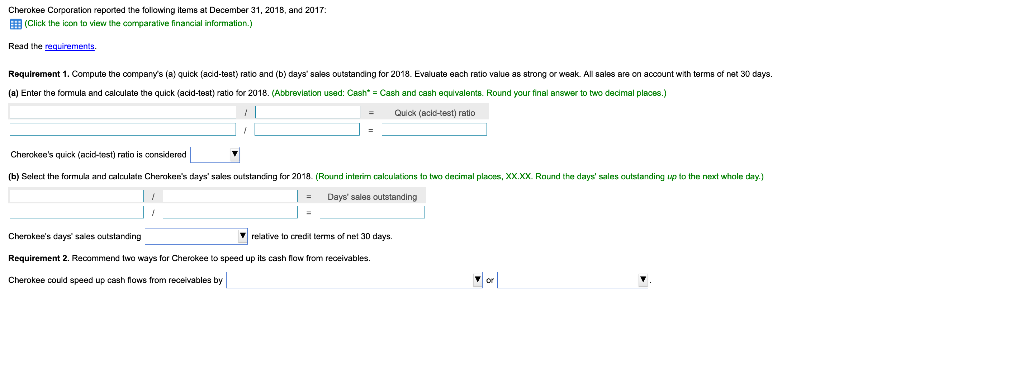

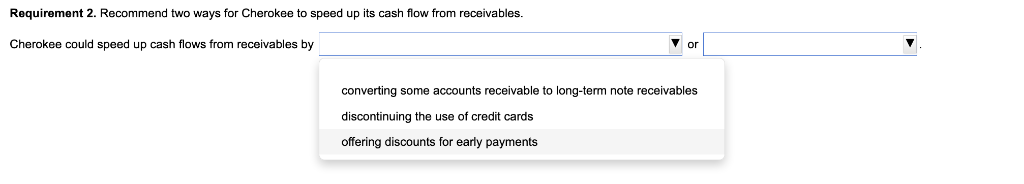

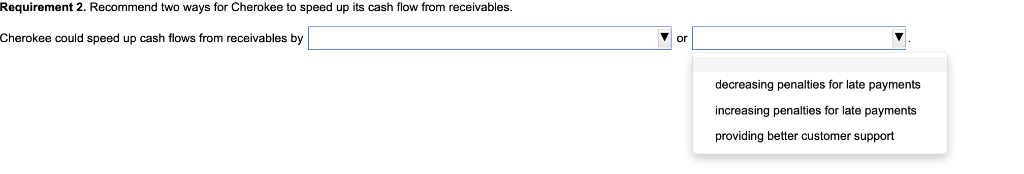

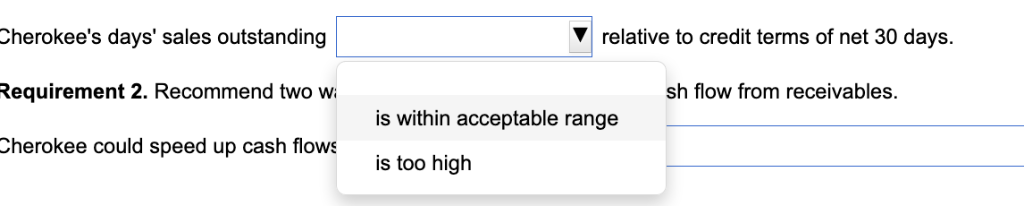

Requirements 1. Compute the company's (a) quick (acid-test) ratio and (b) days' sales outstanding for 2018. Evaluate each ratio value as strong or weak. All sales are on account with terms of net 30 days. Recommend two ways for Cherokee to speed up its cash flow from receivables. 2. Print Done iData Table Balance Sheets (Summarized) Year End Year End 2018 2017 2018 2017 Current assets: Current liabilities: Cash Marketable securities Accounts receivable, net Inventory Other current assets $ 17,000 $ 13,000 Accounts payable $ 16,000 $ 17,500 107,000 109,000 21,000 23,000 12,000 Other current liabilities 54,000 68,000 Long-term liabilities 20,000 193,000 189,000 8,000 8,000 Stockholders' equity 152,000 152,500 Long-term assets 10,000 $ 295,000 300,000 Total liabilities and equity $ 295,000 $ 300,000 Total assets Income Statement (partial) 2018 Sales revenue $ 793,000 PrintDone Cherokee Corporation reported the foliowing items at December 31, 2018, and 2017. (Click the icon to view the comparative financial information.) Read the requirements Requirement 1. Compute the company's (a quick (acd-test) ratio and (b) days salas outstanding for 2018. Eveluate each ratio value as strong or weak. All sales are on account with terms of nat 30 days. (a) Enter the formula and calculate the quick (acld-test) rato for 2018. (Abbrevietion usad: CashCash and cash equivalents. Round your final answer to two decimal places.) Quick (acid-test) ratio Cherckee's quick (acid-est) ratio is considered (b) Selert the fmu arnd carulaie Cherakens days saks outstancirng for 2018 Round interin calculations in two decimal places, XXXX Round the days' sales cutstanding up to the next whale day.) - Days' sales outstanding Cherokee's days saes outslanding Requirement 2. Recommend two ways far Cherckee to speed up is cash law frorn receivables Cherokee couid speed up cash fnows from receivables by | reative lo credit terms of net 30 days. Requirement 2. Recommend two ways for Cherokee to speed up its cash flow from receivables Cherokee could speed up cash flows from receivables by or converting some accounts receivable to long-term note receivables discontinuing the use of credit cards offering discounts for early payments Requirement 2. Recommend two ways for Cherokee to speed up its cash flow from receivables. Cherokee could speed up cash flows from receivables by or decreasing penalties for late payments increasing penalties for late payments providing better customer support V relative to credit terms of net 30 days Cherokee's days' sales outstanding Requirement Cherokee could speed up cash flows sh flow from receivables. 2. Recommend two Wis within acceptable range is too high