Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cherry Pickings Farms Inc. is considering whether to borrow funds to purchase a machine for cherry picking or lease the asset under an operating lease

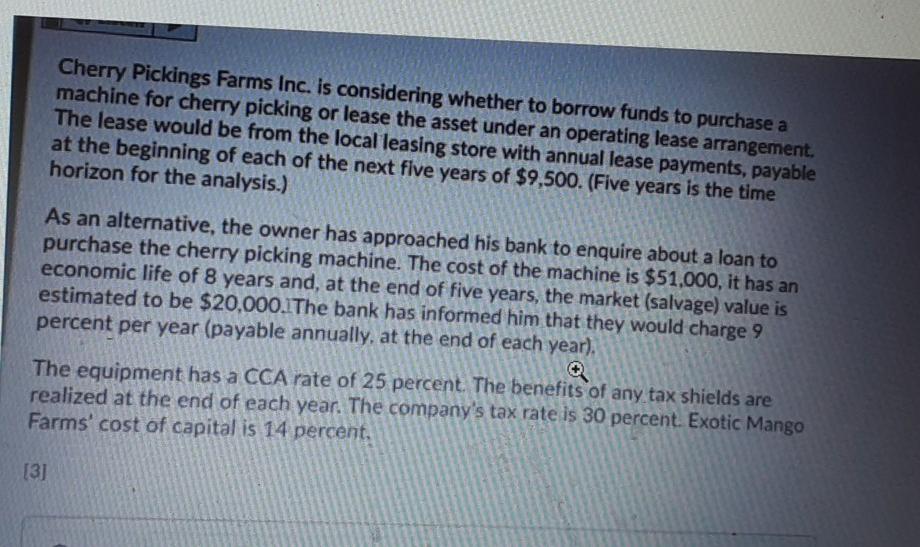

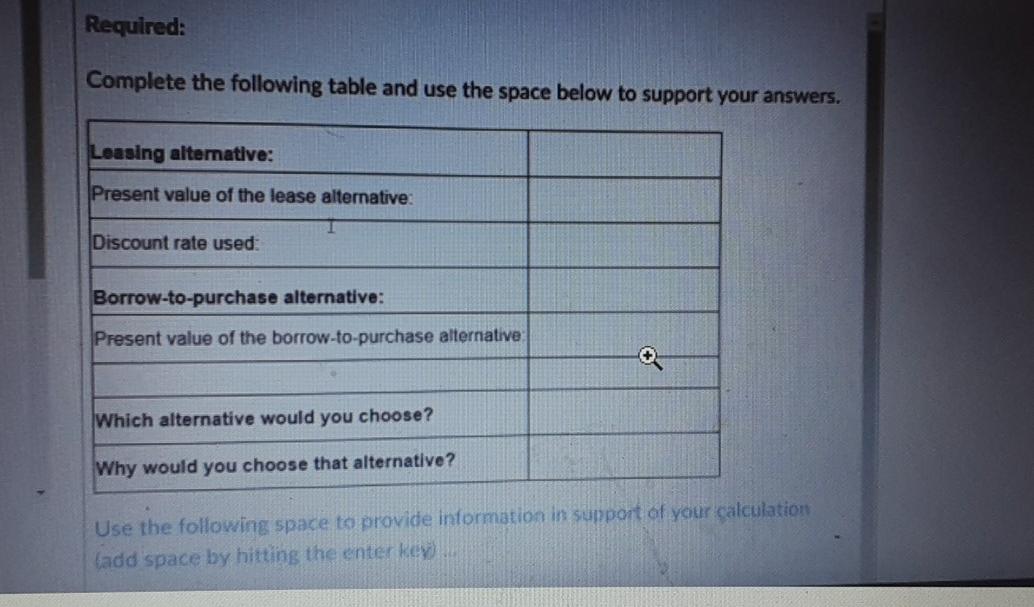

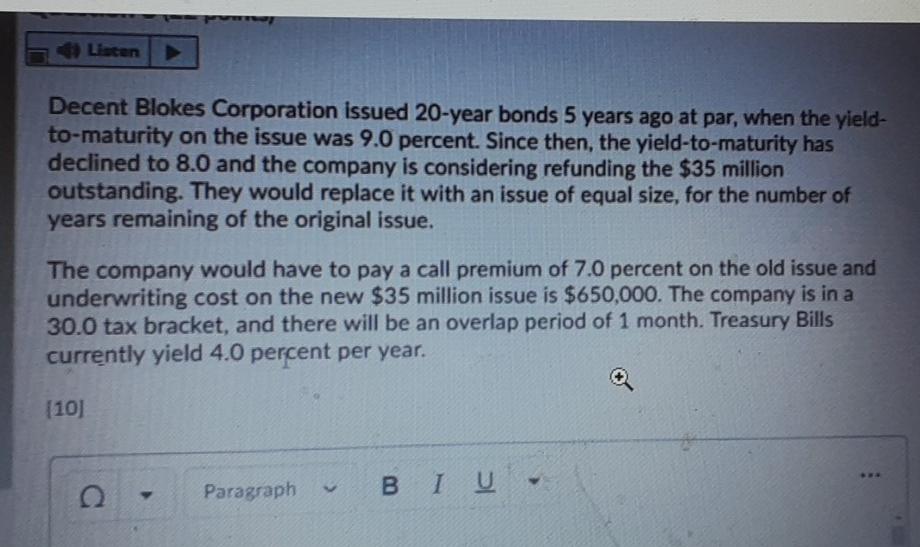

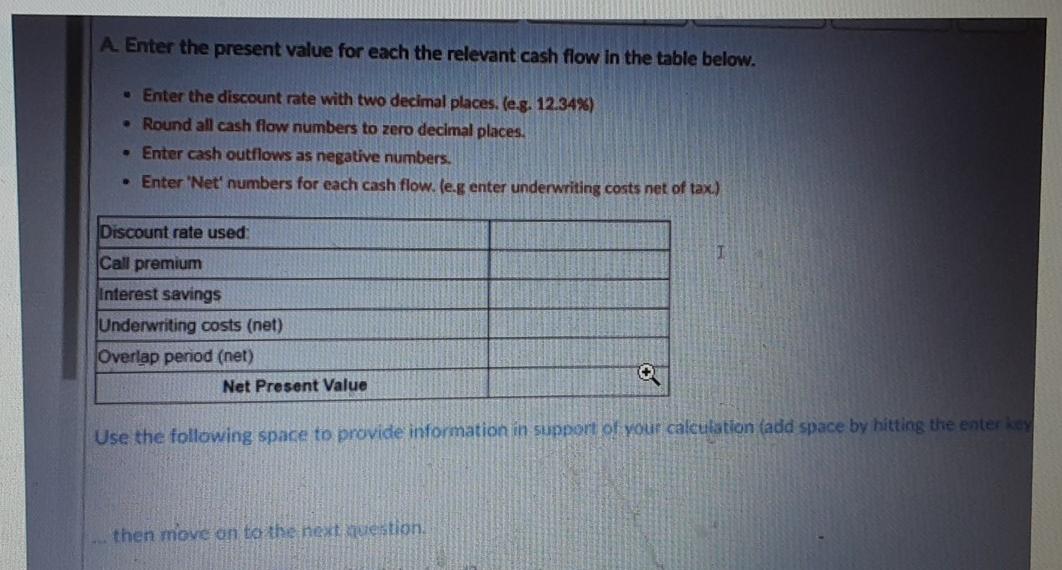

Cherry Pickings Farms Inc. is considering whether to borrow funds to purchase a machine for cherry picking or lease the asset under an operating lease arrangement. The lease would be from the local leasing store with annual lease payments, payable at the beginning of each of the next five years of $9,500. (Five years is the time horizon for the analysis.) As an alternative, the owner has approached his bank to enquire about a loan to purchase the cherry picking machine. The cost of the machine is $51,000, it has an economic life of 8 years and, at the end of five years, the market (salvage) value is estimated to be $20,000.1The bank has informed him that they would charge 9 percent per year (payable annually, at the end of each year) The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realized at the end of each year. The company's tax rate is 30 percent. Exotic Mango Farms' cost of capital is 14 percent. [3] Required: Complete the following table and use the space below to support your answers. Leasing alternative: Present value of the lease alternative: Discount rate used: Borrow-to-purchase alternative: Present value of the borrow-to-purchase alternative # Which alternative would you choose? Why would you choose that alternative? Use the following space to provide information in support of your calculation Cadd space by hitting the enter key Listen Decent Blokes Corporation issued 20-year bonds 5 years ago at par, when the yield- to-maturity on the issue was 9.0 percent. Since then, the yield-to-maturity has declined to 8.0 and the company is considering refunding the $35 million outstanding. They would replace it with an issue of equal size, for the number of years remaining of the original issue. The company would have to pay a call premium of 7.0 percent on the old issue and underwriting cost on the new $35 million issue is $650,000. The company is in a 30.0 tax bracket, and there will be an overlap period of 1 month. Treasury Bills currently yield 4.0 percent per year. (10) Paragraph BIU- A Enter the present value for each the relevant cash flow in the table below. Enter the discount rate with two decimal places. (e.g. 12.34%) Round all cash flow numbers to zero decimal places. Enter cash outflows as negative numbers. Enter "Net' numbers for each cash flow. (e.g enter underwriting costs net of tax.) Discount rate used: Call premium Interest savings Underwriting costs (net) Overlap period (net) Net Present Value Use the following space to provide information in support of your calculation fadd space by hitting the enter key then move on to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started