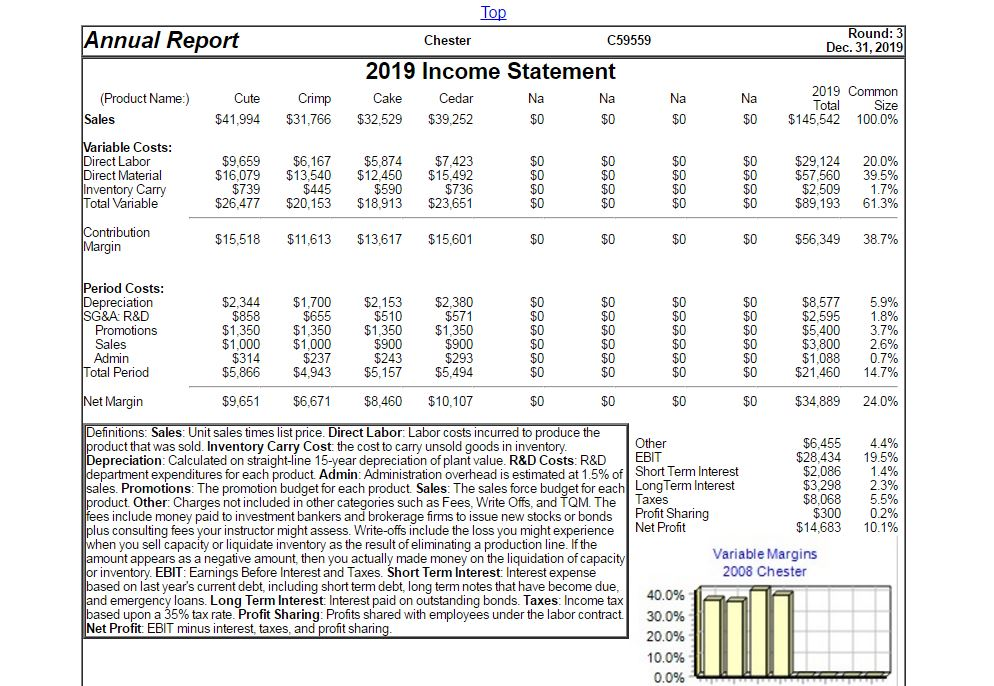

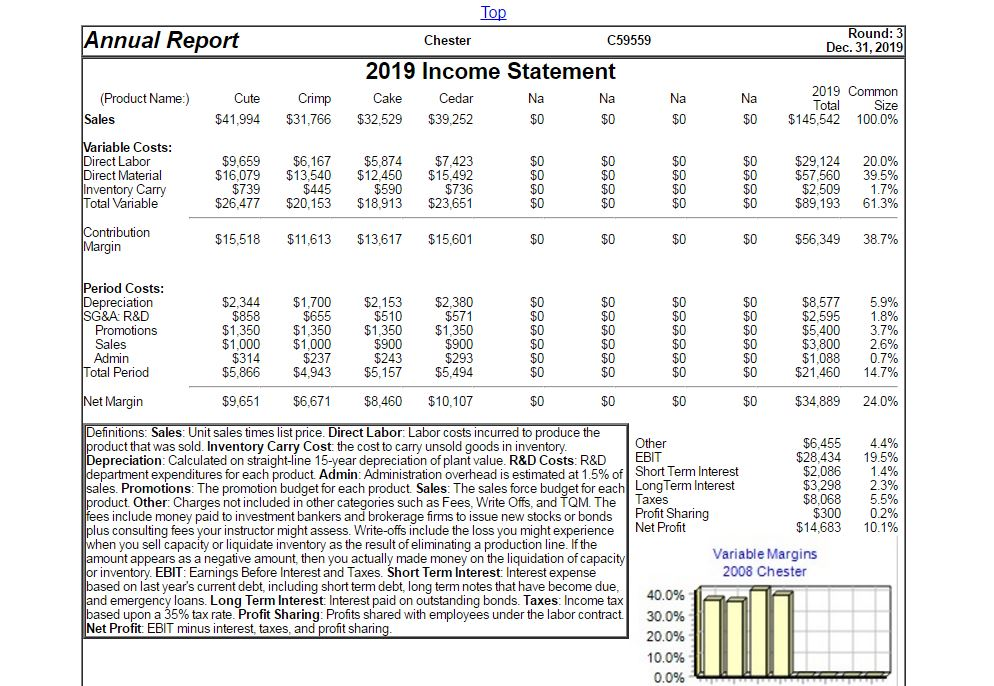

| Chester has negotiated a new labor contract for the next round that will affect the cost for their product Cute. Labor costs will go from $7.75 to $8.25 per unit. Assume all period and variable costs as reported on Chester's Income Statement remain the same. If Chester were to pass on half the new labor costs to their customers, how many units of product Cute would need to be sold next round to break even on the product? |

| Select: 1 |

| | 485 | | | 466 | | | 1,300 | | | 475

| |

Round: 3 Annual Report C59559 Chester Dec. 31, 2019 2019 Income Statement 2019 Common Product Name Cute Cake Cedar Na Na Na Na rimp Total Size $0 $145,542 100.0% Sales $41,994 $31,766 $32,529 $39,252 $0 $0 $0 Variable Costs: Direct Labor $9,659 $6,167 $5,874 $7,423 $0 $0 $0 $0 $29,124 20.0% Direct Material $16,079 $13,540 $12,450 $15,492 $0 $0 $0 $0 $57,560 39.5% Inventory Carry $739 $445 $590 $736 $0 $0 $0 $0 $2,509 1.7% Total Variable $26,477 $20,153 $18,913 $23,651 $0 $0 $0 $0 $89,193 61.3% Contribution $15,518 $11,613 $13,617 $15,601 $0 $0 $0 $0 $56,349 38.7% Margin Period Costs: Depreciation $2,344 $1,700 $22,153 $2,380 $0 $0 $0 $0 $8,577 5.9% SG&A R&D $858 $655 $510 $57 $0 $0 $0 $0 $2,595 1.8% Promotions $1,350 $1,350 $1,350 $1,350 $0 $0 $0 $0 $5,400 3.7% Sales $1,000 $1,000 $900 $900 $0 $0 $0 $0 $3,800 2.6% Admin $314 $237 $243 $293 $0 $0 $0 $0 $1,088 0.7% Total Period $5,866 $4,943 $5,157 $5,494 $0 $0 $0 $0 $21,460 14.7% Net Margin $9,65 $6,671 $8,460 $10,107 $0 $0 $0 $0 $34,889 24.0% Definitions: Sales Unit sales times list price. Direct Labor: Labor costs incurred to produce the Other $6,455 44% product that was sold. nventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EB $28,434 19.5% department expenditures for each product. Admin: Administration overhead is estimated at 1.5% of Short Term Interest $2,086 1.4% $3,298 2.3% sales. Promotions: The promotion budget for each product Sales: The sales force budget for each interest product Other Charges not included in other categories such as Fees, rite Offs, and TQM. The Taxes W $8,068 5.5% fees include money paid to investment bankers and brokerage firms to issue new stocks or bonds Profit Sharing $300 0.2% Net Profit $14,683 10.1% plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the Variable Margins amount appears as a negative amount, then you actually made money on the liquidation of capacity 2008 Chester EBIT: Earnings Before Interest and Taxes. Short Term Interest lnterest expense or inventory. based on last years current debt, including short term debt, long term notes that have become due 40.0% and emergenc y loans. Long Term Interest: Interest paid on outstanding bonds Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees underthe labor contract 30.0% Net Profit EBIT minus interest, taxes, and profit sharing 20.0% 10.0% 0.05% Round: 3 Annual Report C59559 Chester Dec. 31, 2019 2019 Income Statement 2019 Common Product Name Cute Cake Cedar Na Na Na Na rimp Total Size $0 $145,542 100.0% Sales $41,994 $31,766 $32,529 $39,252 $0 $0 $0 Variable Costs: Direct Labor $9,659 $6,167 $5,874 $7,423 $0 $0 $0 $0 $29,124 20.0% Direct Material $16,079 $13,540 $12,450 $15,492 $0 $0 $0 $0 $57,560 39.5% Inventory Carry $739 $445 $590 $736 $0 $0 $0 $0 $2,509 1.7% Total Variable $26,477 $20,153 $18,913 $23,651 $0 $0 $0 $0 $89,193 61.3% Contribution $15,518 $11,613 $13,617 $15,601 $0 $0 $0 $0 $56,349 38.7% Margin Period Costs: Depreciation $2,344 $1,700 $22,153 $2,380 $0 $0 $0 $0 $8,577 5.9% SG&A R&D $858 $655 $510 $57 $0 $0 $0 $0 $2,595 1.8% Promotions $1,350 $1,350 $1,350 $1,350 $0 $0 $0 $0 $5,400 3.7% Sales $1,000 $1,000 $900 $900 $0 $0 $0 $0 $3,800 2.6% Admin $314 $237 $243 $293 $0 $0 $0 $0 $1,088 0.7% Total Period $5,866 $4,943 $5,157 $5,494 $0 $0 $0 $0 $21,460 14.7% Net Margin $9,65 $6,671 $8,460 $10,107 $0 $0 $0 $0 $34,889 24.0% Definitions: Sales Unit sales times list price. Direct Labor: Labor costs incurred to produce the Other $6,455 44% product that was sold. nventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EB $28,434 19.5% department expenditures for each product. Admin: Administration overhead is estimated at 1.5% of Short Term Interest $2,086 1.4% $3,298 2.3% sales. Promotions: The promotion budget for each product Sales: The sales force budget for each interest product Other Charges not included in other categories such as Fees, rite Offs, and TQM. The Taxes W $8,068 5.5% fees include money paid to investment bankers and brokerage firms to issue new stocks or bonds Profit Sharing $300 0.2% Net Profit $14,683 10.1% plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the Variable Margins amount appears as a negative amount, then you actually made money on the liquidation of capacity 2008 Chester EBIT: Earnings Before Interest and Taxes. Short Term Interest lnterest expense or inventory. based on last years current debt, including short term debt, long term notes that have become due 40.0% and emergenc y loans. Long Term Interest: Interest paid on outstanding bonds Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees underthe labor contract 30.0% Net Profit EBIT minus interest, taxes, and profit sharing 20.0% 10.0% 0.05%