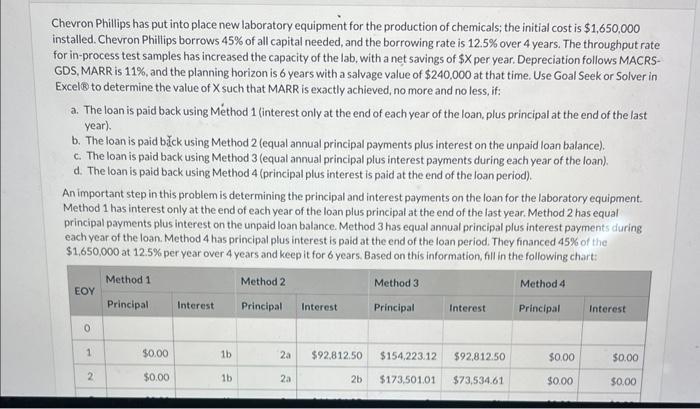

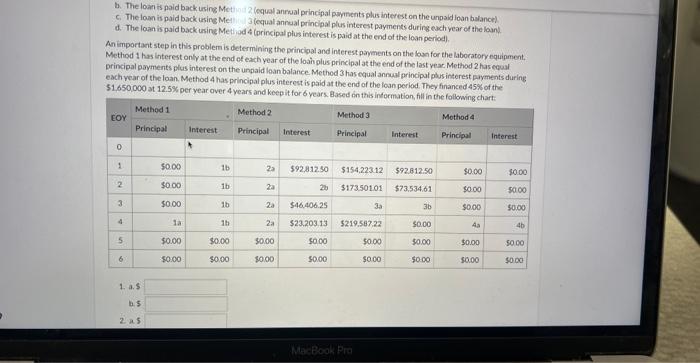

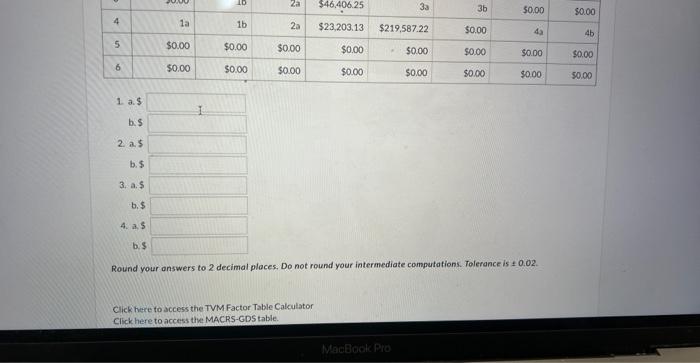

Chevron Phillips has put into place new laboratory equipment for the production of chemicals; the initial cost is $1,650,000 installed. Chevron Phillips borrows 45% of all capital needed, and the borrowing rate is 12.5% over 4 years. The throughput rate for in-process test samples has increased the capacity of the lab, with a net savings of $X per year. Depreciation follows MACRSGDS, MARR is 11%, and the planning horizon is 6 years with a salvage value of $240,000 at that time. Use Goal Seek or Solver in ExcelB to determine the value of X such that MARR is exactly achieved, no more and no less, if: a. The loan is paid back using Method 1 (interest only at the end of each year of the loan, plus principal at the end of the last year). b. The loan is paid bck using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). c. The loan is paid back using Method 3 (equal annual principal plus interest payments during each year of the loan). d. The loan is paid back using Method 4 (principal plus interest is paid at the end of the loan period). An important step in this problem is determining the principal and interest payments on the loan for the laboratory equipment. Method 1 has interest only at the end of each year of the loan plus principal at the end of the last year. Method 2 has equal principal payments plus interest on the unpaid loan balance. Method 3 has equal annual principal plus interest payments during each year of the loan. Method 4 has principal plus interest is paid at the end of the loan period. They financed 45% of the $1,650,000 at 12.5% per year over 4 years and keep it for 6 years. Based on this information, fill in the following chart: b. The loan is paid back uring Metina 2 (equal anrual principal powincats plus interest on the unpaid loan balance) c. The loan is paid back tasine Med 3 (equal annual principal plus interest payments during each year of the loan? d. The loan is pald back using Method 4 (principal plus interest is paid at the end of the loan period). An important step in this problern is determining the princigal and interest payments on the Ioan for the laboratory equipment. Method 1 has interest only at the end of each year of the loah plus princlpal at the end of the last veac. Method 2 has equal principal payments plus interest on the unpaid loan balance. Method 3 has equal annual principal plusinterest payments during each vear of the loan. Method 4 has principal plus interest is paid at the end of the loan period. They financed 45% of the $1.650,000 at 12.5% per year over 4 years and keep it for 6 years. Based on this information. fill in the following chart: Click hiere to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table