Answered step by step

Verified Expert Solution

Question

1 Approved Answer

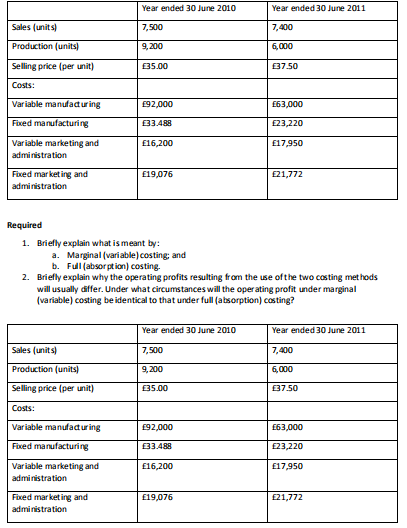

Chew Ltd manufactures and sells a single product. The summarized data below relate to its first two years of operation. 3. Calculate, for each of

Chew Ltd manufactures and sells a single product. The summarized data below relate to its first two years of operation.

3. Calculate, for each of the two years, the operating profit and the closing inventory value using: a. Marginal (variable) costing; and b. Full (absorption) costing. 4. Prepare, for each of the two years, a reconciliation which explains the difference in the operating profits resulting from the use of the two costing methods.

Year ended 30 June 2010 7,500 9,200 35.00 Year ended 30 June 2011 7,400 6,000 E37.50 Sales (units Production (units Selling price (per unit) Costs: Variable manufadt ur ing Fixed manufacturing Variable marketing and 192,000 E33.488 16,200 E63,000 E23,220 E17,950 administration Fixed mar ket ing and E19,076 21,772 administration 1. Briefly explain what is meant by Marginal (variable)costing: and Full (absorption) costing. a. b. 2. Briefly explain why the operating profits resulting from the use ofthe two casting met hods will usually differ. Under what circumstances will the operating profit under marginal (variable) costing be identical to that under full (atsorption) costing? Year ended 30 June 2010 7,500 9,200 E35.00 Year ended 30 June 2011 7,400 6,000 E37.50 Sales (units Production (units) Selling price (per unit) Costs: Variable manufadt ur ing Fixed manufacturing Variable marketing and 192,000 E63,000 E23,220 E17,950 16,200 administration Fixed mar ket ing and E19,076 21,772 administration Year ended 30 June 2010 7,500 9,200 35.00 Year ended 30 June 2011 7,400 6,000 E37.50 Sales (units Production (units Selling price (per unit) Costs: Variable manufadt ur ing Fixed manufacturing Variable marketing and 192,000 E33.488 16,200 E63,000 E23,220 E17,950 administration Fixed mar ket ing and E19,076 21,772 administration 1. Briefly explain what is meant by Marginal (variable)costing: and Full (absorption) costing. a. b. 2. Briefly explain why the operating profits resulting from the use ofthe two casting met hods will usually differ. Under what circumstances will the operating profit under marginal (variable) costing be identical to that under full (atsorption) costing? Year ended 30 June 2010 7,500 9,200 E35.00 Year ended 30 June 2011 7,400 6,000 E37.50 Sales (units Production (units) Selling price (per unit) Costs: Variable manufadt ur ing Fixed manufacturing Variable marketing and 192,000 E63,000 E23,220 E17,950 16,200 administration Fixed mar ket ing and E19,076 21,772 administrationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started