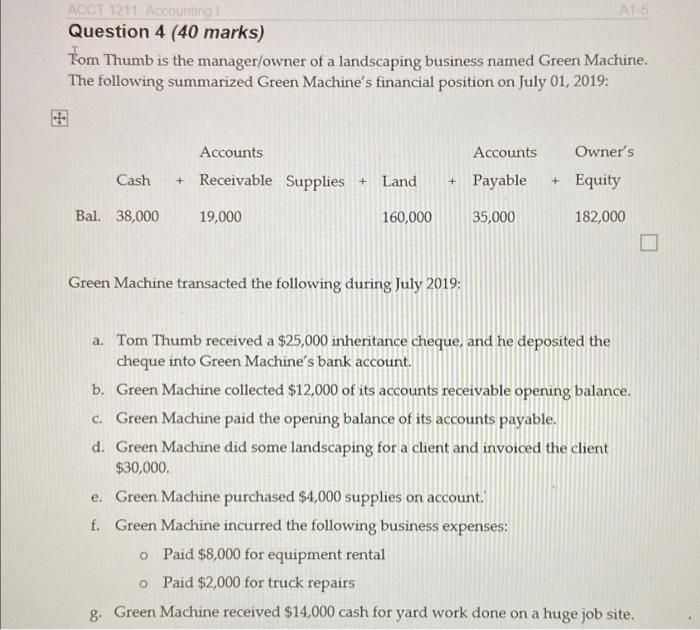

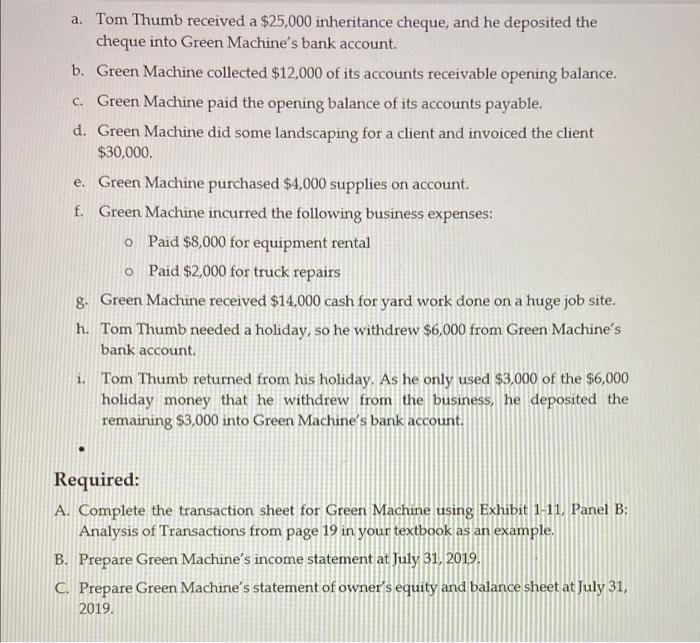

NCT 1211 Accounting AT Question 4 (40 marks) Tom Thumb is the manager/owner of a landscaping business named Green Machine. The following summarized Green Machine's financial position on July 01, 2019: Owner's Accounts + Receivable Supplies Accounts Payable Cash + Land + + Equity Bal. 38,000 19,000 160,000 35,000 182,000 Green Machine transacted the following during July 2019: a. Tom Thumb received a $25,000 inheritance cheque, and he deposited the cheque into Green Machine's bank account. b. Green Machine collected $12,000 of its accounts receivable opening balance. c. Green Machine paid the opening balance of its accounts payable. d. Green Machine did some landscaping for a client and invoiced the client $30,000. e. Green Machine purchased $4,000 supplies on account. f. Green Machine incurred the following business expenses: o Paid $8,000 for equipment rental o Paid $2,000 for truck repairs g. Green Machine received $14,000 cash for yard work done on a huge job site. a. Tom Thumb received a $25,000 inheritance cheque, and he deposited the cheque into Green Machine's bank account. b. Green Machine collected $12,000 of its accounts receivable opening balance. C. Green Machine paid the opening balance of its accounts payable. d. Green Machine did some landscaping for a client and invoiced the client $30,000 e. Green Machine purchased $4,000 supplies on account f. Green Machine incurred the following business expenses: o Paid $8,000 for equipment rental O Paid $2,000 for truck repairs 8. Green Machine received $14,000 cash for yard work done on a huge job site. h. Tom Thumb needed a holiday, so he withdrew $6,000 from Green Machine's bank account. i. Tom Thumb returned from his holiday. As he only used $3,000 of the $6,000 holiday money that he withdrew from the business, he deposited the remaining $3,000 into Green Machine's bank account. Required: A. Complete the transaction sheet for Green Machine using Exhibit 1-11, Panel B: Analysis of Transactions from page 19 in your textbook as an example. B. Prepare Green Machine's income statement at July 31, 2019. C. Prepare Green Machine's statement of owner's equity and balance sheet at July 31, 2019