Question

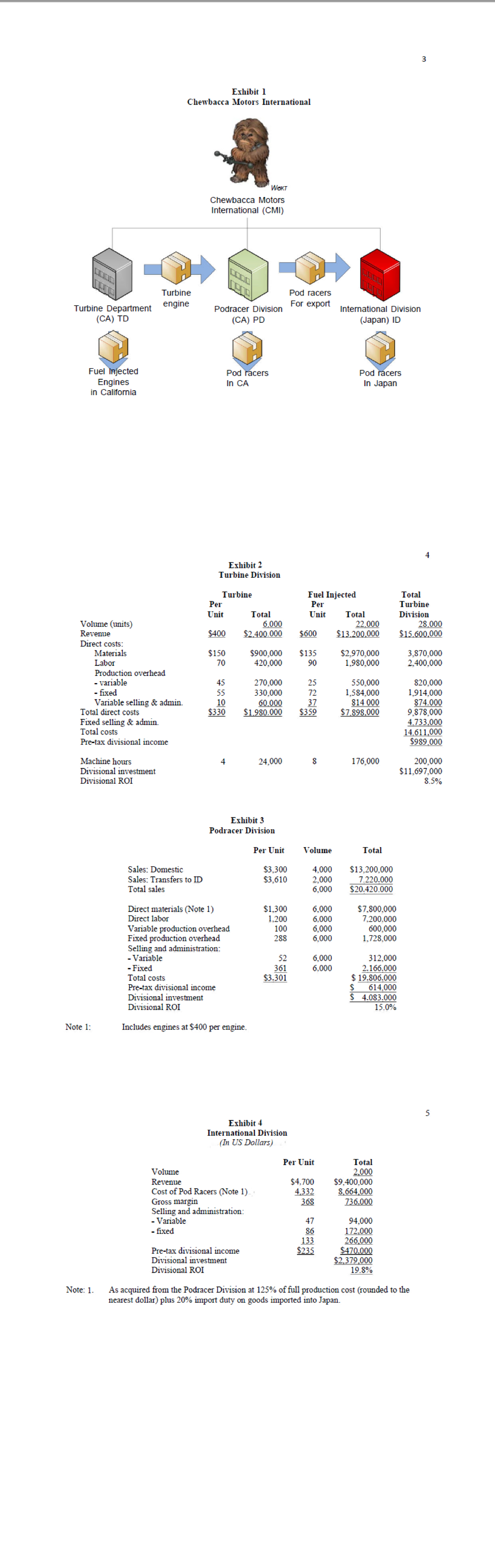

Chewbacca Motors International (CMI) is an international company in California that is currently organized into three divisions, each of which is treated as an investment

Chewbacca Motors International (CMI) is an international company in California that is currently

organized into three divisions, each of which is treated as an investment centre. Divisional

performance evaluation and managerial bonuses are based on achieving a 12% divisional return on

investment (ROI). Divisional ROI is calculated as pretax divisional income divided by divisional

investment. See Exhibit 1 for a diagram showing the structure of CMI.

Hank Solo, President of CMI, is very concerned about both divisional and overall corporate

performance. The following discussion took place recently between Hank Solo and Elan Harrar, the

new controller.

Hank Solo, President: "I wonder if the growth we enjoyed in the early years in San Francisco was

really worth it. Now that we're an international organization, I'm not really sure what's going on in

each of the divisions anymore..."

Elan Harrar, Controller: "But you've laid out some ground rules for the divisional managers to

work within. I heard you say this morning that they are supposed to act as independent business

units and maximize divisional return on investments."

Hank Solo, President: "I've also instructed the divisional managers to buy from and sell to each

other whenever possible and that the price for these internal transactions has to be set at 1.25 times

full production cost. Every time I turn around, one of them is complaining about what the other

divisions are doing!"

The Turbine Division (TD) manufactures standard turbine engines and fuel injected engines. The

manufacturing process involves product design, machining of parts, assembly, and quality

assurance. TD has developed a strong reputation based on product quality and the guarantee of

complete customer satisfaction. Lately, CMI management has expressed some concerns regarding

the overall profitability of TD given CMI's overall desired rate of return of 12% before taxes (the

corporate tax rate in California is 40%). All of the turbine engines produced by TD are sold to the

Podracer Division (PD) of CMI.

Information concerning the manufacture of the engines is provided in Exhibit 2. The manager of TD

has been complaining that his division's ROI is decreasing as turbine engine sales to SD increase.

He has argued with Hank Solo that he should be allowed to increase the price of carburetor engines

to $500 which is the market price for a similar engine. Alternatively, the TD manager has

threatened to stop producing turbine engines. Sales prospects for the fuel injected engine are

virtually limitless at the current price of $600 per engine. The only restriction facing TD is an upper

limit of 200,000 machine hours per year.

The Podracer Division (PD) manufactures standard pod racer valued for their durability and

performance. Information on the profitability of PD is shown in Exhibit 3. PD buys all of its

turbine engines from TD.

Hank Solo has been pleased with the past performance of PD as sales and profits have continued to

increase. He decided to ask the PD manager how a price increase in carburetor engines would affect

sales.

The reply was that pod racer sales are price sensitive and the proposed increase in the price of

engines from TD would require SD to increase the domestic price of the pod racer to $3,400. This

would cause the domestic sales volume to fall to 3,500 units per year. The PD manager also

complained that TD's service has steadily decreased over the past year, causing delays in the

production of pod racer, and if delivery times do not improve, some sales could be lost.

The International Division (ID) of CMI is located in Japan where the corporate tax rate is 30%. ID's

only business activity is to sell pod racers imported from SD. ID pays a 20% import duty based on

the transfer price. Customs officials in Japan carefully monitor the invoices of imported

manufactured goods to ensure that the goods are priced at "fair values". The Government of Japan

considers any price between full production cost and 150% of full production cost to be within its

definition of fair value. Information on ID is provided in Exhibit 4.

While ID is only two years old, it has gained a significant market share in Japan by following a

penetration pricing strategy. All indications are that sales will continue to grow. In response to a

recent inquiry by Hank Solo, ID's manager indicated that the proposed increase in the cost of a pod

racer from TD would lead him to increase the ID sales price by $300 per unit causing volumes to

decline to 1,700 per year.

At the end of their meeting, Hank Solo requested Elan Harrar to analyze the company's current

situation, including the TD manager's two proposals, and recommend improvements.

Specifically, he would like you to determine the impact of each proposal on the pretax income and

return on investment for each division and the company as a whole along with the behavioral

implications of these proposals. Hank Solo would also like a discussion of the relevant

considerations in setting CMI's domestic and international transfer pricing policies. Other issues,

such as organization structure, performance evaluation, the bonus system and improvement of the

company's future profitability, are other concerns Hank Solo would like you to address.

Required:

As Erin Hunter, the new controller, prepare a 1,500-word report (plus exhibits) to Hank Solo,

President of Chewbacca Motors International.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started