Question

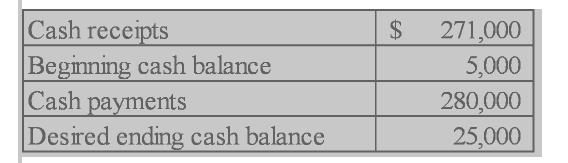

Cheyenne Company has budgeted the following information for June: If there is a cash shortage, the company borrows money from the bank. All cash is

Cheyenne Company has budgeted the following information for June:

If there is a cash shortage, the company borrows money from the bank. All cash is borrowed at the beginning of the month in $1,000 increments and interest is paid monthly at 1% on the first day of the following month. The company had no debt before June 1st. The amount of interest paid on July 1 would be:

$250. $400. $221. $290.

2

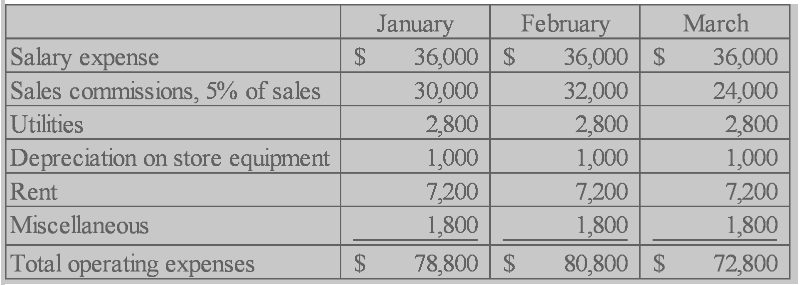

Barnes Company expects to begin operating on January 1. The company's master budget contained the following operating expense budget:  Sales commissions are paid in cash in the month following the month in which the expense is recognized. All other expense items requiring cash payment are paid in the month in which they are recognized. The amount of accumulated depreciation appearing on the company's March 31 pro forma balance sheet is:

Sales commissions are paid in cash in the month following the month in which the expense is recognized. All other expense items requiring cash payment are paid in the month in which they are recognized. The amount of accumulated depreciation appearing on the company's March 31 pro forma balance sheet is:

$1,000.

$2,000.

$3,000.

$12,000.

3.

Bates Company plans to add a new item to its line of consumer product offerings. Two possible products are under consideration. Each unit of Product A costs $6 to produce and has a contribution margin of $3, while each unit of Product B costs $12 and has a contribution margin of $4. What is the differential revenue for this decision?

$7

$1

$6

$9

4.

Relevant costs are often referred to as:

Unavoidable costs

Differential costs

Sunk costs

All of these

5.

Which of the following statements is true?

Fixed costs are sometimes relevant for decision making.

Opportunity costs are never relevant to decision making.

Information must be exactly accurate to be relevant to decision making.

A cost that is relevant in one decision context is relevant in other decision contexts.

6.

Rachel is deciding whether to remain in the home she has lived in for the past ten years, which is located very near her work, or to move into a newer home that is located in the suburbs further from her job. The old house was purchased for $160,000 and has a market value of $220,000. The new home can be purchased for $285,000. Which of the following is not relevant to Rachel's decision?

Driving distance to work

Cost of the old house

Market value of the old house

Cost of the new house

7.

Select the correct statement regarding relevant costs and revenues.

Sunk costs are relevant for decision-making purposes.

Relevant costs are frequently called unavoidable costs.

Direct labor is an example of a unit-level cost.

Only variable costs are relevant for decision making.

$ Cash receipts Beginning cash balance Cash payments Desired ending cash balance 271,000 5,000 280,000 25,000 $ Salary expense Sales commissions, 5% of sales Utilities Depreciation on store equipment Rent Miscellaneous Total operating expenses January February 36,000$ 36,000 $ 30,000 32,000 2,800 2,800 1,000 1,000 7,200 7,200 1,800 1,800 78,800 $ 80,800 $ March 36,000 24,000 2,800 1,000 7,200 1,800 72,800 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started