Answered step by step

Verified Expert Solution

Question

1 Approved Answer

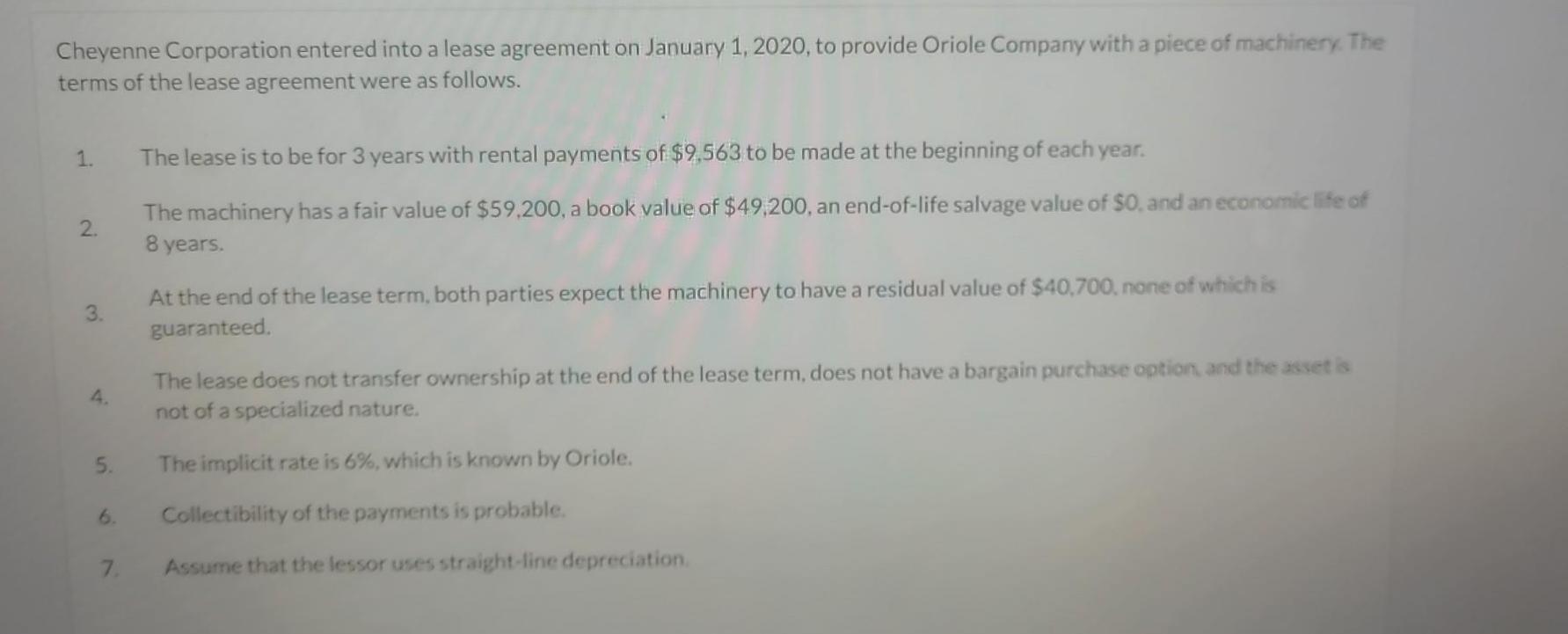

Cheyenne Corporation entered into a lease agreement on January 1, 2020, to provide Oriole Company with a piece of machinery. The terms of the

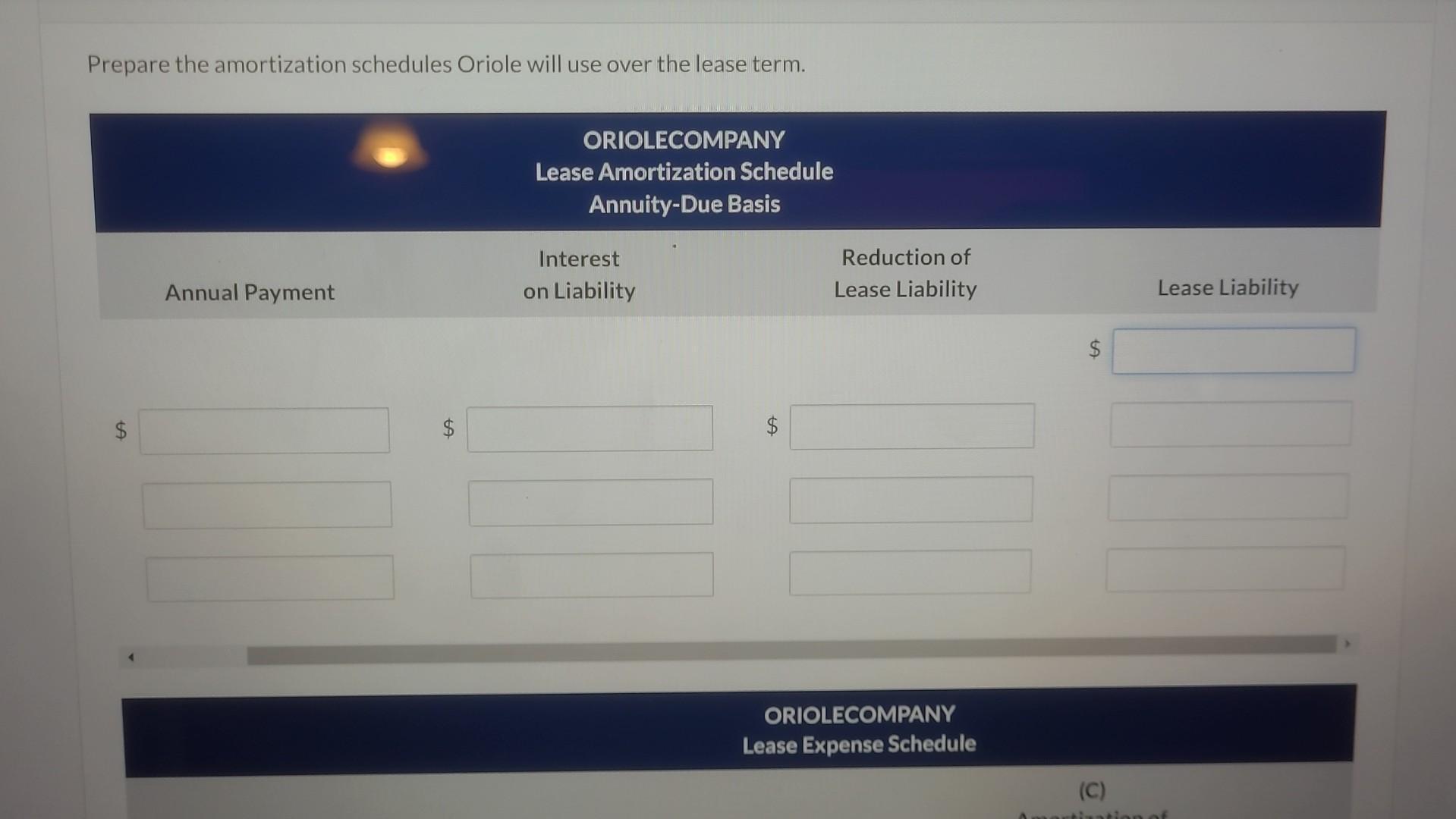

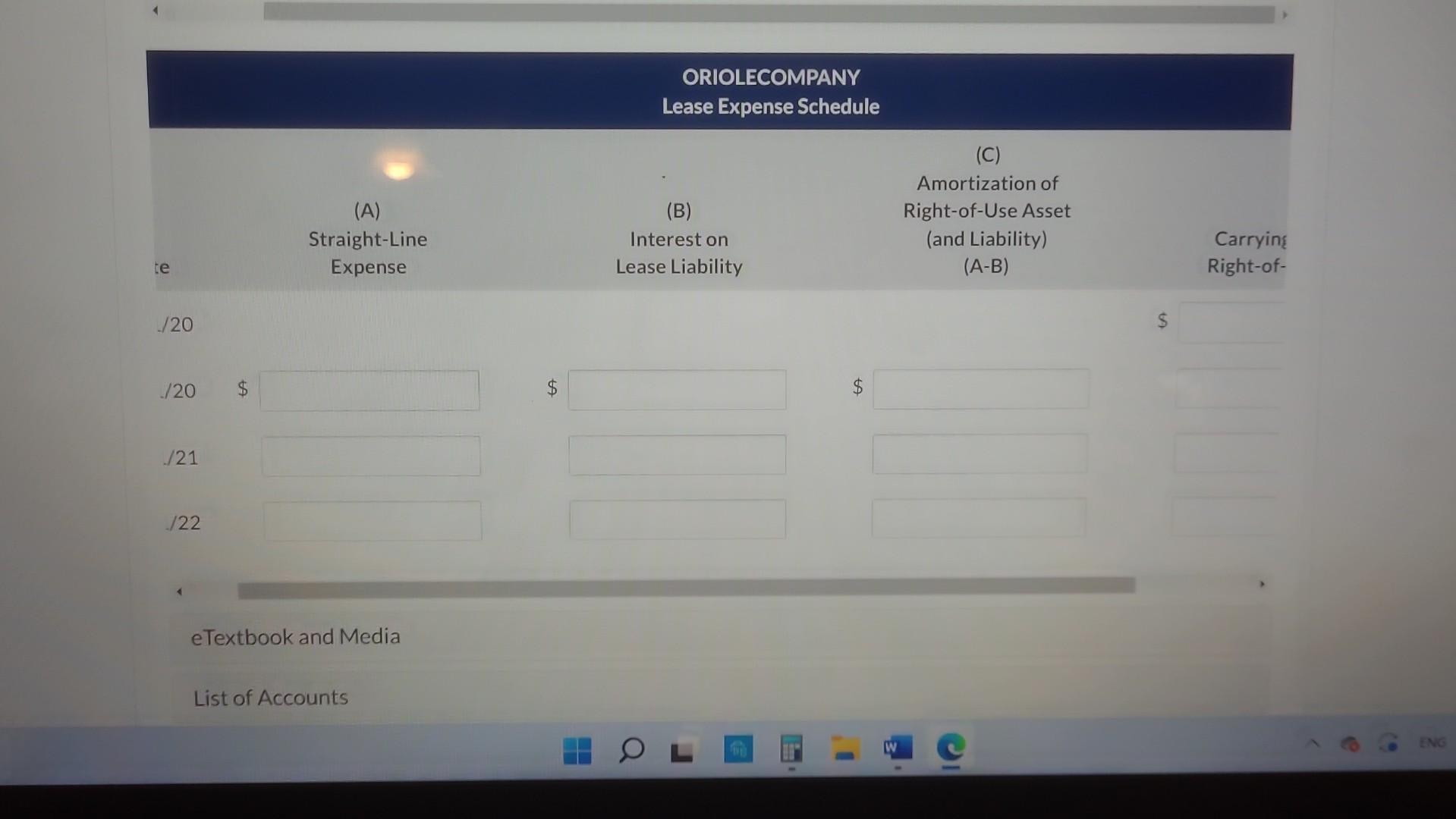

Cheyenne Corporation entered into a lease agreement on January 1, 2020, to provide Oriole Company with a piece of machinery. The terms of the lease agreement were as follows. 1. 2. 3. 5. 6. 7. The lease is to be for 3 years with rental payments of $9,563 to be made at the beginning of each year. The machinery has a fair value of $59,200, a book value of $49,200, an end-of-life salvage value of $0, and an economic life of 8 years. At the end of the lease term, both parties expect the machinery to have a residual value of $40,700, none of which is guaranteed. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature. The implicit rate is 6%, which is known by Oriole. Collectibility of the payments is probable. Assume that the lessor uses straight-line depreciation. Prepare the amortization schedules Oriole will use over the lease term. $ Annual Payment +A $ ORIOLECOMPANY Lease Amortization Schedule Annuity-Due Basis Interest on Liability Reduction of Lease Liability ORIOLECOMPANY Lease Expense Schedule $ (C) Lease Liability tion of te /20 /20 /21 /22 (A) Straight-Line Expense eTextbook and Media List of Accounts LA ORIOLECOMPANY Lease Expense Schedule (B) Interest on Lease Liability (C) Amortization of Right-of-Use Asset (and Liability) (A-B) Carrying Right-of- ENG

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A lease will be considered as Financial lease if following conditions are satisfie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started