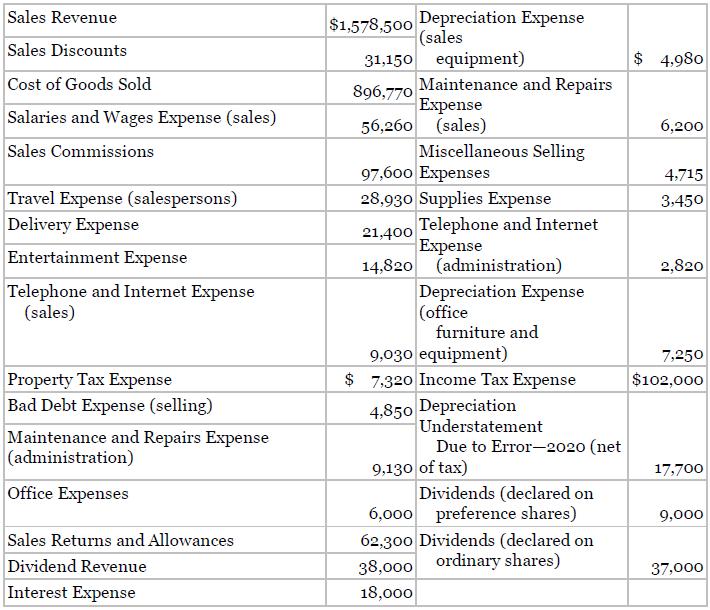

The following account balances were included in the trial balance of Twain Corporation at June 30, 2022.

Question:

The following account balances were included in the trial balance of Twain Corporation at June 30, 2022.

The Retained Earnings account had a balance of $337,000 at July 1, 2021. There are 80,000 ordinary shares outstanding.

Instructions

Prepare an income statement and a retained earnings statement for the year ended June 30, 2022.

$1,578,500 Depreciation Expense (sales Sales Revenue Sales Discounts 31,150 equipment) $ 4.980 Cost of Goods Sold Maintenance and Repairs 896,770 Expense 56,260 (sales) Salaries and Wages Expense (sales) 6,200 Sales Commissions Miscellaneous Selling 97,600 Expenses 4,715 Travel Expense (salespersons) Delivery Expense 28,930 Supplies Expense 3.450 Telephone and Internet Expense 14,820 (administration) 21,400 Entertainment Expense 2,820 Telephone and Internet Expense (sales) Depreciation Expense (office furniture and 9,030 equipment) $ 7,320 Income Tax Expense 7,250 Property Tax Expense $102,000 4,850 Depreciation Understatement Bad Debt Expense (selling) Maintenance and Repairs Expense |(administration) Due to Error-2020 (net 9,130 of tax) Dividends (declared on 6,000 preference shares) 17,700 Office Expenses 9,000 Sales Returns and Allowances 62,300 Dividends (declared on ordinary shares) Dividend Revenue 38,000 37,000 Interest Expense 18,000

Step by Step Answer:

Twain Corporation Income statement For the year ended June 30 2022 Particulars Amount Amount Sales r...View the full answer

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The following account balances were included in the trial balance of Reid Corporation at June 30,2014: During 2014, Reid incurred production salary and wage costs of S71 0,000, consumed raw materials...

-

The Following Account Balances Were Included In The Trial Balance Of Vaughn Corporation At June 30, 2020. The Retained Earnings account had a balance of $317.200 at July 1, 2019. There are 81,220...

-

The following account balances were taken from Harris Corporation's year-end adjusted trial balance (assume these are the company's only temporary accounts): Dividends . . . . . . . . . . . . . . . ....

-

In a survey of 1,002 people, 701 (or 70%) said that they voted in the last presidential election (based on data from ICR Research Group). The margin of error was 3 percentage points. However, actual...

-

For each predator-prey system, determine which of the variables, x or y, represents the prey population and which represents the predator population. Is the growth of the prey restricted just by the...

-

Find Vo in the network infigure. ww R1 5v(+ Vo 4 V (+1) +1

-

Target prices, target costs, activity-based costing systems. Snappy Tiles is a small dis tributor of marble tiles. Snappy identifies its three major activities and cost pools as ordering, receiving...

-

Frankton Corporation has experienced difficult financial times for the past five years resulting in serious cash flow problems, negative earnings, and increasing deficits in retained earnings. The...

-

Kings Department Store is contemplating the purchase of a new machine at a cost of $17,180. The machine will provide $3,300 per year in cash flow for seven years. Kings has a cost of capital of 12...

-

Dry Quick (DQ) is a medium-sized, private manufacturing company located near Timmins, Ontario. DQ has a June 30 year-end. Your firm, Poivre & Sel (P&S), has recently been appointed as auditors forDQ....

-

The following financial statement was prepared by employees of Walters plc. Instructions Identify and discuss the weaknesses in classification and disclosure in the income statement above. You should...

-

Maher AG reported income before income tax during 2022 of 790,000. Additional transactions occurring in 2022 but not considered in the 790,000 are as follows. 1. The company experienced an uninsured...

-

Creative Homework/Short Project Assume that you are a marketing consultant for one of the clients in item 14.16. You believe that the business would benefit from nontraditional marketing. Develop...

-

Problem 1-47 (LO 1-3) (Algo) Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Taxpayer Mihwah...

-

Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an Installed cost of $83,000. Its useful life was estimated to...

-

Kelly is a self-employed tax attorney whose practice primarily involves tax planning. During the year, she attended a three-day seminar regarding new changes to the tax law. She incurred the...

-

For her dissertation, Catherine wanted to study the role of women in management positions in organisations. In particular, she was interested in difficulties women experience in management positions....

-

! Required information [The following information applies to the questions displayed below.] Andrea would like to organize SHO as either an LLC (taxed as a sole proprietorship) or a C corporation. In...

-

In 2020, Aquaculture Incorporated applied for several commercial fishing licences for its commercial fishing vessels. The application was successful and on January 2, 2020, Aquaculture was granted 22...

-

A horizontal annulus with inside and outside diameters of 8 and 10 cm, respectively, contains liquid water. The inside and outside surfaces are maintained at 40 and 20oC, respectively. Calculate the...

-

How can earnings management affect the quality of earnings?

-

Letterman Company computed earnings per share as follows. Net income Common shares outstanding at year-end Letterman has a simple capital structure. What possible errors might the company have made...

-

What is meant by tax allocation within a period? What is the justification for such practice?

-

Caspian Sea Drinks needs to raise $74.00 million by issuing additional shares of stock. If the market estimates CSD will pay a dividend of $2.69 next year, which will grow at 3.45% forever and the...

-

i need help in B and C Integrative Case 5-72 (Algo) Cost Estimation, CVP Analysis, and Decision Making (LO 5-4.5.9) Luke Corporation produces a variety of products, each within their own division....

-

Relate PSA (Public Securities Association) speed to the average life of a MBS. Describe the PSA measure and discuss which MBS would have the greater average life, one with a PSA of 100 or one with a...

Study smarter with the SolutionInn App