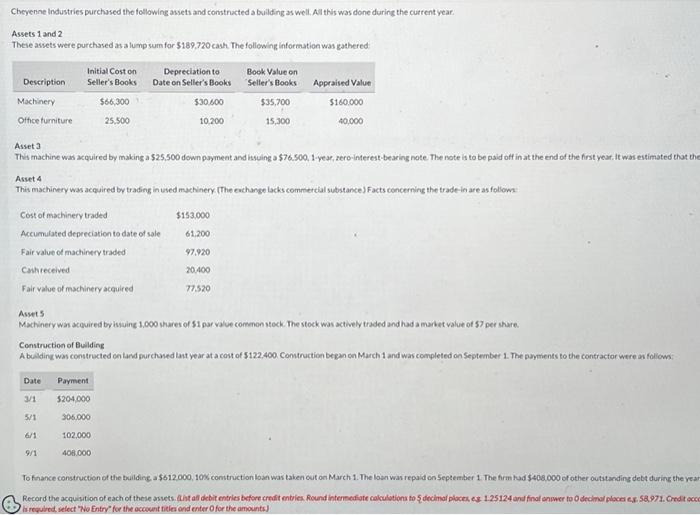

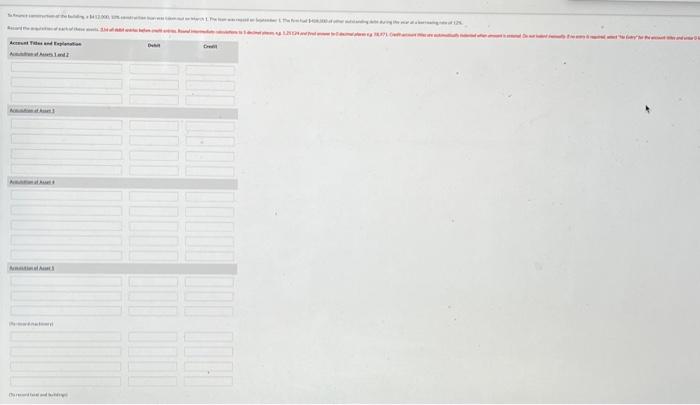

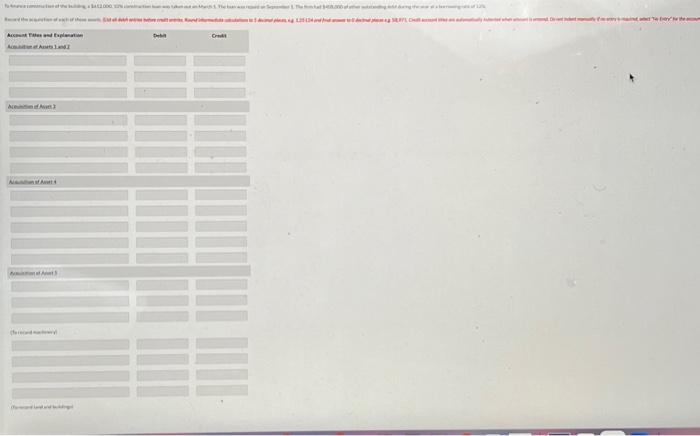

Cheyenne industries purchsed the tollowing assets and constructed a building as well. Al this was done during the curtent year. Assets 1 and 2 These assets were purchased as a lump sum for $189,720cahh. The following information was gathered Asset 3 This machine was acquired by making a $25,500 down poyment and issuing a $76.500,1-year, zero-interest-bearing note the note is to be paid otf in at the end of the first year it was estimated that th Asset 4 This machinery was acquired by trading in used mackinery (The ewchange lacks commercial substance) Facts concerning the trade-in are as follows Assts Machinery war acevired by isuing 1,000 shares of 51 par value comen steck. The stock was actively traded and had a market value of 57 per share. Construction of Bulding A buldinat was constructed co land purchuxd lant year at a cost of 5122,400 . Contruction beean ce March 1 and was completed on Septenber 1 . The paymients to the contractor were an follom: To finance construction of the buildine a 5812000,100 contruction loan was taken cut on March 1. The loan was repuld on 5 eptember 1 . The firm tud 5400000 of other outatanding debt during the yea Iirnquird select "No Entry" for the occount tieles ond enter Ofor the amounts] Cheyenne industries purchsed the tollowing assets and constructed a building as well. Al this was done during the curtent year. Assets 1 and 2 These assets were purchased as a lump sum for $189,720cahh. The following information was gathered Asset 3 This machine was acquired by making a $25,500 down poyment and issuing a $76.500,1-year, zero-interest-bearing note the note is to be paid otf in at the end of the first year it was estimated that th Asset 4 This machinery was acquired by trading in used mackinery (The ewchange lacks commercial substance) Facts concerning the trade-in are as follows Assts Machinery war acevired by isuing 1,000 shares of 51 par value comen steck. The stock was actively traded and had a market value of 57 per share. Construction of Bulding A buldinat was constructed co land purchuxd lant year at a cost of 5122,400 . Contruction beean ce March 1 and was completed on Septenber 1 . The paymients to the contractor were an follom: To finance construction of the buildine a 5812000,100 contruction loan was taken cut on March 1. The loan was repuld on 5 eptember 1 . The firm tud 5400000 of other outatanding debt during the yea Iirnquird select "No Entry" for the occount tieles ond enter Ofor the amounts]