Question

The total face value of Reliance Bank's portfolio of eight-year zero coupon bonds is $39 million. The current market yield on the bonds is

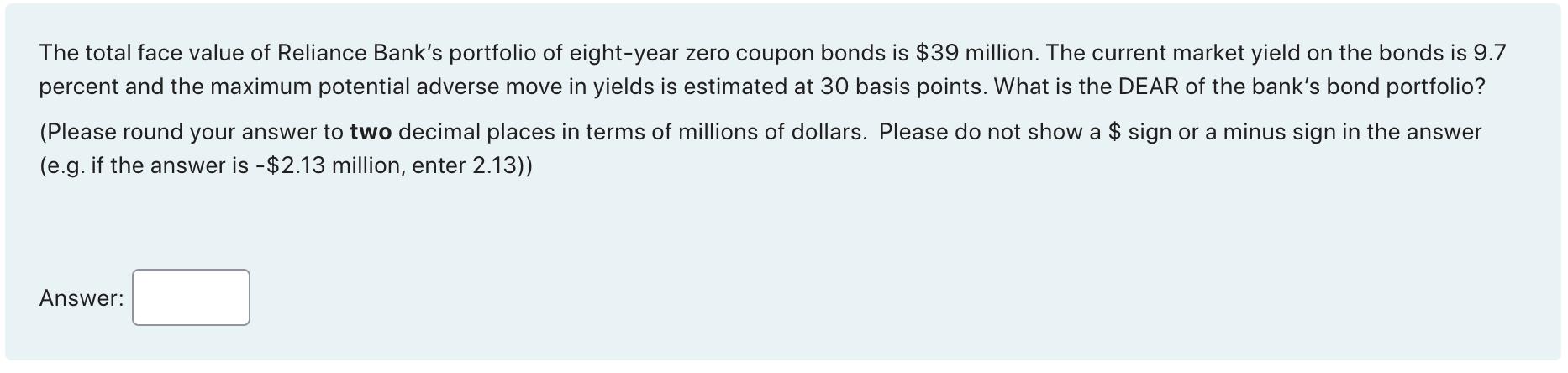

The total face value of Reliance Bank's portfolio of eight-year zero coupon bonds is $39 million. The current market yield on the bonds is 9.7 percent and the maximum potential adverse move in yields is estimated at 30 basis points. What is the DEAR of the bank's bond portfolio? (Please round your answer to two decimal places in terms of millions of dollars. Please do not show a $ sign or a minus sign in the answer (e.g. if the answer is -$2.13 million, enter 2.13)) Answer:

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The DEAR of the banks bond portfolio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

13th Edition

9780470374948, 470423684, 470374942, 978-0470423684

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App