Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chick'N (Proprietary) Limited (CL) is in the process of finalising their financial statements for the year ended 30 June 2022. CL manufactures detonators used

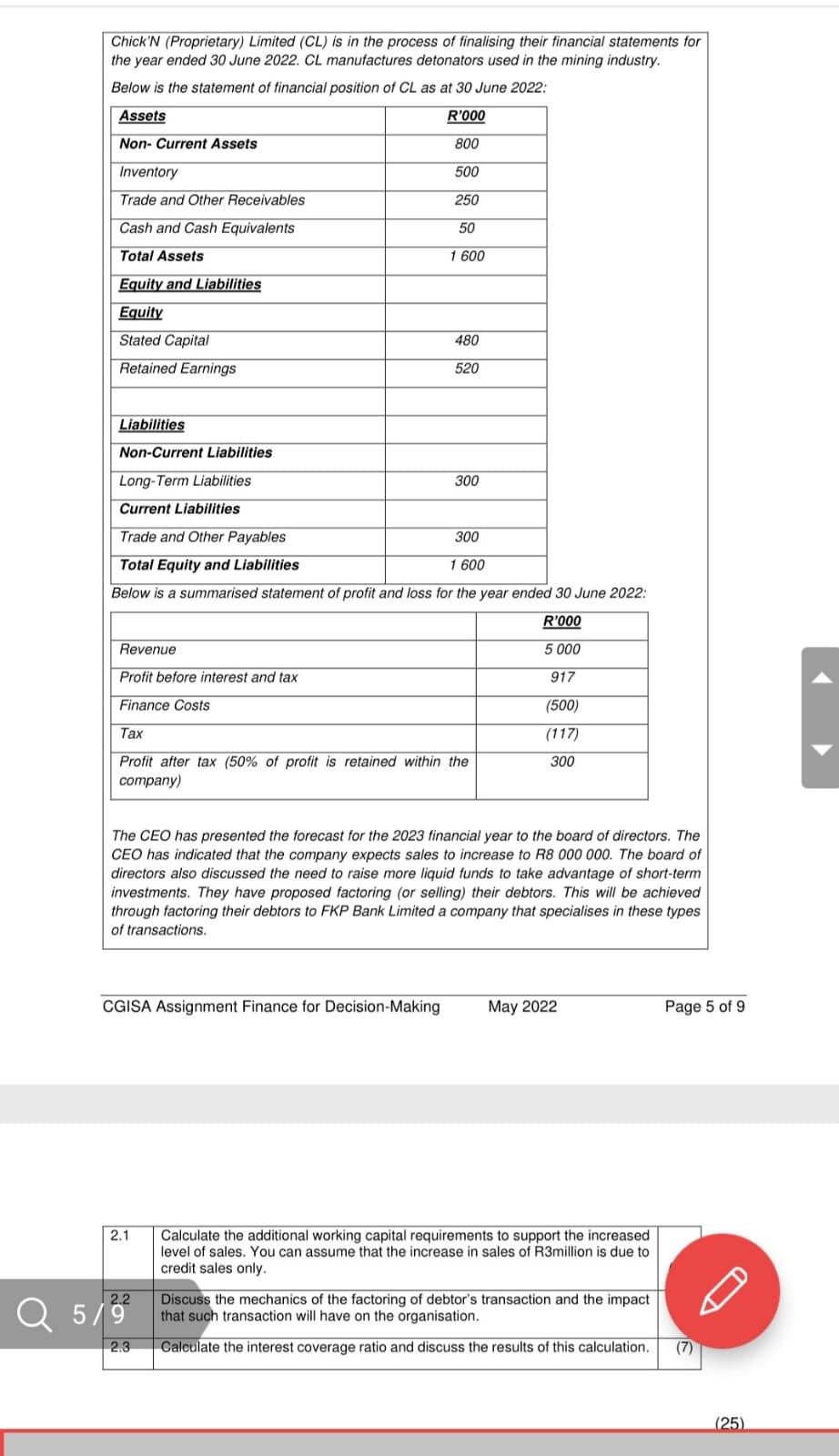

Chick'N (Proprietary) Limited (CL) is in the process of finalising their financial statements for the year ended 30 June 2022. CL manufactures detonators used in the mining industry. Below is the statement of financial position of CL as at 30 June 2022: Assets R'000 Non- Current Assets 800 Inventory 500 Trade and Other Receivables 250 Cash and Cash Equivalents 50 Total Assets 1 600 Equity and Liabilities Equity Stated Capital 480 Retained Earnings 520 Liabilities Non-Current Liabilities Long-Term Liabilities 300 Current Liabilities Trade and Other Payables 300 Total Equity and Liabilities 1 600 Below is a summarised statement of profit and loss for the year ended 30 June 2022: R'000 Revenue 5 000 Profit before interest and tax 917 Finance Costs (500) (117) Profit after tax (50% of profit is retained within the company) 300 The CEO has presented the forecast for the 2023 financial year to the board of directors. The CEO has indicated that the company expects sales to increase to R8 000 000. The board of directors also discussed the need to raise more liquid funds to take advantage of short-term investments. They have proposed factoring (or selling) their debtors. This will be achieved through factoring their debtors to FKP Bank Limited a company that specialises in these types of transactions. CGISA Assignment Finance for Decision-Making May 2022 Page 5 of 9 2.1 Calculate the additional working capital requirements to support the increased level of sales. You can assume that the increase in sales of R3million is due to credit sales only. 2.2 5/9 Discuss the mechanics of the factoring of debtor's transaction and the impact that such transaction will have on the organisation. Calculate the interest coverage ratio and discuss the results of this calculation. (7) 2.3 (25)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Working capital Current Assets Current Liabilities Working Capital of Chick N Limited for the year 2022 inventory Trade and Other receivables ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started