Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chili acquired 60% of 100,000 ordinary shares of RM1 each in Spice on 1 July 20X2, when the retained earnings of Spice were RM58,000.

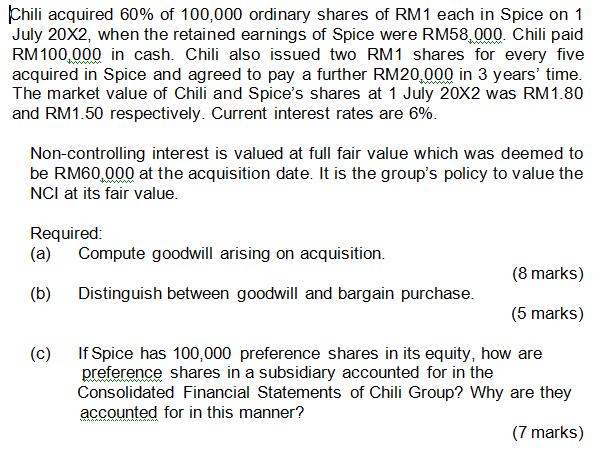

Chili acquired 60% of 100,000 ordinary shares of RM1 each in Spice on 1 July 20X2, when the retained earnings of Spice were RM58,000. Chili paid RM100,000 in cash. Chili also issued two RM1 shares for every five acquired in Spice and agreed to pay a further RM20,000 in 3 years' time. The market value of Chili and Spice's shares at 1 July 20X2 was RM1.80 and RM1.50 respectively. Current interest rates are 6%. Non-controlling interest is valued at full fair value which was deemed to be RM60,000 at the acquisition date. It is the group's policy to value the NCI at its fair value. Required: (a) (b) Compute goodwill arising on acquisition. Distinguish between goodwill and bargain purchase. (8 marks) (5 marks) (c) If Spice has 100,000 preference shares in its equity, how are preference shares in a subsidiary accounted for in the Consolidated Financial Statements of Chili Group? Why are they accounted for in this manner? (7 marks)

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of Share of Identified Net Assets Acquired Fair Value of Non Controlling Interest 60000 Share of INA Acquired 60000040060 90000 Calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started