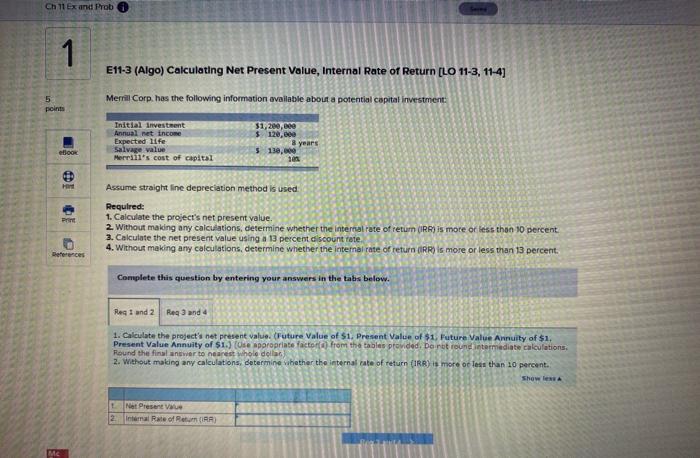

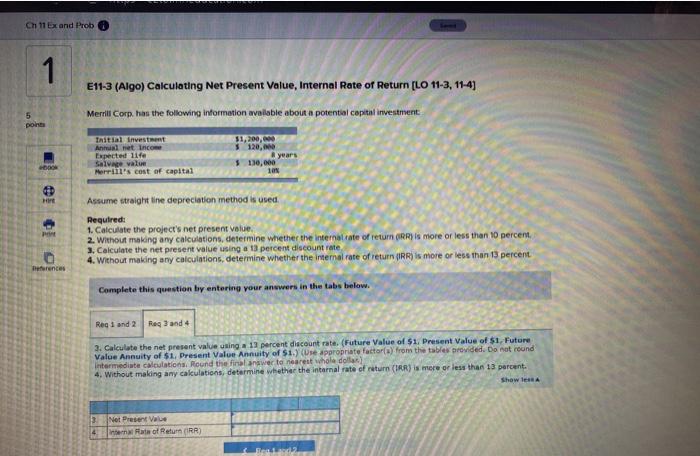

Chill Ex and Prob 1 E11-3 (Algo) Calculating Net Present Value, Internal Rate of Return [LO 11-3, 11-4) Merrill Corp. has the following information available about a potential capital investment: 5 points Initial investment Annual net income Expected life Salvage value Merrill's cost of capital $1,200,000 120, 3 years 5 130.000 100 etik Assume straight line depreciation method is used PE Required: 1. Calculate the project's net present value. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent 3. Calculate the net present value using a 13 percent discount fate 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 13 percent. References Complete this question by entering your answers in the tabs below. Reg 1 und 2 Req3 and 4 1. Calculate the project's net present value. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (ose appropriate factor from the tables provided. Dort round intermediate calculations Round the final answer to nearest whole della 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. Show less Net Present Internal Rate of RRR) 2 Ch 11 Ex and Prob 1 E11-3 (Algo) Calculating Net Present Value, Internal Rate of Return [LO 11-3, 11-4) 5 point Merrill Corp. hos the following information available about a potential capital investment Taitial Investment Antunet Incom Expected life Salve value Merrill's cost of capital 120,000 years $ 110,000 10 Hint Assume straight line depreciation method is used Required: 1. Calculate the project's net present value 2. Without making any calculations, determine whether the internaliate of return (IRR) is more or less than 10 percent 3. Calculate the net present value using a 13 percent discount rate 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 15 percent Derences Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 and 4 3. Calculate the net present value using a 13 percent discount rate (Future Value of $1. Present Value of $1. Future Value Annuity of $. Present Value Annuity of $1.) (Use appropriate factors) from the tables provided. Do not round intermediate calculations. Round the finanswer to nearest whola dollar 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 13 percent. Show less Net Present Value in of Return (IRR)