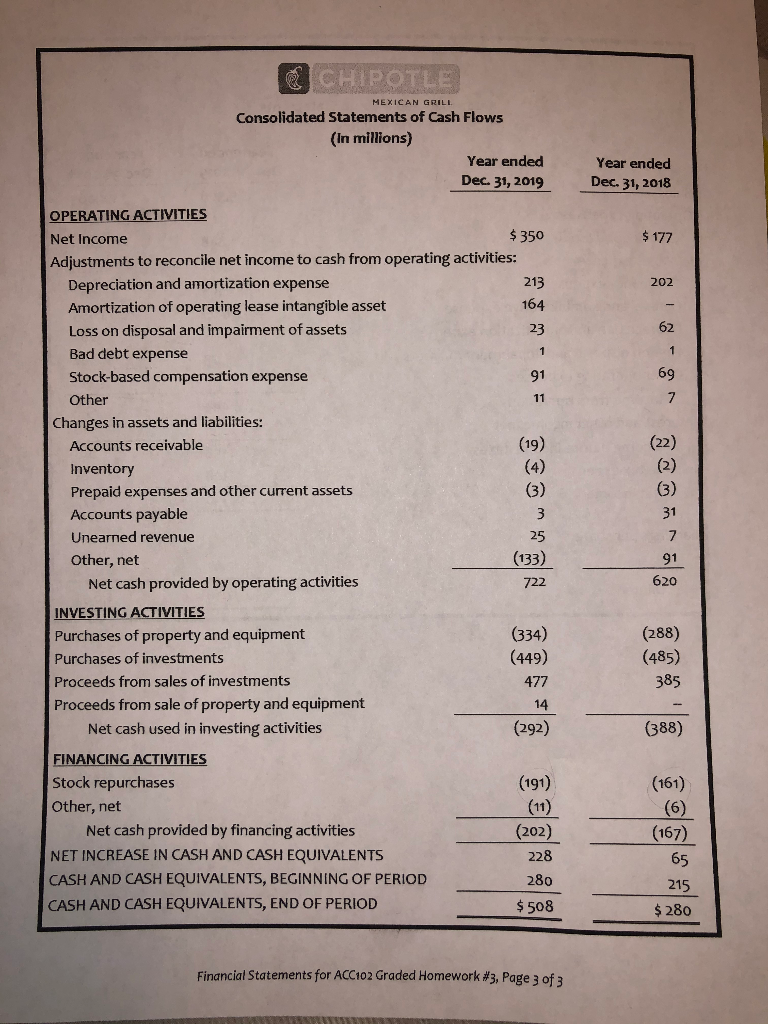

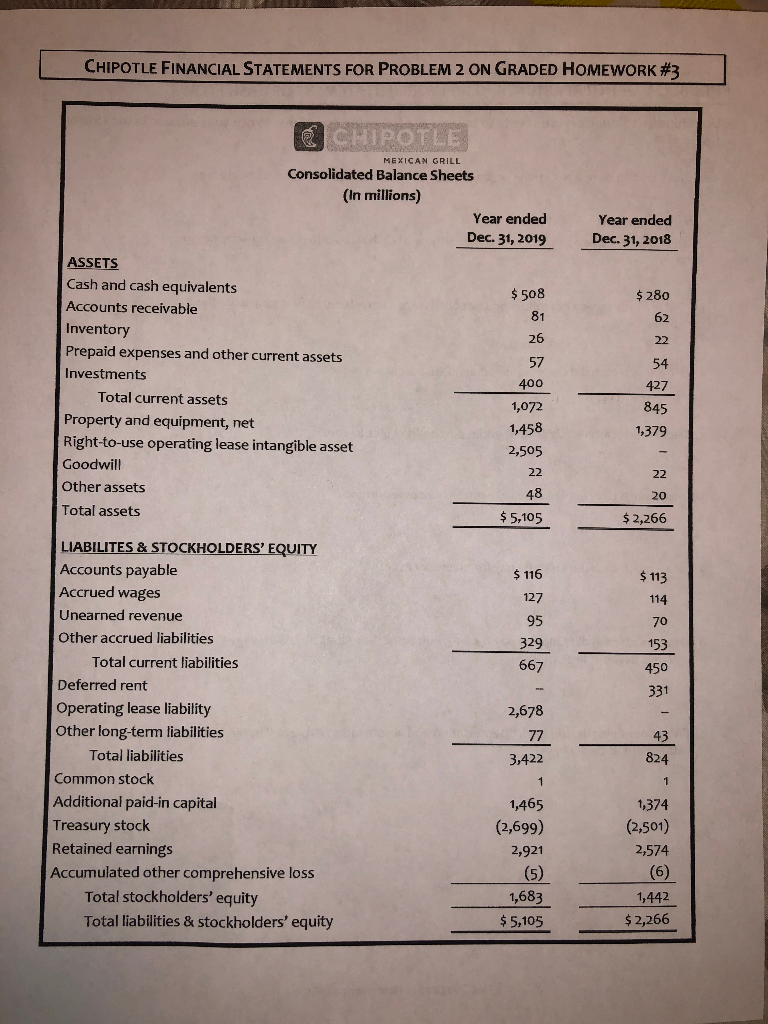

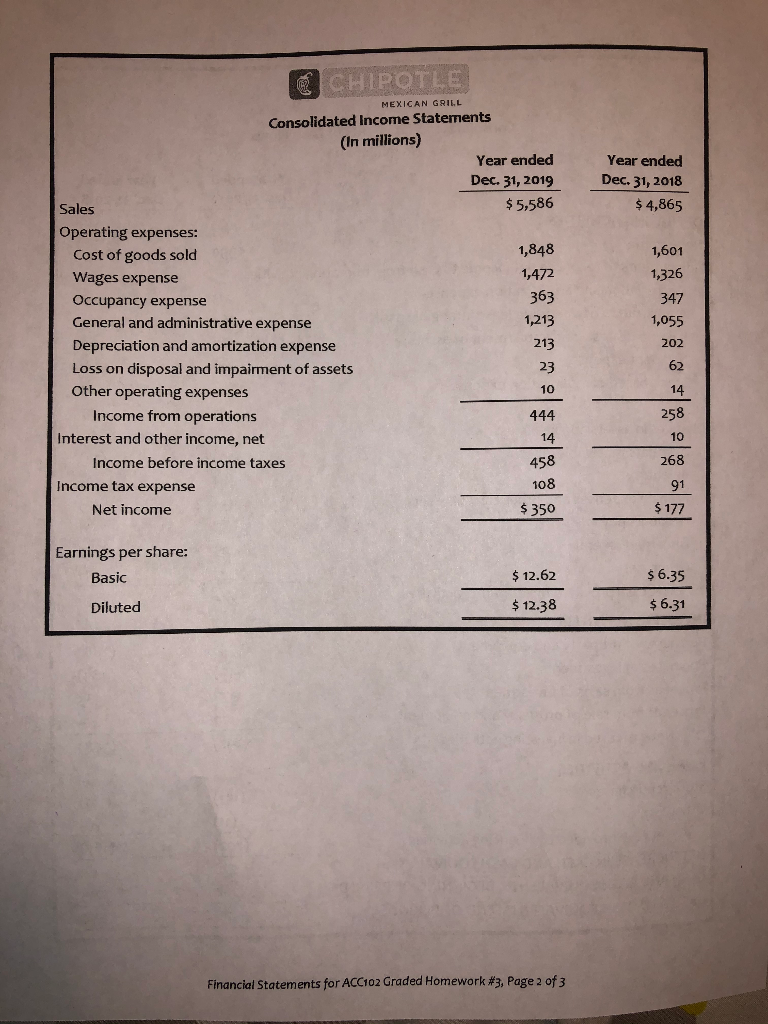

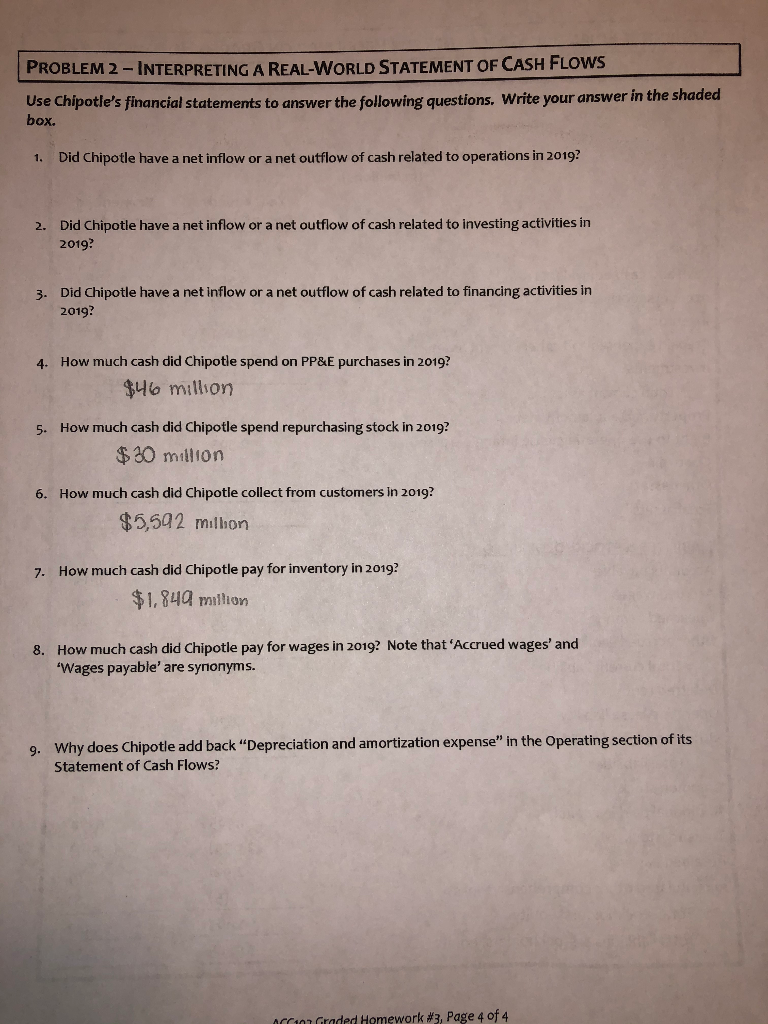

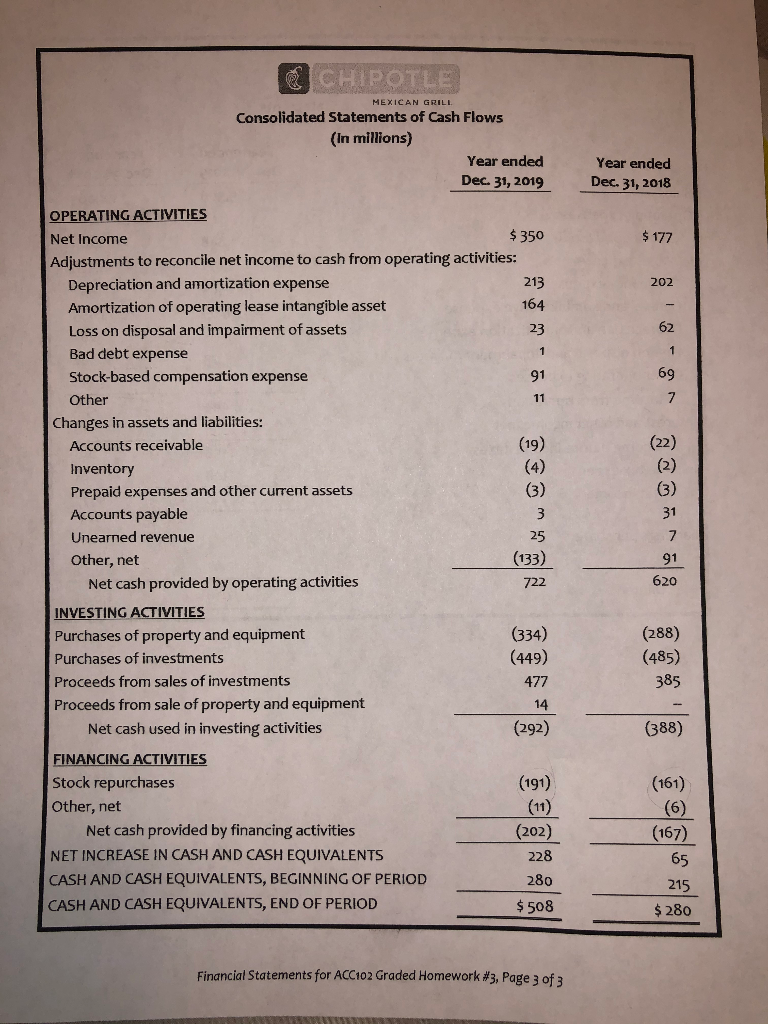

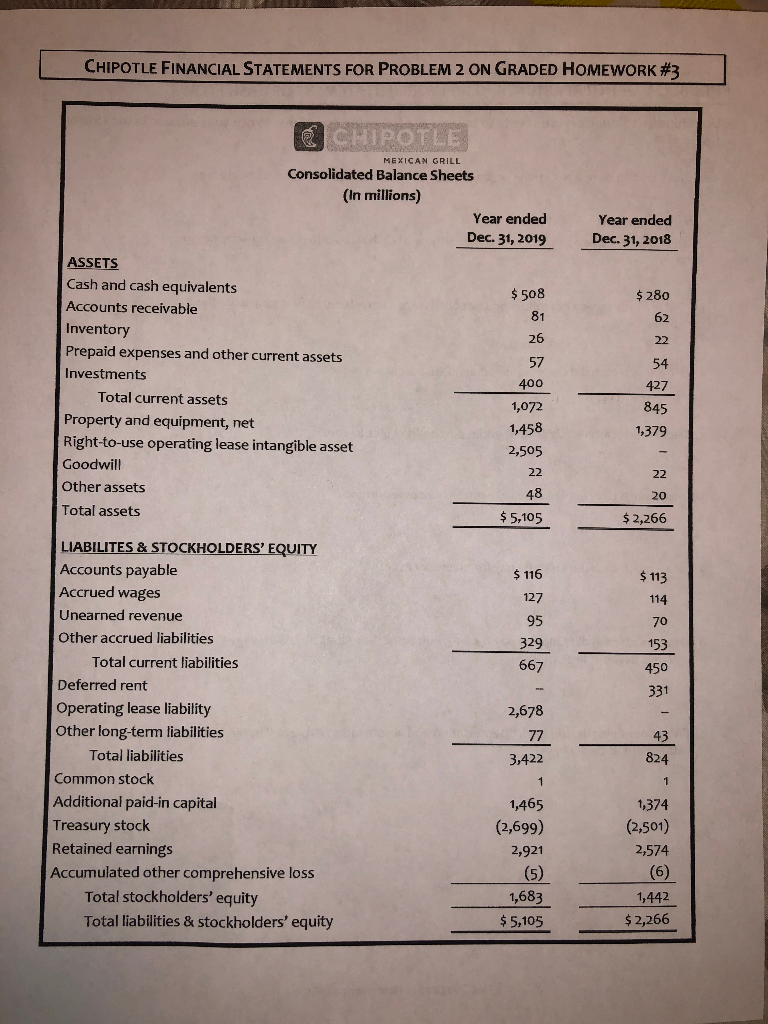

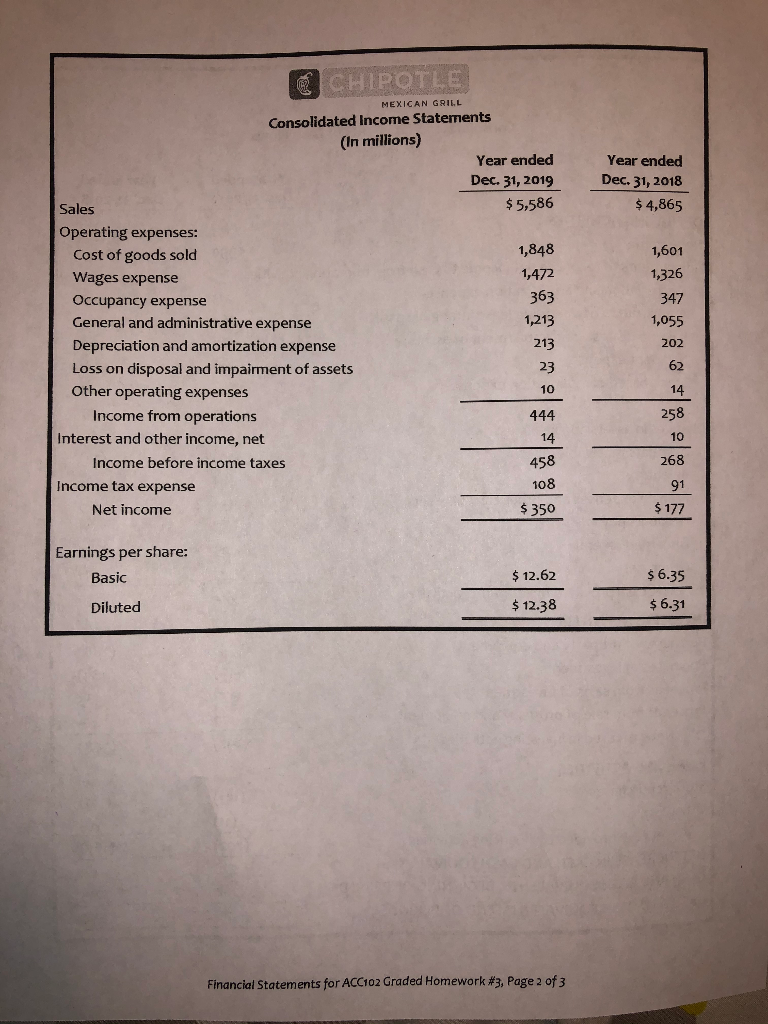

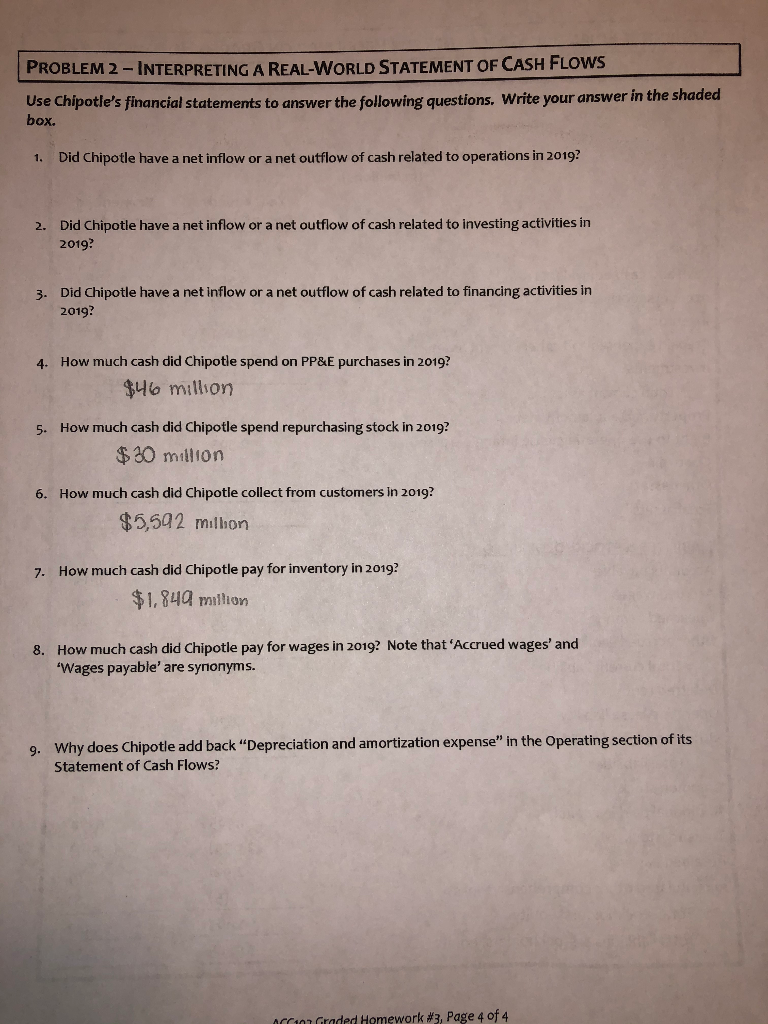

CHIPOTLE MEXICAN GRILL Consolidated Statements of Cash Flows (In millions) Year ended Dec 31, 2019 Year ended Dec 31, 2018 $ 177 ' ^ aan " OPERATING ACTIVITIES Net Income $350 Adjustments to reconcile net income to cash from operating activities: Depreciation and amortization expense Amortization of operating lease intangible asset Loss on disposal and impairment of assets Bad debt expense Stock-based compensation expense Other Changes in assets and liabilities: Accounts receivable Inventory Prepaid expenses and other current assets Accounts payable 3 Unearned revenue 25 Other, net (133) Net cash provided by operating activities 722 INVESTING ACTIVITIES Purchases of property and equipment (334) Purchases of investments (449) Proceeds from sales of investments 477 Proceeds from sale of property and equipment 14 Net cash used in investing activities (292) FINANCING ACTIVITIES Stock repurchases (191) Other, net Net cash provided by financing activities (202) NET INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 280 CASH AND CASH EQUIVALENTS, END OF PERIOD $ 508 620 (288) (485) 385 (388) (161) (11) (167) 65 228 215 $ 280 Financial Statements for ACC102 Graded Homework #3, Page 3 of 3 CHIPOTLE FINANCIAL STATEMENTS FOR PROBLEM 2 ON GRADED HOMEWORK #3 CHIPOTLE MEXICAN GRILL Year ended Dec. 31, 2018 $ 508 $ 280 Consolidated Balance Sheets In millions) Year ended Dec 31, 2019 ASSETS Cash and cash equivalents Accounts receivable Inventory Prepaid expenses and other current assets Investments 400 Total current assets 1,072 Property and equipment, net 1,458 Right-to-use operating lease intangible asset 2,505 Goodwill Other assets 48 Total assets $ 5,105 54 427 845 1,379 22 20 $2,266 $ 116 $ 113 95 329 667 331 2,678 LIABILITES & STOCKHOLDERS' EQUITY Accounts payable Accrued wages Unearned revenue Other accrued liabilities Total current liabilities Deferred rent Operating lease liability Other long-term liabilities Total liabilities Common stock Additional paid-in capital Treasury stock Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total liabilities & stockholders' equity 12 43 3,422 824 1,465 (2,699) 2,921 (5) 1,683 $ 5,105 1,374 (2,501) 2,574 (6) 1,442 $2,266 Year ended Dec. 31, 2018 $ 4,865 CHIPOTLE MEXICAN GRILL Consolidated Income Statements (In millions) Year ended Dec. 31, 2019 Sales $5,586 Operating expenses: Cost of goods sold 1,848 Wages expense 1,472 Occupancy expense 363 General and administrative expense 1,213 Depreciation and amortization expense 213 Loss on disposal and impairment of assets Other operating expenses Income from operations Interest and other income, net Income before income taxes Income tax expense Net income $ 350 1,601 1,326 347 1,055 202 23 268 108 $ 177 Earnings per share: Basic $ 12.62 $6.35 Diluted $ 12.38 $6.31 Financial Statements for ACC102 Graded Homework #3, Page 2 of 31 PROBLEM 2 - INTERPRETING A REAL-WORLD STATEMENT OF CASH FLOWS use Chipotle's financial statements to answer the following questions. Write your answer in the shaded box. 1. Did Chipotle have a net inflow or a net outflow of cash related to operations in 2019? 2. Did Chipotle have a net inflow or a net outflow of cash related to investing activities in 2019? 3. Did Chipotle have a net inflow or a net outflow of cash related to financing activities in 2019? 4. How much cash did Chipotle spend on PP&E purchases in 2019? $46 million 5. How much cash did Chipotle spend repurchasing stock in 2019? $30 million 6. How much cash did Chipotle collect from customers in 2019? $5,592 millon 7. How much cash did Chipotle pay for inventory in 2019? $1,849 million 8. How much cash did Chipotle pay for wages in 2019? Note that 'Accrued wages' and 'Wages payable' are synonyms. 9. Why does Chipotle add back Depreciation and amortization expense" in the Operating section of its Statement of Cash Flows? ACC . Bader Homework #3, Page 4 of 4 CHIPOTLE MEXICAN GRILL Consolidated Statements of Cash Flows (In millions) Year ended Dec 31, 2019 Year ended Dec 31, 2018 $ 177 ' ^ aan " OPERATING ACTIVITIES Net Income $350 Adjustments to reconcile net income to cash from operating activities: Depreciation and amortization expense Amortization of operating lease intangible asset Loss on disposal and impairment of assets Bad debt expense Stock-based compensation expense Other Changes in assets and liabilities: Accounts receivable Inventory Prepaid expenses and other current assets Accounts payable 3 Unearned revenue 25 Other, net (133) Net cash provided by operating activities 722 INVESTING ACTIVITIES Purchases of property and equipment (334) Purchases of investments (449) Proceeds from sales of investments 477 Proceeds from sale of property and equipment 14 Net cash used in investing activities (292) FINANCING ACTIVITIES Stock repurchases (191) Other, net Net cash provided by financing activities (202) NET INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 280 CASH AND CASH EQUIVALENTS, END OF PERIOD $ 508 620 (288) (485) 385 (388) (161) (11) (167) 65 228 215 $ 280 Financial Statements for ACC102 Graded Homework #3, Page 3 of 3 CHIPOTLE FINANCIAL STATEMENTS FOR PROBLEM 2 ON GRADED HOMEWORK #3 CHIPOTLE MEXICAN GRILL Year ended Dec. 31, 2018 $ 508 $ 280 Consolidated Balance Sheets In millions) Year ended Dec 31, 2019 ASSETS Cash and cash equivalents Accounts receivable Inventory Prepaid expenses and other current assets Investments 400 Total current assets 1,072 Property and equipment, net 1,458 Right-to-use operating lease intangible asset 2,505 Goodwill Other assets 48 Total assets $ 5,105 54 427 845 1,379 22 20 $2,266 $ 116 $ 113 95 329 667 331 2,678 LIABILITES & STOCKHOLDERS' EQUITY Accounts payable Accrued wages Unearned revenue Other accrued liabilities Total current liabilities Deferred rent Operating lease liability Other long-term liabilities Total liabilities Common stock Additional paid-in capital Treasury stock Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total liabilities & stockholders' equity 12 43 3,422 824 1,465 (2,699) 2,921 (5) 1,683 $ 5,105 1,374 (2,501) 2,574 (6) 1,442 $2,266 Year ended Dec. 31, 2018 $ 4,865 CHIPOTLE MEXICAN GRILL Consolidated Income Statements (In millions) Year ended Dec. 31, 2019 Sales $5,586 Operating expenses: Cost of goods sold 1,848 Wages expense 1,472 Occupancy expense 363 General and administrative expense 1,213 Depreciation and amortization expense 213 Loss on disposal and impairment of assets Other operating expenses Income from operations Interest and other income, net Income before income taxes Income tax expense Net income $ 350 1,601 1,326 347 1,055 202 23 268 108 $ 177 Earnings per share: Basic $ 12.62 $6.35 Diluted $ 12.38 $6.31 Financial Statements for ACC102 Graded Homework #3, Page 2 of 31 PROBLEM 2 - INTERPRETING A REAL-WORLD STATEMENT OF CASH FLOWS use Chipotle's financial statements to answer the following questions. Write your answer in the shaded box. 1. Did Chipotle have a net inflow or a net outflow of cash related to operations in 2019? 2. Did Chipotle have a net inflow or a net outflow of cash related to investing activities in 2019? 3. Did Chipotle have a net inflow or a net outflow of cash related to financing activities in 2019? 4. How much cash did Chipotle spend on PP&E purchases in 2019? $46 million 5. How much cash did Chipotle spend repurchasing stock in 2019? $30 million 6. How much cash did Chipotle collect from customers in 2019? $5,592 millon 7. How much cash did Chipotle pay for inventory in 2019? $1,849 million 8. How much cash did Chipotle pay for wages in 2019? Note that 'Accrued wages' and 'Wages payable' are synonyms. 9. Why does Chipotle add back Depreciation and amortization expense" in the Operating section of its Statement of Cash Flows? ACC . Bader Homework #3, Page 4 of 4